Question: Need more in depth help This last page is what a Chegg expert answered. I dont understand it can anyone help? Is this better? PART

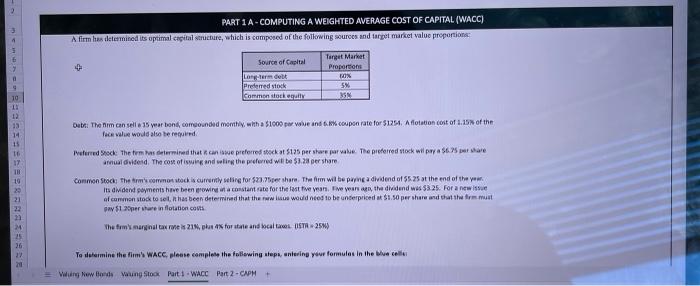

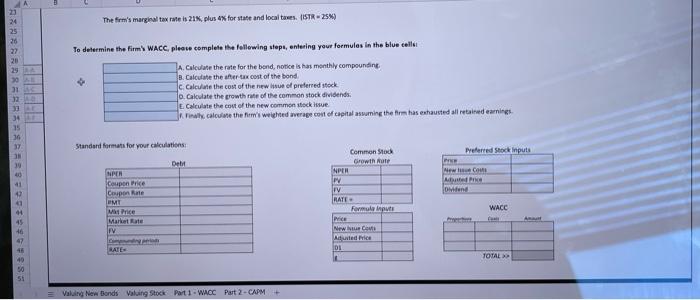

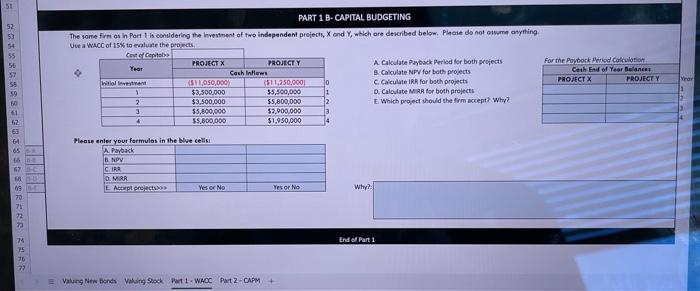

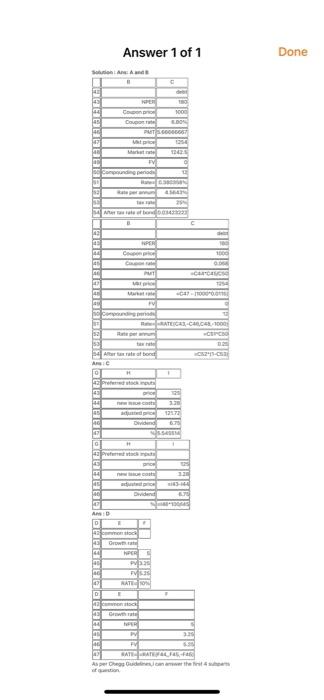

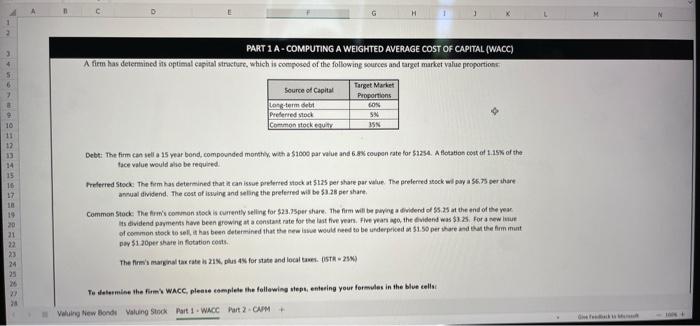

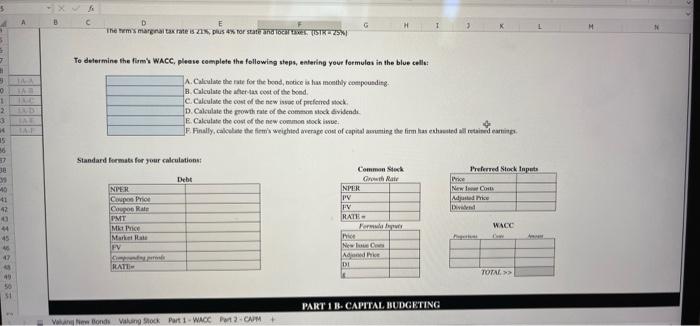

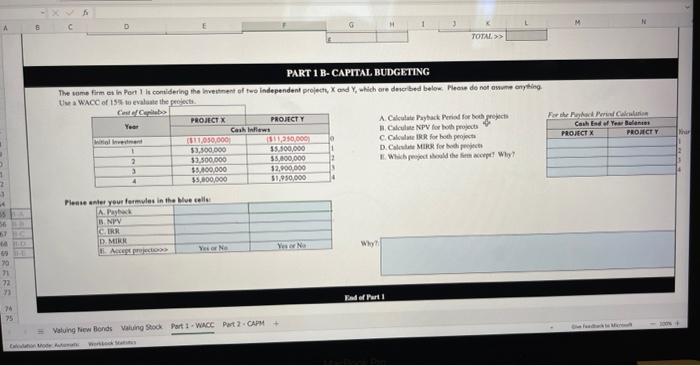

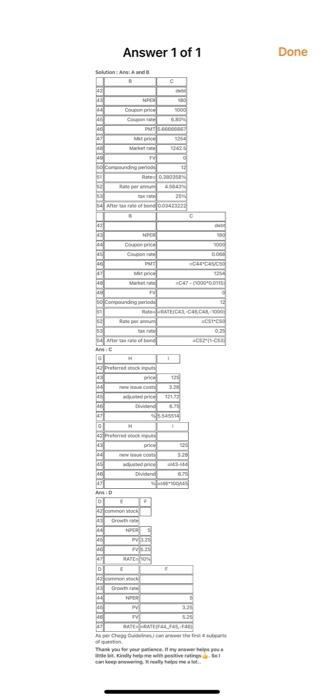

PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) Afirm has determined its optimal capital structure, which is composed of the following sources and target market value proportion + Source of Capital Long-term delt Preferred stock common stock egally Torget Market Proportion ON 5W 35 10 Ott The Him can selle 15 year boncomoded maily, with a $1.000 per we and 6 coupon rate for 51254. Aflotation cost of 1.15 of the face value wodd also be red 12 13 14 15 16 17 TH 19 29 Pferred Stock The temas derlermined that can we preferred stock at $125 per store per value. The preferred stock will pay a 56. here amaldided. The coming and in the preferred wil$3.23 per share Common Stock Therm.commotto is currently selling for $21.7.pershare. The firm will be punea dividend of 55.25 at the end of the ye. in didend payment have been prowita constant rate for the last five years. The year, the dividend was $325. For a twisse of common stock to sell has been determined that the www.us would need to be underpriced at $1.50 per here and trust a $1 per here in flotation costs 22 2 The firm's marginal tax reis 21,4% for state and local US25) 25 To determine the firm's WACC, please complete the following steps, entering your formules in the wall 27 21 Wung New Bodewung Stock Part 1 - WACC Part 2 -CAPM The firm's marginal tax rate lis 21. plus ex for state and local tases. ISTR-250 24 25 20 27 20 29 To determine the firm' WACC, please complete the following steps, entering your formules in the blue celle 31 2 LA. Calculate the rate for the bend, notice is has monthly compounding B. Calculate the after tax cost of the bond c. Calculate the cost of the whole of preferred stock 0. Calculate the growth rate of the common stock dividends E. Calculate the cost of the new common stock issue Ja in calculate the firm's weighted werage cost of capitaluring the firm has exhausted all retained earnings 34 15 36 Standard formats for your calculations Preferred to inputs Debt Common Stod Growth Mate NPER PV TV 40 New Are Ond NPR Coupon Price Coupon inte MT Mince Market FV RATE 28 WACC 46 Formula Price NEW COMO duted Price DI RATE TOTAL >> 40 50 51 Valung New Bonds Valuing Stock Part 1 - WACC Part 2 - CAPM + SZ 54 55 56 37 56 59 PART 1 B-CAPITAL BUDGETING The same firmos in Port las considering the investment of two independent projech, Xend y, which are described below. Please do not own anything Uve a WACC of 15% to evaluate the promet Cost Capital PROJECT X PROJECT Y A Calculate Payback period for both projects Year Cashinews 8. Calculate NPV for both projects Intoller 511,050,000 (511.250.000 10 Calculate IRR for both projects 1 $3.500.000 35,500,000 D. Calculate MRR for both projects 2 $3,500,000 55,800,000 E. Which project should the firm accept> Why? 3 $5,800,000 $2,000,000 55.800,000 $1,950,000 For the Payback wiod calculation Cath End of Year Balance PROJECT X PROJECT Y nar 4 mmpHmmchm%E 52 63 64 65 Please enter your formules in the Nve cells A Payback NPV CIRR O. MRR E Acept reject Yes of No Yes or No Why? ER 09 70 71 End of Part 1 24 75 16 77 Valung New bonds Valing Stock I. WAOC Part 2 - CAPM Answer 1 of 1 Done And Coco 1000 COLOR PUTO HE DI TV Rate per CH 100 CCC mo ATEN- CC-1000 CINCO Bairat tera | Are Pre 43 12 SAM 43 04 Dividend AD 1 Orow .. F RATE E D 44 PV BATEARYL FE-FR As per deschi D H 1 PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm has determined its optimal capital structure, which is composed of the following pources and target market value proportions Source of Capital Proportions Long term debit Preferred toch Common stock.cat Target Market GON 5 Debt: The firm can set a 15 year bond.compounded monthly with a $1000 par value and 6.9% coupon rate for $1254. A floration cost of 1.15% of the face value would also be required Preferred Stock The term has determined that it can stue preferred stock at $125 pershare par le The preferred stock wilaya 56 per here annual dividend. The cost of issuing and reling the preferred wi$328 per share Common Stock: The firm' common stock is currently selling for $23.75per share. The firm will be dividend of 55 35 at the end of the year is dividend payments have been growing constant rate for the last five years. Five years the dividend was $ For a new of common stock to sell, has been determined that the wise would need to be underpriced $1.50 per here and that the firm must pa 51 Oper share infotation costs 20 21 22 23 24 The firm's marginal tax rate 21% us for state and local STR 210 M 22 28 To determine the firm' WACC, please complete the following the entering your formules in the blue celle Volung New Bondi valuing Stock Part 1 WACC Part 2-CAM + 5 C D Themmaga tax rates plus ex for starter TISTRES H 0 1 2 To determine the firm' WACC, please complete the following steps, entering your formules in the blue cell: A Case the rate for the bood, notice is has monthly compounding, B. Calculate the whers cost of the bed c. Calculate the cost of the new invoe of preferred och D. Calculate the growth rate of the common dividende E. Calculate the cost of the new common stock iwe JF Finally call the time weighted average cost of capital in the firm has exhausted all retained LAT 15 56 Standard formats for your calculations Debt 3e 3 40 41 42 Commen Sie Growth Rate NPER PY FY RATE Formu Preferred Stock Inputs Price New Con Addre NPER Coupon Price Coupon Rate PMT Mit Price Narketa FV Cm RATE WACC New Ande 1 TOTAL PART 1 B. CAPITAL BUDGETING Vw Bonds Vigock Part 1 - WACC 2-CAM A H TOTAL. >> PART 1 B-CAPITAL BUDGETING The same time in Port 1 scondering the Investment of two independent project, X and Y, which are described below. Please do not own anything UM WACC of 15 to evaluate the perfecte Catalubs PROJECTX PROJECT Y A. Calcule Pay Period for both Cash In Calcule NPV for both projects Winter (311,050,000 13110.000 C.Cate for both project $3,300,000 55.500.000 D. Case MERR for bedre 2 $2.500.000 $5.000.000 I Wij dhe fem? Why? 3 $5,400.000 12,800,000 4 35.000.000 $1,950,000 For Cars Cash End of Year Bus PROJECT X PROACTY 1 7 55 56 Please enter your formules in the wesele A. Pa I NPV CIRR D. MIRK Acero Yo Ne Yes No Why 90 22 Ef Part + 76 75 Voluing Bonds Valuing Stock Part 1 WACC Part 2.CAPM Com Answer 1 of 1 Done Solution de Judo C 000 PESCORT NO NET 2014 4043 CD CH DOO BLOG Murter CT-00000 U 023 for . D DO ME RATED D G NOW Than PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) Afirm has determined its optimal capital structure, which is composed of the following sources and target market value proportion + Source of Capital Long-term delt Preferred stock common stock egally Torget Market Proportion ON 5W 35 10 Ott The Him can selle 15 year boncomoded maily, with a $1.000 per we and 6 coupon rate for 51254. Aflotation cost of 1.15 of the face value wodd also be red 12 13 14 15 16 17 TH 19 29 Pferred Stock The temas derlermined that can we preferred stock at $125 per store per value. The preferred stock will pay a 56. here amaldided. The coming and in the preferred wil$3.23 per share Common Stock Therm.commotto is currently selling for $21.7.pershare. The firm will be punea dividend of 55.25 at the end of the ye. in didend payment have been prowita constant rate for the last five years. The year, the dividend was $325. For a twisse of common stock to sell has been determined that the www.us would need to be underpriced at $1.50 per here and trust a $1 per here in flotation costs 22 2 The firm's marginal tax reis 21,4% for state and local US25) 25 To determine the firm's WACC, please complete the following steps, entering your formules in the wall 27 21 Wung New Bodewung Stock Part 1 - WACC Part 2 -CAPM The firm's marginal tax rate lis 21. plus ex for state and local tases. ISTR-250 24 25 20 27 20 29 To determine the firm' WACC, please complete the following steps, entering your formules in the blue celle 31 2 LA. Calculate the rate for the bend, notice is has monthly compounding B. Calculate the after tax cost of the bond c. Calculate the cost of the whole of preferred stock 0. Calculate the growth rate of the common stock dividends E. Calculate the cost of the new common stock issue Ja in calculate the firm's weighted werage cost of capitaluring the firm has exhausted all retained earnings 34 15 36 Standard formats for your calculations Preferred to inputs Debt Common Stod Growth Mate NPER PV TV 40 New Are Ond NPR Coupon Price Coupon inte MT Mince Market FV RATE 28 WACC 46 Formula Price NEW COMO duted Price DI RATE TOTAL >> 40 50 51 Valung New Bonds Valuing Stock Part 1 - WACC Part 2 - CAPM + SZ 54 55 56 37 56 59 PART 1 B-CAPITAL BUDGETING The same firmos in Port las considering the investment of two independent projech, Xend y, which are described below. Please do not own anything Uve a WACC of 15% to evaluate the promet Cost Capital PROJECT X PROJECT Y A Calculate Payback period for both projects Year Cashinews 8. Calculate NPV for both projects Intoller 511,050,000 (511.250.000 10 Calculate IRR for both projects 1 $3.500.000 35,500,000 D. Calculate MRR for both projects 2 $3,500,000 55,800,000 E. Which project should the firm accept> Why? 3 $5,800,000 $2,000,000 55.800,000 $1,950,000 For the Payback wiod calculation Cath End of Year Balance PROJECT X PROJECT Y nar 4 mmpHmmchm%E 52 63 64 65 Please enter your formules in the Nve cells A Payback NPV CIRR O. MRR E Acept reject Yes of No Yes or No Why? ER 09 70 71 End of Part 1 24 75 16 77 Valung New bonds Valing Stock I. WAOC Part 2 - CAPM Answer 1 of 1 Done And Coco 1000 COLOR PUTO HE DI TV Rate per CH 100 CCC mo ATEN- CC-1000 CINCO Bairat tera | Are Pre 43 12 SAM 43 04 Dividend AD 1 Orow .. F RATE E D 44 PV BATEARYL FE-FR As per deschi D H 1 PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm has determined its optimal capital structure, which is composed of the following pources and target market value proportions Source of Capital Proportions Long term debit Preferred toch Common stock.cat Target Market GON 5 Debt: The firm can set a 15 year bond.compounded monthly with a $1000 par value and 6.9% coupon rate for $1254. A floration cost of 1.15% of the face value would also be required Preferred Stock The term has determined that it can stue preferred stock at $125 pershare par le The preferred stock wilaya 56 per here annual dividend. The cost of issuing and reling the preferred wi$328 per share Common Stock: The firm' common stock is currently selling for $23.75per share. The firm will be dividend of 55 35 at the end of the year is dividend payments have been growing constant rate for the last five years. Five years the dividend was $ For a new of common stock to sell, has been determined that the wise would need to be underpriced $1.50 per here and that the firm must pa 51 Oper share infotation costs 20 21 22 23 24 The firm's marginal tax rate 21% us for state and local STR 210 M 22 28 To determine the firm' WACC, please complete the following the entering your formules in the blue celle Volung New Bondi valuing Stock Part 1 WACC Part 2-CAM + 5 C D Themmaga tax rates plus ex for starter TISTRES H 0 1 2 To determine the firm' WACC, please complete the following steps, entering your formules in the blue cell: A Case the rate for the bood, notice is has monthly compounding, B. Calculate the whers cost of the bed c. Calculate the cost of the new invoe of preferred och D. Calculate the growth rate of the common dividende E. Calculate the cost of the new common stock iwe JF Finally call the time weighted average cost of capital in the firm has exhausted all retained LAT 15 56 Standard formats for your calculations Debt 3e 3 40 41 42 Commen Sie Growth Rate NPER PY FY RATE Formu Preferred Stock Inputs Price New Con Addre NPER Coupon Price Coupon Rate PMT Mit Price Narketa FV Cm RATE WACC New Ande 1 TOTAL PART 1 B. CAPITAL BUDGETING Vw Bonds Vigock Part 1 - WACC 2-CAM A H TOTAL. >> PART 1 B-CAPITAL BUDGETING The same time in Port 1 scondering the Investment of two independent project, X and Y, which are described below. Please do not own anything UM WACC of 15 to evaluate the perfecte Catalubs PROJECTX PROJECT Y A. Calcule Pay Period for both Cash In Calcule NPV for both projects Winter (311,050,000 13110.000 C.Cate for both project $3,300,000 55.500.000 D. Case MERR for bedre 2 $2.500.000 $5.000.000 I Wij dhe fem? Why? 3 $5,400.000 12,800,000 4 35.000.000 $1,950,000 For Cars Cash End of Year Bus PROJECT X PROACTY 1 7 55 56 Please enter your formules in the wesele A. Pa I NPV CIRR D. MIRK Acero Yo Ne Yes No Why 90 22 Ef Part + 76 75 Voluing Bonds Valuing Stock Part 1 WACC Part 2.CAPM Com Answer 1 of 1 Done Solution de Judo C 000 PESCORT NO NET 2014 4043 CD CH DOO BLOG Murter CT-00000 U 023 for . D DO ME RATED D G NOW Than

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts