Question: Help with charts for each alternative and manual solution (26 Pts.) 3. Using an after tax Net Present Worth analysis choose between the two alternatives

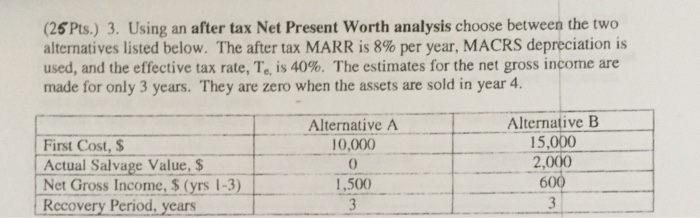

(26 Pts.) 3. Using an after tax Net Present Worth analysis choose between the two alternatives listed below. The after tax MARR is 8% per year, MACRS depreciation is used, and the effective tax rte, Te, is 40%. The estimates for the net gross income are made for only 3 years. They are zero when the assets are sold in year 4. Alternative B 15,000 2,000 600 3 Alternative A 10,000 First Cost, S Actual Salvage Value, $ Net Gross Income, $ (yrs 1-3) Recovery Period, years 1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts