Question: help w homework #2 20:49 Expert Q&A Done need 4 and 5 -HOMEWORK ASSIGNMENT- Students should complete mest or all of the work in this

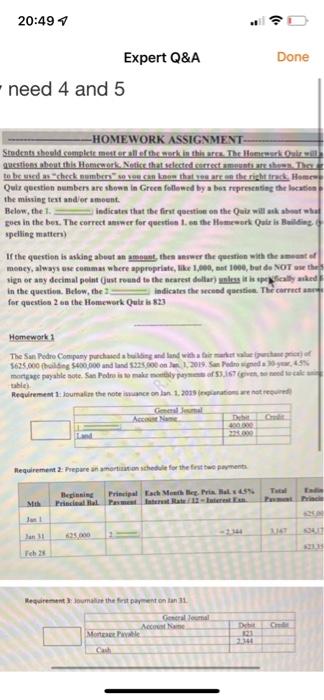

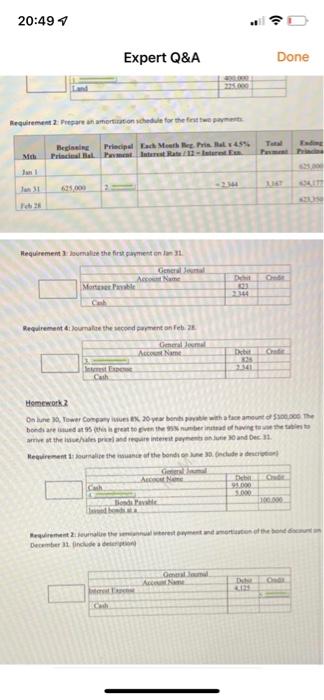

20:49 Expert Q&A Done need 4 and 5 -HOMEWORK ASSIGNMENT- Students should complete mest or all of the work in this area. The Homemark Oule will questions about this Homework. Notice that selected correct amounts are shows. The to be used as "check numbers" so you can know that you are on the right track Homer Quiz question numbers are shown in Green followed by a bos representing the location the missing text and/or amount. Below, the 1. indicates that the first question on the Quiz will ask about what goes in the box. The correct answer for question 1. on the Homework Quiris Building spelling matters) If the question is asking about an amount, then answer the question with the amount of money, always use commas where appropriate, like 1,000, not 1000, but de NOT use the sign or any decimal point (just round to the nearest dollar) unless it is spegically asked in the question. Below, the 13 indicates the second question. The correct for question 2 on the Homework Quiris 823 Homework 1 The San Pedro Company purchased a building and land with a fair market value purchase price of $625,000 (building $400,000 and land $225,000 on Jan 1, 2019. San Pedro signed a 30-year 4.5% mortgage payable note. San Pedro is to make monthly payms of 53,167 (given to need to calc table). Requirement 1: Joumalize the note issuance on Jan 1, 2019 (explanations are not required) General Jesmal Account Name Debt Cra 400.000 225.000 Requirement 2: Prepare an amortization schedule for the first two payments Beginning Principal Hal Principal Each Month Beg. Pria Bals 45% Payment Interest Rate/12-Interest an M Jan 31 625,000 Feb 28 Requirement 3: Joumalize the first payment on Jan 31. Account Name Mortgage Payable Cash General Journal Debit 823 2344 Tatal Endin Pusat Princ 625.00 3147 624,17 $21345 20:49 Expert Q&A 400.08) 225.000 Requirement 2: Prepare an amortization schedule for the first two payments Beginning Principal Each Mouth Beg. Pris. Bal v 4.5% Ma Priscinal Bal Payment Interest Rate /12-Interest Es Feb 26 Requirement 3: Joumalize the first payment on a 1 Account Name Mortger Pavable Debit 823 3344 Requirement 4: Journalize the second payment on Feb. 28 General Journal Account Name Crate Debit 828 2.341 Interest Expense Cash Homework 2 On June 30, Tower Company issues 8% 20-year bonts payable with a face amount of $300,000 The bonds are usued at 95 (this is great to given the 95% number instead of having to use the table to issue/ales pricel and require interest payments on June 30 and Dec Requirement 1: Journalize the issuance of the bonds on June 30 (include a description) General Inmal Account Name Debil Chade 95.000 1.000 Bonds Pavable 100.000 und bonds Requirement 2: Journalize the semiannual weerest payment and amortization of the bond docunt an December 31. Included) Omeral Journal Account Name Dabe Onde Intered Expe 4.125 Cash General Journal Done Total Pam Ending Princi 625,000 421350 20:49 Expert Q&A Done need 4 and 5 -HOMEWORK ASSIGNMENT- Students should complete mest or all of the work in this area. The Homemark Oule will questions about this Homework. Notice that selected correct amounts are shows. The to be used as "check numbers" so you can know that you are on the right track Homer Quiz question numbers are shown in Green followed by a bos representing the location the missing text and/or amount. Below, the 1. indicates that the first question on the Quiz will ask about what goes in the box. The correct answer for question 1. on the Homework Quiris Building spelling matters) If the question is asking about an amount, then answer the question with the amount of money, always use commas where appropriate, like 1,000, not 1000, but de NOT use the sign or any decimal point (just round to the nearest dollar) unless it is spegically asked in the question. Below, the 13 indicates the second question. The correct for question 2 on the Homework Quiris 823 Homework 1 The San Pedro Company purchased a building and land with a fair market value purchase price of $625,000 (building $400,000 and land $225,000 on Jan 1, 2019. San Pedro signed a 30-year 4.5% mortgage payable note. San Pedro is to make monthly payms of 53,167 (given to need to calc table). Requirement 1: Joumalize the note issuance on Jan 1, 2019 (explanations are not required) General Jesmal Account Name Debt Cra 400.000 225.000 Requirement 2: Prepare an amortization schedule for the first two payments Beginning Principal Hal Principal Each Month Beg. Pria Bals 45% Payment Interest Rate/12-Interest an M Jan 31 625,000 Feb 28 Requirement 3: Joumalize the first payment on Jan 31. Account Name Mortgage Payable Cash General Journal Debit 823 2344 Tatal Endin Pusat Princ 625.00 3147 624,17 $21345 20:49 Expert Q&A 400.08) 225.000 Requirement 2: Prepare an amortization schedule for the first two payments Beginning Principal Each Mouth Beg. Pris. Bal v 4.5% Ma Priscinal Bal Payment Interest Rate /12-Interest Es Feb 26 Requirement 3: Joumalize the first payment on a 1 Account Name Mortger Pavable Debit 823 3344 Requirement 4: Journalize the second payment on Feb. 28 General Journal Account Name Crate Debit 828 2.341 Interest Expense Cash Homework 2 On June 30, Tower Company issues 8% 20-year bonts payable with a face amount of $300,000 The bonds are usued at 95 (this is great to given the 95% number instead of having to use the table to issue/ales pricel and require interest payments on June 30 and Dec Requirement 1: Journalize the issuance of the bonds on June 30 (include a description) General Inmal Account Name Debil Chade 95.000 1.000 Bonds Pavable 100.000 und bonds Requirement 2: Journalize the semiannual weerest payment and amortization of the bond docunt an December 31. Included) Omeral Journal Account Name Dabe Onde Intered Expe 4.125 Cash General Journal Done Total Pam Ending Princi 625,000 421350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts