Question: HELLO :), COULD SOMEONE PLEASEEE EXPLAIN TO ME IN A DETAILED AND EASY WAY WHY IS THE OPTION HIGHLITED IN YELLOW THE CORRECT ANSWER. I

HELLO :), COULD SOMEONE PLEASEEE EXPLAIN TO ME IN A DETAILED AND EASY WAY WHY IS THE OPTION HIGHLITED IN YELLOW THE CORRECT ANSWER. I AM HAVING A HARD TIME ON UNDERSTANDING AND SOLVING THIS. THE SOLUTION IN RED IS WHAT I HAVE SO FAR. PLEASE, HELP ME! THANK YOU SO MUCH IN ADVANCE!!!

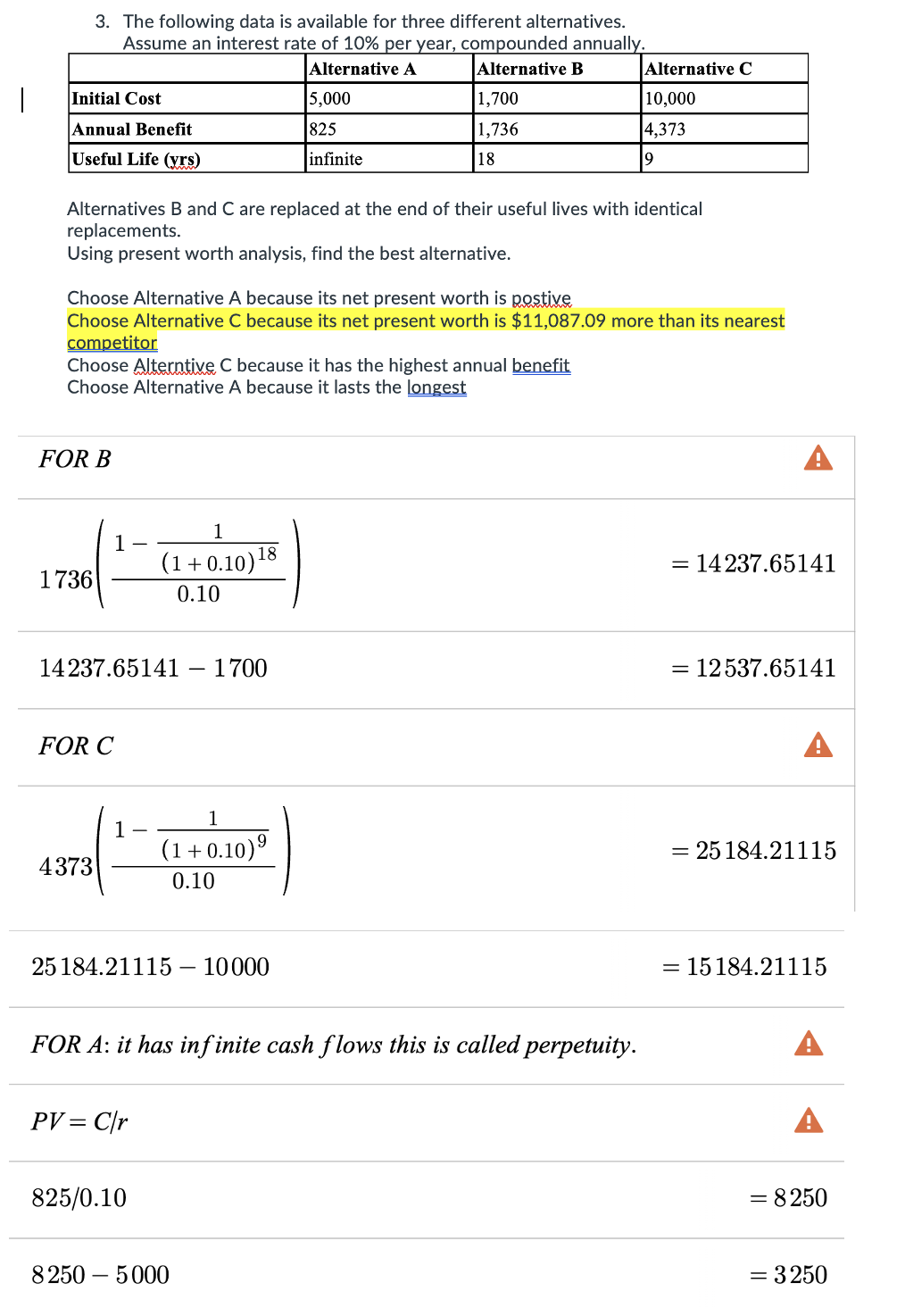

3. The following data is available for three different alternatives. Assume an interest rate of 10% ner vear. comnounded annuallv. Alternatives B and C are replaced at the end of their useful lives with identical replacements. Using present worth analysis, find the best alternative. Choose Alternative A because its net present worth is postive Choose Alternative C because its net present worth is $11,087.09 more than its nearest competitor Choose Alterntive C because it has the highest annual benefit Choose Alternative A because it lasts the longest FOR B 1736(0.101(1+0.10)181) =14237.651 14237.651411700 =12537.651 FOR C 4373(0.101(1+0.10)91) =25184.211 25184.2111510000 =15184.211 FOR A: it has infinite cash flows this is called perpetuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts