Question: Help with completed units please !!! You have recently been appointed as the cost accountant for Carla Vista Hair Co. Ltd., a manufacturer of hair

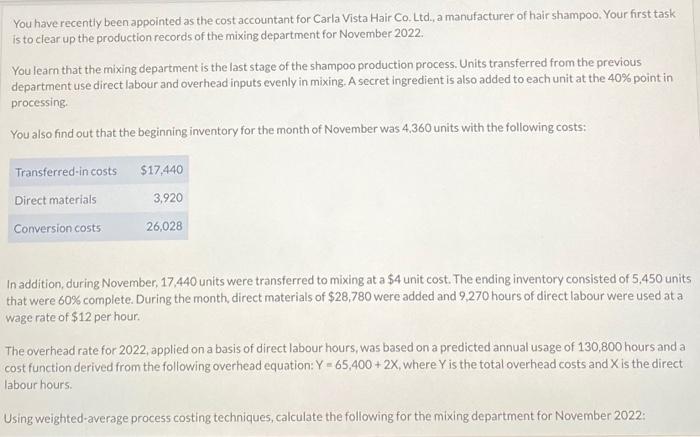

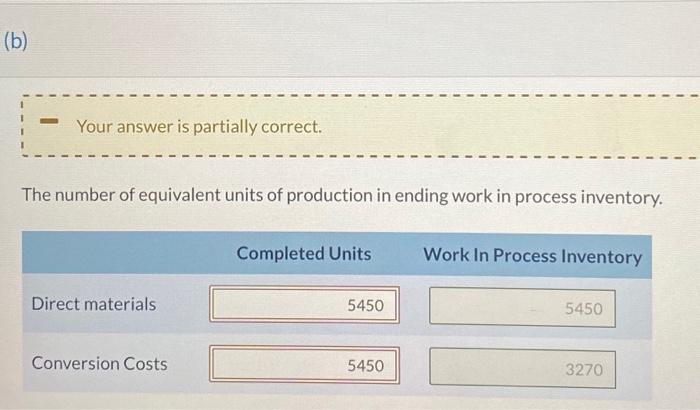

You have recently been appointed as the cost accountant for Carla Vista Hair Co. Ltd., a manufacturer of hair shampoo. Your first task is to clear up the production records of the mixing department for November 2022. You learn that the mixing department is the last stage of the shampoo production process. Units transferred from the previous department use direct labour and overhead inputs evenly in mixing. A secret ingredient is also added to each unit at the 40% point in processing, You also find out that the beginning inventory for the month of November was 4.360 units with the following costs: In addition, during November, 17,440 units were transferred to mixing at a $4 unit cost. The ending inventory consisted of 5.450 units that were 60% complete. During the month, direct materials of $28,780 were added and 9,270 hours of direct labour were used at a wage rate of $12 per hour. The overhead rate for 2022 , applied on a basis of direct labour hours, was based on a predicted annual usage of 130,800 hours and a cost function derived from the following overhead equation: Y=65,400+2X, where Y is the total overhead costs and X is the direct labour hours. Using weighted-average process costing techniques, calculate the following for the mixing department for November 2022 : The number of equivalent units of production in ending work in process inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts