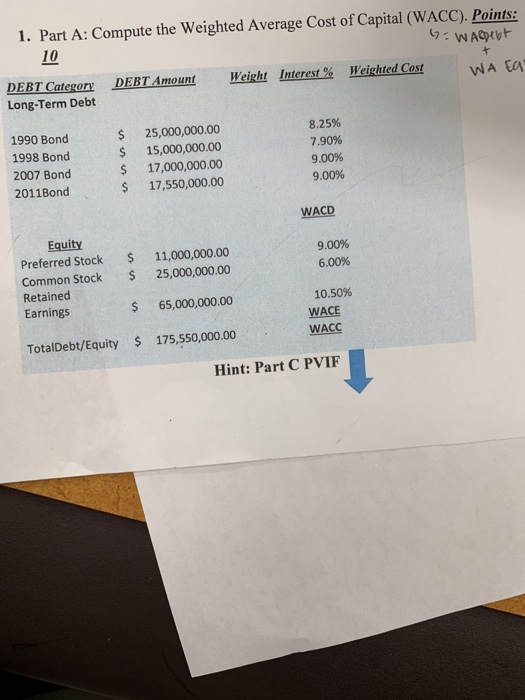

Question: HELP WACC CALCULATIONS 1. Part A: Compute the Weighted Average Cost of Capital (WACC). Points: 10 G=Wardent DEBT Category DEBT Amount Weight Interest % Weighted

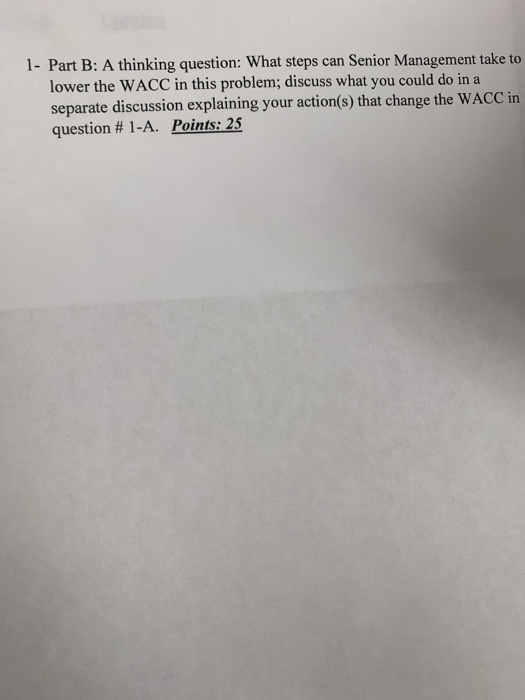

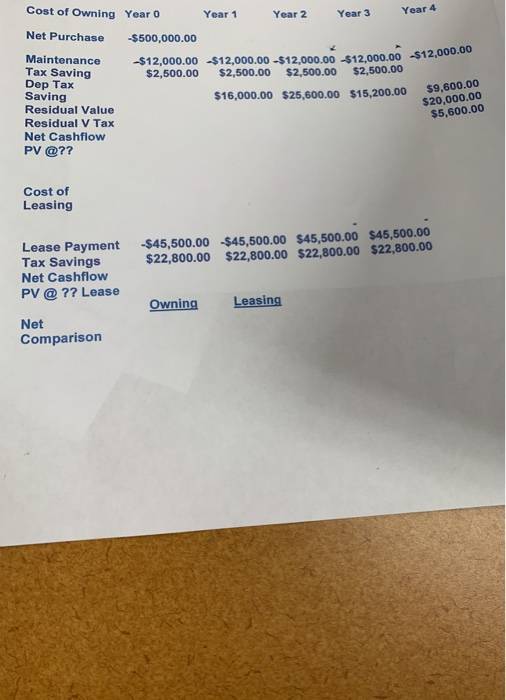

1. Part A: Compute the Weighted Average Cost of Capital (WACC). Points: 10 G=Wardent DEBT Category DEBT Amount Weight Interest % Weighted Cost WA Ea Long-Term Debt 1990 Bond 1998 Bond 2007 Bond 2011Bond $ $ $ $ 25,000,000.00 15,000,000.00 17,000,000.00 17,550,000.00 8.25% 7.90% 9.00% 9.00% WACD Equity Preferred Stock Common Stock Retained Earnings $ $ 9.00% 6.00% 11,000,000.00 25,000,000.00 $ 65,000,000.00 10.50% WACE WACC TotalDebt/Equity $ 175,550,000.00 Hint: Part C PVIF 1- Part B: A thinking question: What steps can Senior Management take to lower the WACC in this problem; discuss what you could do in a separate discussion explaining your action(s) that change the WACC in question # 1-A. Points: 25 Cost of Owning Year Year 1 Year 2 Year 3 Year 4 Net Purchase $500,000.00 $12,000.00 $12,000.00 $2,500.00 $12,000.00 $12,000.00 $12,000.00 $2,500.00 $2,500.00 $2,500.00 $16,000.00 $25,600.00 $15,200.00 Maintenance Tax Saving Dep Tax Saving Residual Value Residual V Tax Net Cashflow PV @?? $9,600.00 $20,000.00 $5,600.00 Cost of Leasing $45,500.00 $22,800.00 $45,500.00 $45,500.00 $45,500.00 $22,800.00 $22,800.00 $22,800.00 Lease Payment Tax Savings Net Cashflow PV @ ?? Lease Owning Leasing Net Comparison

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts