Question: help with any decision would be helpful, thank you Name Crat savet A 10.2002 00 PM COT Perceptual Map (at end of this year) Pimn

help with any decision would be helpful, thank you

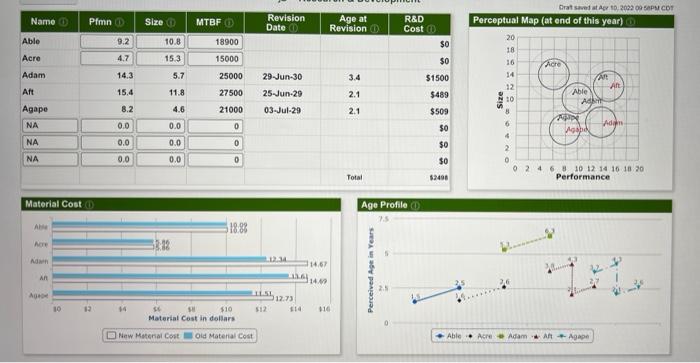

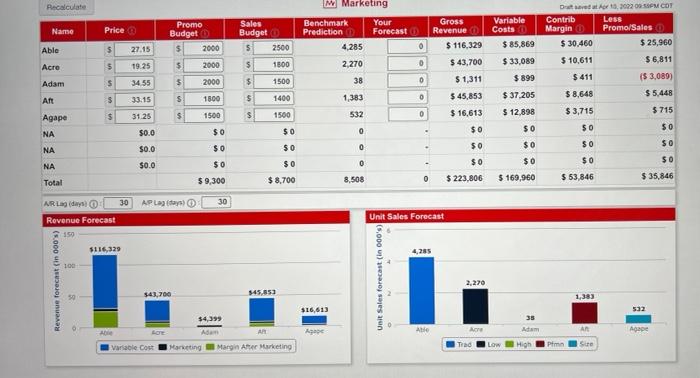

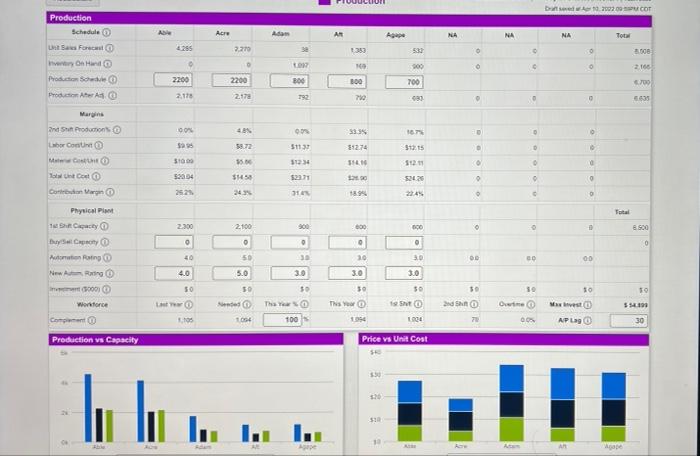

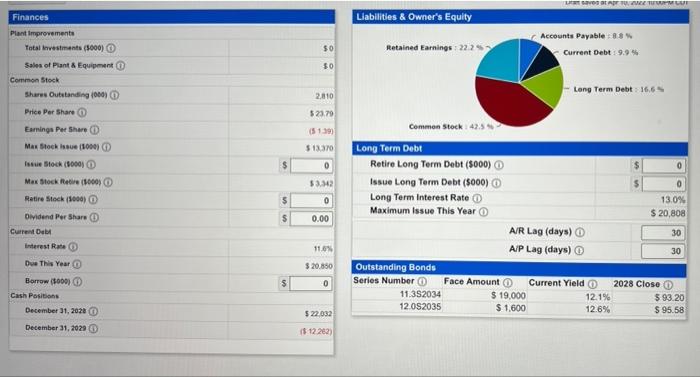

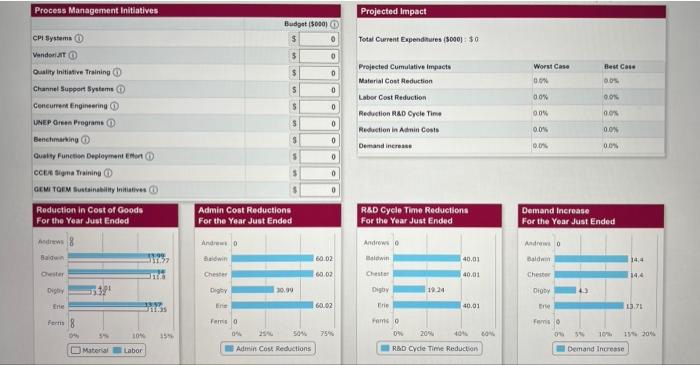

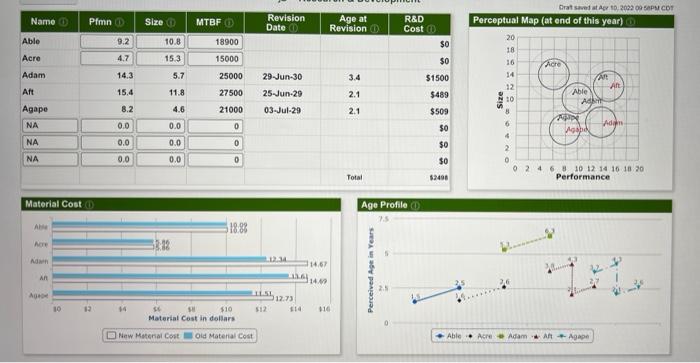

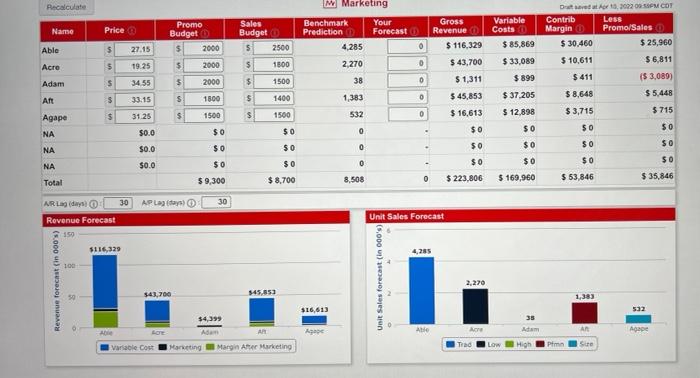

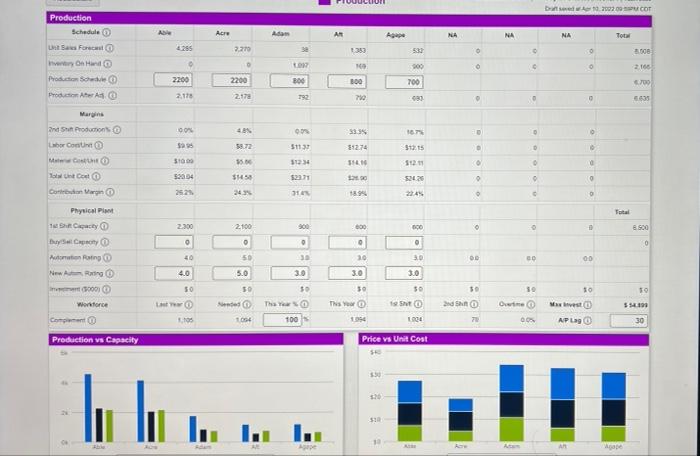

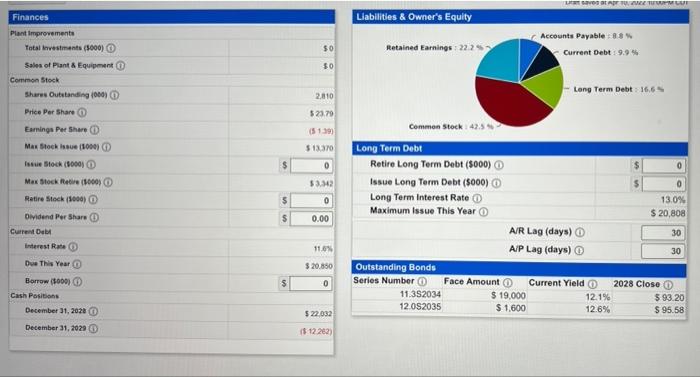

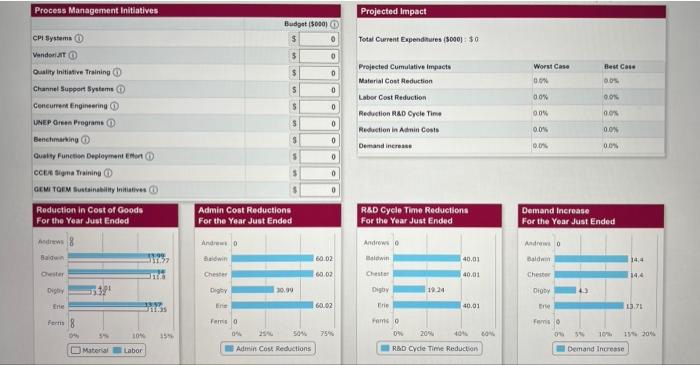

Name Crat savet A 10.2002 00 PM COT Perceptual Map (at end of this year) Pimn Size MTBF Revision Date Age at Revision 20 Able 9.2 10.8 R&D Cost $0 $0 51500 Acre 4.7 15.3 20 Adam 14.3 18900 15000 25000 27500 21000 5.7 3.4 15.4 11.8 29-Jun-30 25-Jun-29 03-Jul-29 2.1 Aft Agape NA Able $489 $509 Size 8.2 2.1 4.6 0.0 18 16 14 An 12 AN 10 Ad 3 IN 6 Adin Ugand 4 2 0 0 2 4 6 8 10 12 14 16 18 20 Performance 0.0 0 50 0.0 0.0 0 $0 NA NA 0.0 0.0 0 $0 Total $2490 Material Costo Age Profile 518 8% Are 53:12 Ah LI 114.67 16 1442 Perceived Agein Years an Age 10 12 14 512 514 $10 Material Cost in dollars New Material Cost Old Material Cost Able. Acre Adam A - Agape Recalculate Name Price Sales Budget M Marketing Benchmark Your Prediction Forecast 4285 2,270 Gross Revenue $ 116.329 Promo Budget $ 2000 $ 2000 5 Able 27.15 0 2500 1800 Variable Costs $ 85,869 $ 33,089 $899 De Ar 1,2002-09 FM COT Contrib Less Margin Promo/Sales $ 30,460 $ 25,960 $ 10,611 $ 6,811 $ 411 ($ 3,089) $ 8,648 $5,448 Acro 5 19.25 $ 0 $ 43,700 $ Adam 34 55 5 2000 $ 38 1500 0 $ Ant 33.15 $ 1800 $ 1400 1,383 0 $ $ 715 31.25 $ 1500 $ Agape 532 1500 0 $ 37.205 $ 12,898 $0 $1,311 $ 45,853 $ 16,613 $0 $0 $0 $ 3,715 SO 50 NA $0.0 $0 $0 0 $0 $0.0 NA SO $0 SO $0 0 $0 $0.0 $0 $0 NA $0 $0 0 Total $8,700 8,508 $ 9,300 0 $223,806 $ 53,846 $ 35,846 $ 169,960 AP Lady 30 ARLA days 30 Revenue Forecast Unit Sales Forecast 150 5116,329 4,285 100 Revenue forecast (in 000 s) Unit Sales forecast (in 000's) 2.270 543,700 $45.853 1,383 $16,613 532 $4,39 Adam Lor AR A Atle Acne AR Agape Variable Cost Margin Aer Marketing Marketing Trad Low High Pim Site 2020-COT A Acre Acom AR A NA NA NA Tot 4255 7.770 1353 533 0 O 0 3.508 Production Schedule Forecast von Hand Productions Producer 200 0 2.166 2200 2200 300 300 700 700 2.175 2.17 re 030 0 5635 00 4 09 33.3 18 0 $29 59.72 5113 $5274 312215 . Margin 2nd St Productions Labor Cont Meer Son Corto Contraron $100 51234 11 12 $15 520 52120 0 $2004 2521 24 10 1894 0 Total 2.300 2.100 600 CO o 8.900 0 O 0 . 0 Physical Pit 1 Shady SCO Actor Rating Newing 0001 40 50 17988: 20 3.0 20 00 4.0 5.0 3.0 3.0 50 50 30 . 30 TO 35290 o The reaso This 2nd 0. MO Wottore Coment LO os ISNO 1004 Oui QOS 164 100 1394 APLI 30 Production vs Capacity Price vs Unit Cost LLLLLL 518 1 Vape SAPETE Liabilities & Owner's Equity 50 Retained Earnings 222 Accounts Payable 88 Current Debt: 9.9 $0 Long Term Debt 1665 2.810 Finances Plant improvements Total Investments (5000) Sales of Plant & Equipment Common Stock Shares Outstanding 10001 Price Per Share o Earnings Per Share Max Stock Issue (1000) Issue Stock (1000) Max Stock Retire (1000 Retire stock (1000) 523.79 (5139 $13.30 0 0 53.42 0 $ 0.00 Common stock 42.5 Long Term Debt Retire Long Term Debt (5000) Issue Long Term Debt (5000) 0 Long Term Interest Rate 13.0% Maximum Issue This Year $ 20,808 A/R Lag (days) 30 AIP Lag (days) 30 Outstanding Bonds Series Number Face Amount Current Yield 2028 Close 11.352034 $ 19,000 12.1% $ 93 20 12.082035 $ 1.600 12.8% $ 95.58 11.0 Dividend Per Share Current Debt Interest Rate Due This Year Borrow (5000) Cash Positions December 31, 2018 December 31, 2029 $ 20,850 $ 0 $ 22.032 $ 12.262) Process Management Initiatives Projected Impact Budget (5000) $ Total Current Expenditures (5000): $0 5 0 0 Best Case $ Worst Case . 5 0 00% Projected Cumulative impacts Material Cost Reduction Labor Cost Reduction Reduction R&D Cycle Time Reduction in Alin Costs Demandiner 05 0.0% . 0 005 $ 0 0.0% 0.0 0 $ 5 0.0% CP Systems Vendor JT Quality Initiative Training Channel Support Systems Concurrent Engineering UNEP Gran Programs Benchmarking Quality Function Deployment fort CCR Sine Training OM TOM Sinability to Reduction in Cost of Goods For the Year Just Ended Andrews 8 Bac . Oester 0.0% 0 5 0 0 Admin Cost Reductions For the Year Just Ended R&D Cycle Time Reductions For the Year Just Ended Demand increase For the Year Just Ended Andrew Ando Andrews Baldwin Baldwin 60.02 40.01 14.4 Chest 60.02 40.01 14.4 Digby 30.99 1024 Digby Ere 1997 En 60.02 tre 13.7: Fem Ferro Digby Tre 40.01 Pomo 09 209 co R&D Cyde The Reduction Foro 04 10 35 04 10 15% 20% Material Labor Admin Cost Reductions Demand Increase

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock