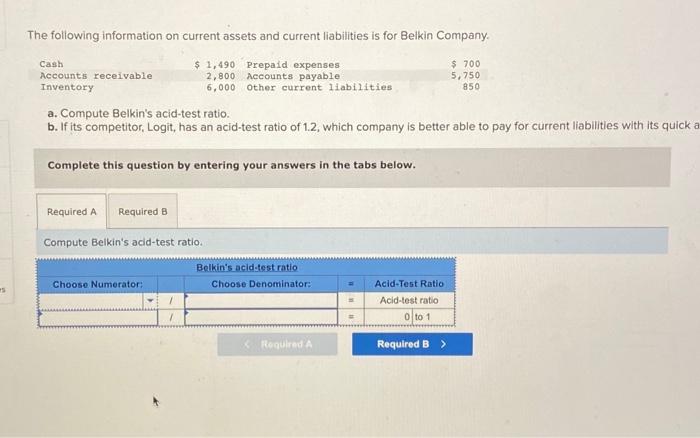

Question: help^^^^^ The following information on current assets and current liabilities is for Belkin Company. a. Compute Belkin's acid-test ratio. b. If its competitor, Logit, has

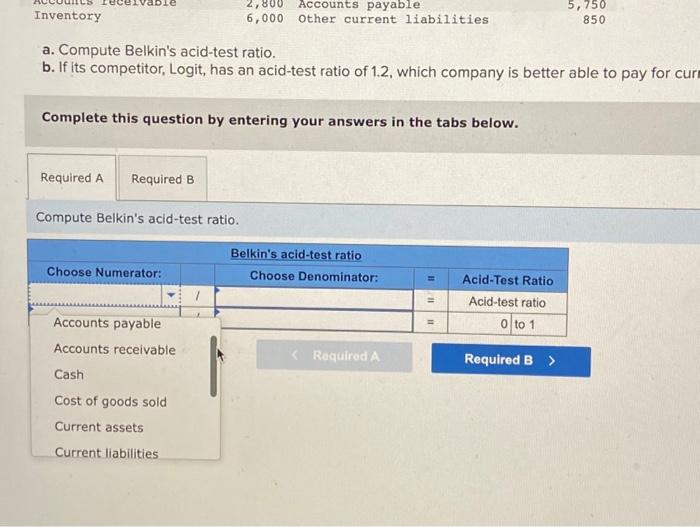

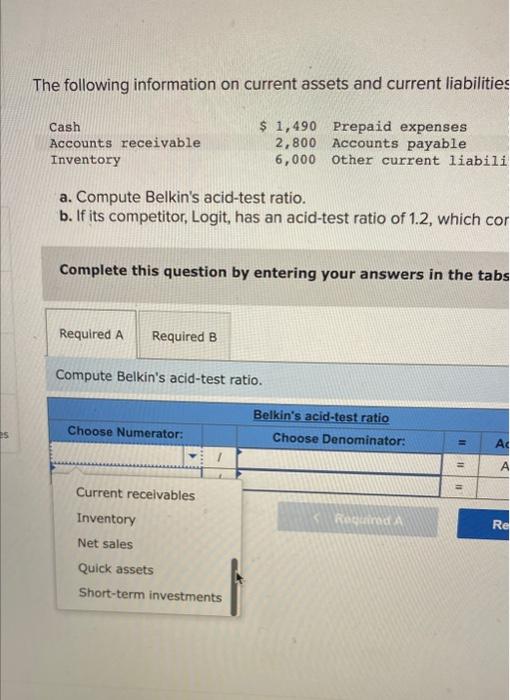

The following information on current assets and current liabilities is for Belkin Company. a. Compute Belkin's acid-test ratio. b. If its competitor, Logit, has an acid-test ratio of 1.2 , which company is better able to pay for current liabilities with its quic Complete this question by entering your answers in the tabs below. Compute Belkin's acid-test ratio. The following information on current assets and current liabilities a. Compute Belkin's acid-test ratio. b. If its competitor, Logit, has an acid-test ratio of 1.2 , which cor Complete this question by entering your answers in the tabs Compute Belkin's acid-test ratio. a. Compute Belkin's acid-test ratio. b. If its competitor, Logit, has an acid-test ratio of 1.2 , which company is better able to pay for Complete this question by entering your answers in the tabs below. Compute Belkin's acid-test ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts