Question: Help this is my final homework it'really important? pls help can i get the answer step by step? much appreciate it??? 2. You have been

Help this is my final homework it'really important? pls help can i get the answer step by step? much appreciate it???

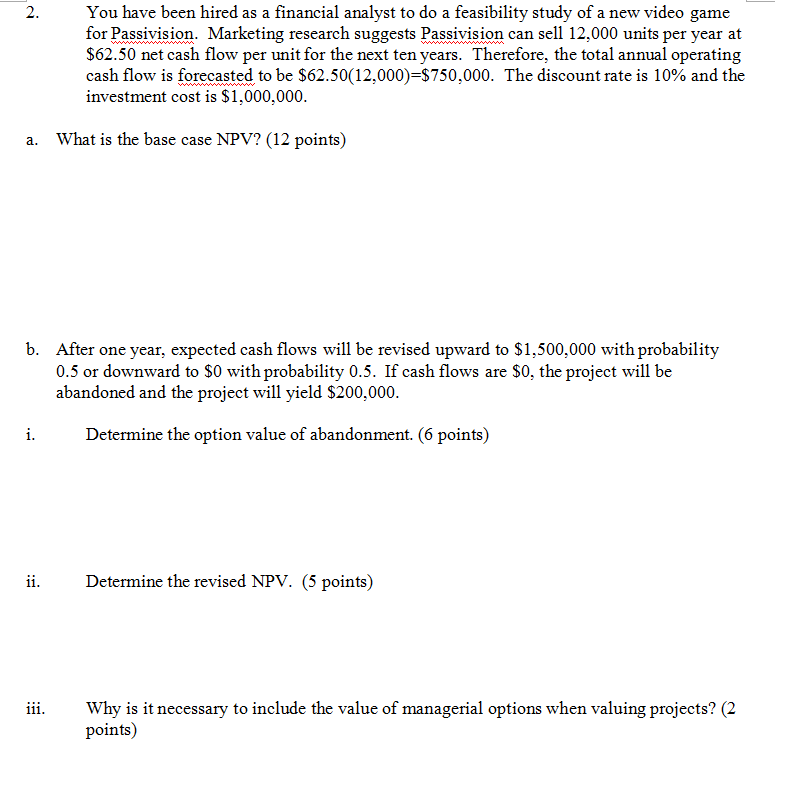

2. You have been hired as a financial analyst to do a feasibility study of a new video game Passivision. Marketing research suggests Passivision can sell 12,000 units per year at $62.50 net cash flow per unit for the next ten years. Therefore, the total annual operating cash flow is forecasted to be $62.50(12,000) $750,000. The discount rate is 10% and the investment cost is $1,000,000. a. What is the base case NPV? (12 points b. After one year, expected cash flows will be revised upward to $1,500,000 with probability 0.5 or downward to $0 with probability 0.5. If cash flows are $0, the project will be abandoned and the project will yield $200,000. i. Determine the option value of abandonment. (6 points) ii. Determine the revised NPV. (5 points) iii. Why is it necessary to include the value of managerial options when valuing projects? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts