Question: Help! What do I have to do to ge the answer 1,350? Do Homework - Ashley Rangel - Google Chrome a https://www.mathx x?homeworkld-495847801&questionld-2&flushed true&cld 5146234¢erwin-yes

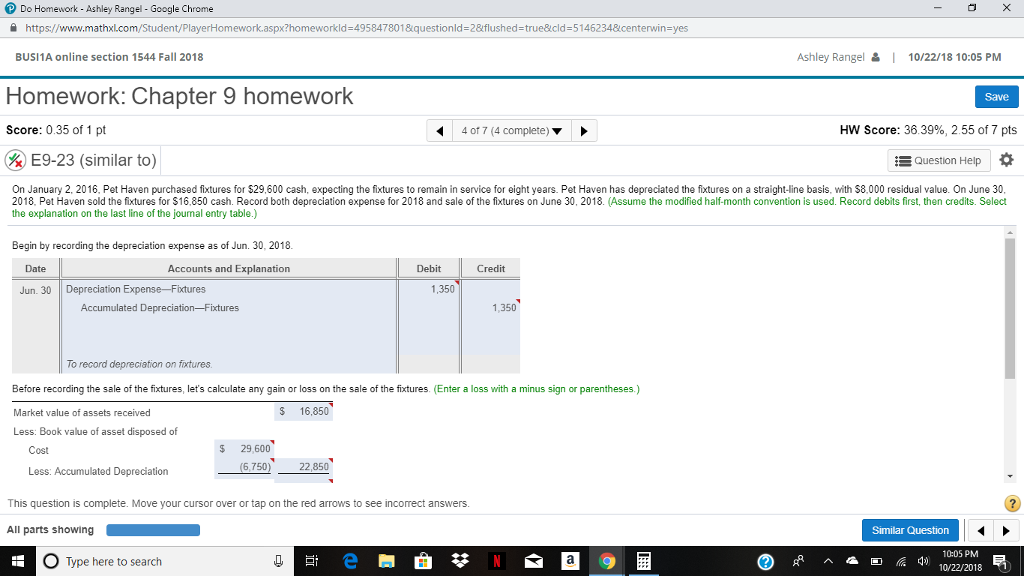

Help! What do I have to do to ge the answer 1,350?

Do Homework - Ashley Rangel - Google Chrome a https://www.mathx x?homeworkld-495847801&questionld-2&flushed true&cld 5146234¢erwin-yes BUSI1A online section 1544 Fall 2018 Ashley Rangel | 10/22/18 10:05 PM Homework: Chapter 9 homework Score: 0.35 of 1 pt 5E9-23 (similar to) Save 4 of 7 (4 complete)> HW Score: 36.39%, 2.55 of 7 pts Question Help On January 2, 2016, Pet Haven purchased fixtures for $29,600 cash, expecting the fixtures to remain in service for eight years. Pet Haven has depreciated the fixtures on a straight-line basis, with S8,000 residual value. On June 30, 2018, Pet Haven sold the fixtures for $16,850 cash. Record both depreciation expense for 2018 and sale of the fixtures on June 30, 2018. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Begin by recording the depreciation expense as of Jun. 30, 2018 Date Accounts and Explanation Debit Credit Jun. 30 Depreciation Expense Fixtures 1,350 1,350 To record depreciation on fixtures Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures. (Enter a loss with a minus sign or parentheses.) Market value of assets received Less: Book value of asset disposed of S 16,850 Cost $ 29,600 750 22,850 Less: Accumulated Depreciation This question is complete. Move your cursor over or tap on the red arrows to see incomect answers All parts showing Similar Question 10:05 PM O Type here to search 10/22/2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts