Question: help with both I'm lost 3 Question 24 (1 point) The risk-free rate is 2.2% and the market risk premium is 6.0%. A stock has

help with both I'm lost

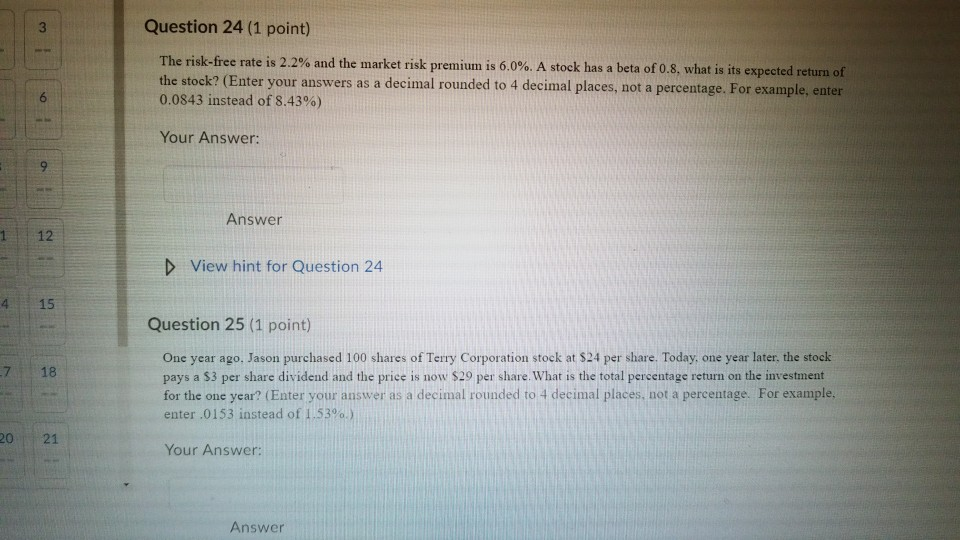

3 Question 24 (1 point) The risk-free rate is 2.2% and the market risk premium is 6.0%. A stock has a beta of 0.8, what is its expected return of the stock? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of8.43%) Your Answer: Answer 112 D View hint for Question 24 415 Question 25 (1 point) One year ago, Jason purchased 100 shares of Terry Corporation stock at s24 per share. Today, one year later, the stock pays a S3 per share dividend and the price is now $29 per share. What is the total percentage return on the investment for the one year? (Enter your answer as a decimal rounded to 4 decimal places, not a percentage. For example, enter .0153 instead of 1.53%.) 718 2021 Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts