Question: Help The two-stage super-normal dividend growth model evaluates the current price of a stock based on the assumption that a stock will: a pay increasing

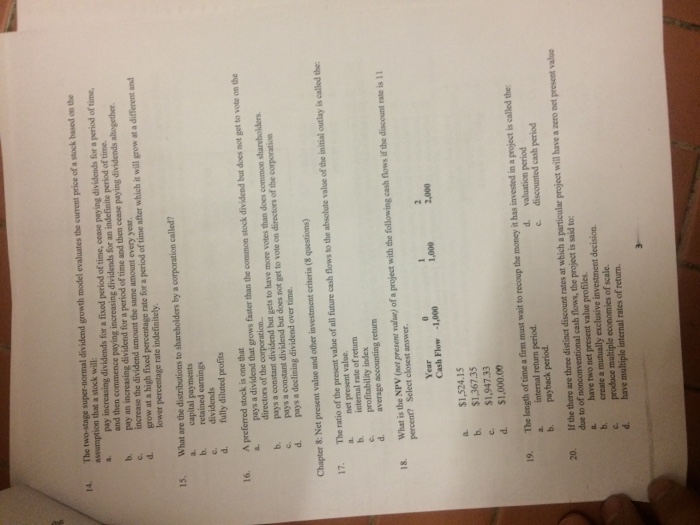

The two-stage super-normal dividend growth model evaluates the current price of a stock based on the assumption that a stock will: a pay increasing dividends for a fixed period of time, cease paying dividends for a priod of time, 14 and then commence paying increasing dividends for an indefinite period of time. pay an increasing dividend for a period of time and then cease paying dividends alogethen lower percentage rate indefinitely c. increase the dividend amount the same amount every year d. grow at a high fixed percentage rate for a period of time after which it will grow at a different and What are the distributions to shareholders by a corporation called? a. capital payments b. retained carnings 15. dividends d. fully diluted profits A preferred stock is one that 16. ead that grows faster than the common stokiendbut does ast gst to vote on the directors of the corporation.. b. pays a constant dividend but gets to have more votes than does common sharebolders c. pays d pays a declining dividend over time. a constant dividend but does not get to vote on directors of the corporation Chapter 8: Net present value and other investment criteria (8 questions) The ratio of the present value of all future cash flows to the absolute value of the initial outlay is called the a. net present value. b. internal rate of return c. profitability index What is the NPV (net present valwe) of a project with the following cash flows if the discount rate is 1 percent? Select closest answer. Cash Flow -1,000 a $1,524.15 b. $1,367.35 c. $1,947.33 d. $1,000.00 The length of time a firm must wait to recoup the money it has in a internal return period. b. payback period 19. d valuation period c discounted cash period 20. If the there are three distinct discount rates at which a particular project will have a zero net present value due to of a. have two net present value profiles cash flows, the project is said to: multiple economies of scale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts