Question: help with A - B steps Annuities and compounding Personal Finance Problem Janet Boyle intends to deposit $300 per year in a credit union for

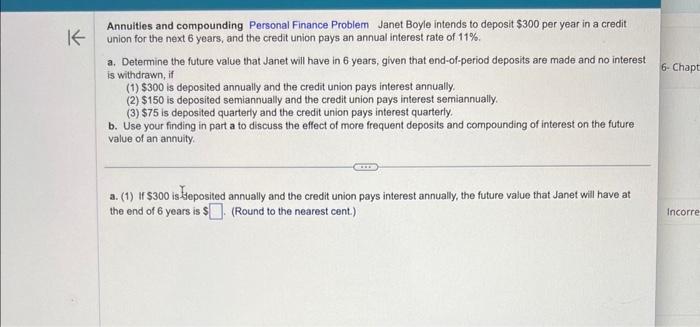

Annuities and compounding Personal Finance Problem Janet Boyle intends to deposit $300 per year in a credit union for the next 6 years, and the credit union pays an annual interest rate of 11%. a. Determine the future value that Janet will have in 6 years, given that end-of-period deposits are made and no interest is withdrawn, if (1) $300 is deposited annually and the credit union pays interest annually. (2) $150 is deposited semiannually and the credit union pays interest semiannually. (3) $75 is deposited quarterly and the credit union pays interest quarterly. b. Use your finding in part a to discuss the effect of more frequent deposits and compounding of interest on the future value of an annuity. a. (1) If $300 is Seposited annually and the credit union pays interest annually, the future value that Janet will have at the end of 6 years is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts