Question: Help with all a. What is the approximate yield to maturity of a 13 percent coupon rate, exist1,000 par value bond which is currently priced

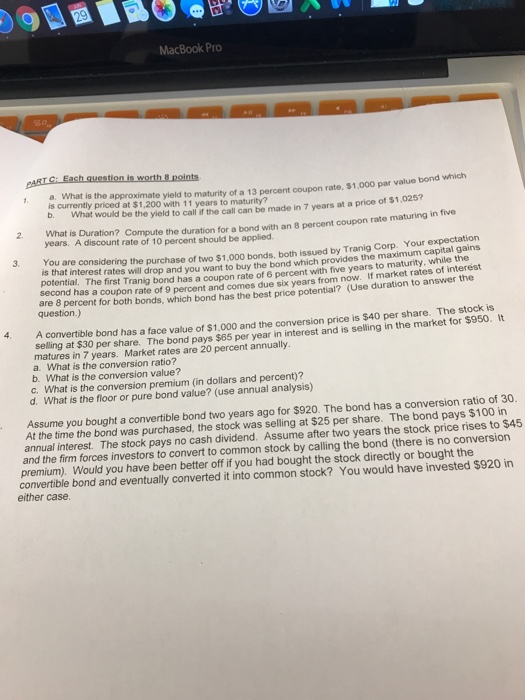

a. What is the approximate yield to maturity of a 13 percent coupon rate, exist1,000 par value bond which is currently priced at exist1, 200 with 11 years to maturity? b. What would be the yield to call if the call can be made in 7 years at a price of exist1, 025? What is Duration? Compute the duration for a bond with an 8 percent coupon rate maturing in five years. A discount rate of 10 percent should be applied. You are considering the purchase of two exist1,000 bonds, both issued by Corp. Your expectation is that interest rates will drop and you want to buy the bond which provides the maximum capital gains potential. The first bond has a coupon rate of 6 percent with five years to maturity, while the second has a coupon rate of 9 percent and comes due six years from now. If market rates of interest are 8 percent for both bonds, which bond has the best price potential? (Use duration to answer the question.) A convertible bond has a face value of exist1,000 and the conversion price is exist40 per share. The stock is selling at exist30 per share. The bond pays exist65 per year in interest and is selling in the market for exist950. It matures in 7 years. Market rates are 20 percent annually. a. What is the conversion ratio? b. What is the conversion value? c. What is the conversion premium (in dollars and percent)? d. What is the floor or pure bond value? (use annual analysis) Assume you bought a convertible bond two years ago for exist920. The bond has a conversion ratio of 30. At the time the bond was purchased, the stock was selling at exist25 per share. The bond pays exist100 in annual interest. The stock pays no cash dividend. Assume after two years the stock price rises to exist45 and the firm forces investors to convert to common stock by calling the bond (there is no conversion premium). Would you have been better off if you had bought the stock directly or bought the convertible bond and eventually converted it into common stock? You would have invested exist920 in either case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts