Question: help with making a pivot table, a general ledgar and a leder I need help making a pivot table and general leder. in the pictures

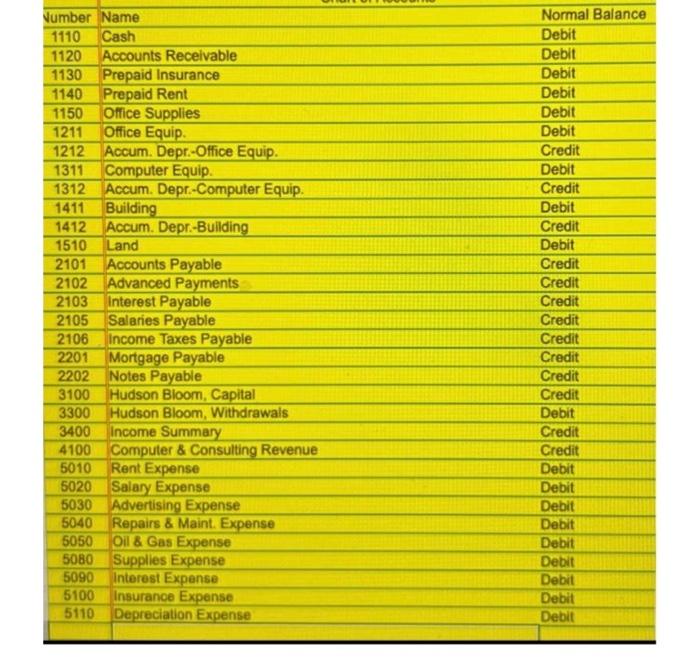

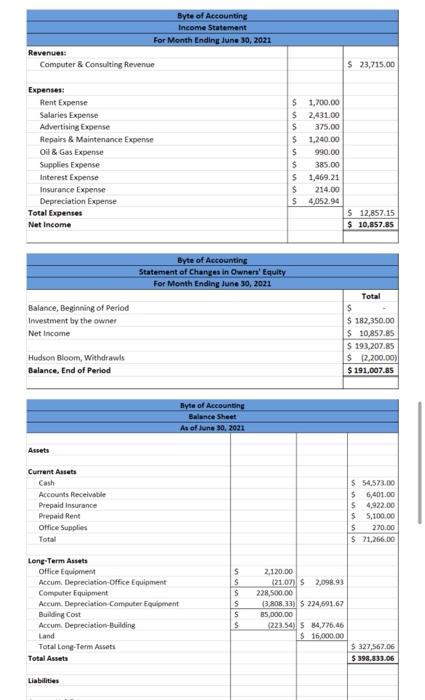

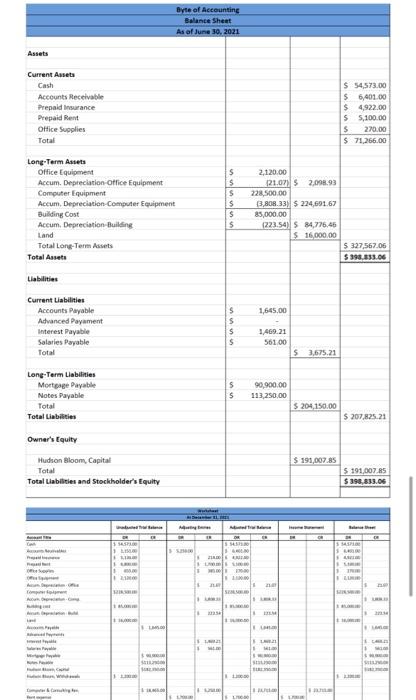

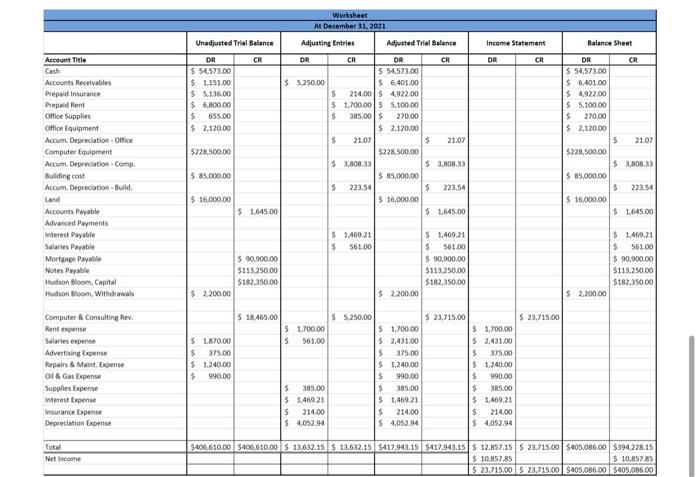

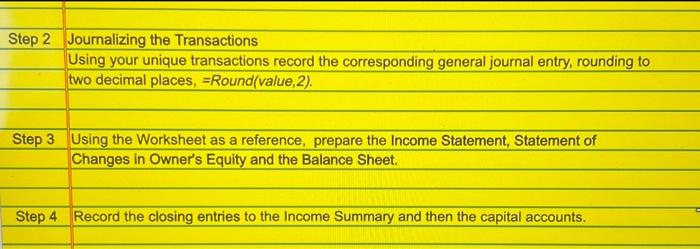

Number Name 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip. 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip. 1411 Building 1412 Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Hudson Bloom, Capital 3300 Hudson Bloom, Withdrawals Income Summary Computer & Consulting Revenue Rent Expense Salary Expense 3400 4100 5010 5020 5030 5040 Advertising Expense Repairs & Maint. Expense Oil & Gas Expense Supplies Expense Interest Expense 5100 Insurance Expense 5110 5050 5080 5090 Depreciation Expense Normal Balance Debit Debit Debit Debit Debit Debit Credit Debit Credit Debit Credit Debit Credit Credit Credit Credit Credit Credit Credit Credit Debit Credit Credit Debit Debit Debit Debit Debit Debit Debit Debit Debit Revenues: Computer & Consulting Revenue Expenses: Rent Expense Salaries Expense Advertising Expense Repairs & Maintenance Expense Oil & Gas Expense Supplies Expense Interest Expense Insurance Expense Depreciation Expense Total Expenses Net Income Balance, Beginning of Period Investment by the owner Net Income Hudson Bloom, Withdrawls Balance, End of Period Assets Current Assets Cash Accounts Receivable Prepaid Insurance Prepaid Rent Office Supplies Total Byte of Accounting Income Statement For Month Ending June 30, 2021 Long-Term Assets Liabilities Byte of Accounting Statement of Changes in Owners' Equity For Month Ending June 30, 2021 Byte of Accounting Balance Sheet As of June 30, 2021 Office Equipment Accum. Depreciation-Office Equipment Computer Equipment Accum. Depreciation Computer Equipment Building Cost Accum. Depreciation-Building Land Total Long-Term Assets Total Assets $ S $ S $ $ $ S S S $ $ S $ S 1,700.00 2,431.00 375.00 1,240.00 990.00 385.00 1,469.21 214.00 4,052.94 2,120.00 (21.07) $2,098.93 228,500.00 (3,808.33) $ 224,691.67 85,000.00 (223.54) $ 84,776.46 $ 16,000.00 $ 23,715.00 $ 12,857.15 $ 10,857.85 Total $ $ 182,350.00 $ 10,857.85 $ 193,207.85 $ (2,200.00) $191,007.85 $ 54,573.00 $6,401.00 S 4,922.00 5,100.00 5 $ 270.00 $71,266.00 $ 327,567.06 $ 398,833.06 Assets Current Assets Cash Long-Term Assets Accounts Receivable Prepaid Insurance Prepaid Rent Office Supplies Total Total Assets Office Equipment Accum. Depreciation Office Equipment Computer Equipment Liabilities Current Liabilities P Accum, Depreciation Computer Equipment Building Cost Accum. Depreciation Building Land Total Long-Term Assets Of A Long-Term Liabilities Mortgage Payable Notes Payable Total Total Liabilities Land A Owner's Equity www Accounts Payable Advanced Payament Hudson Bloom, Capital Total Total Liabilities and Stockholder's Equity Interest Payable Salaries Payable Total Comp Acc S SASFLOR 1 LI ELINA FARR 400.00 21000 SUSU 1 BLO LI S LA Byte of Accounting Balance Sheet As of June 30, 2021 18.00 A S Wurtzba A Decader EL 1 LOR IN 21 $ JUA LAW 1 2325 SLAZ MAL U $ $ S $ $ $ $ S $ $ 5 $ SA A 200.00 SCALD 10000 Les 2,120.00 (21.07) $ 2,098.93 228,500.00 (3,808.33) $ 224,691.67 85,000.00 (223.54) $ 84,776,46 $ 16,000.00 1,645.00 1,469.21 561,00 90,900.00 113,250,00 ER L SEL za LEZ 14100 JA M $ 3,675.21 $ 204,150.00 $191,007.85 LIBUR $ 54,573.00 $ 6,401.00 $ 4,922.00 $ 5,100.00 $ 270.00 $ 71,266.00 $ 327,567.06 $398,833.06 $207,825.21 $191,007.85 $ 398,833.06 AN LUN SILS LIM In Z R 212.34 LAR CARLES SALO BILLE Account Title Cash Accounts Receivables Prepaid Insurance Prepaid Rent Office Supplies Office Equipment Accum. Depreciation - Office Computer Equipment Accum. Depreciation Comp. Building cost Accum. Depreciation Build. Land Accounts Payable Advanced Payments Interest Payable Salaries Payable Mortgage Payable Notes Payable Hudson Bloom, Capital Hudson Bloom, Withdrawals Computer & Consulting Rev. Rent expense Salaries expense Advertising Expense Repairs & Maint. Expense Oil & Gas Expense Supplies Expense Interest Expense Insurance Expense Depreciation Expense Total Net Income Unadjusted Trial Balance DR CR $ 54,573.00 $ 1.151.00 $ 5,136.00 $ 6,800.00 $ 655.00 $ 2.120.00 $228,500.00 $ 85,000.00 $ 16,000.00 $ 2.200.00 $ 1.870.00 $ 375.00 $ 1.240.00 5 990.00 5 1,645.00 $ 90,900.00 $113,250.00 $182.350.00 $18.465.00 Worksheet At December 31, 2021 Adjusting Entries DR $ 5,250,00 5 1,700.00 $ 561.00 $ 385.00 1,469.21 5 5 214.00 $4,052.94 5 $ S S CR $ 3,808.33 1,700.00 $ 385.00 $ $ 6,401.00 214.00 $ 4,922.00 5,100.00 270.00 $ 2.120.00 21.07 $ 223.54 $ 1,469.21 561.00 $ Adjusted Trial Balance CR $ 5.250.00 DR $ 54,573.00 $228,500.00 $ 85,000.00 $ 16,000.00 $ 2,200.00 $ 1,700.00 $ 2,431.00 $ 375.00 $ 1,240.00 $ 990.00 $ 385.00 $ 1,469.21 $ 214.00 $ 4,052.94 $ 21.07 $ 3,808.33 $ 223.54 $ 1,645.00 $ $ 1,469.21 561.00 $ 90,900.00 $113,250.00 $182,350.00 $ 23,715.00 Income Statement DR $ 1,700.00 $ 2,431.00 $ 375.00 $ 1.240.00 990.00 385.00 $ $ $ 1,469.21 S 214.00 $ 4,052.94 CR $ 23,715.00 Balance Sheet DR $ 54,573.00 $ 6,401.00 $ 4,922.00 $ 5,100.00 S 270.00 $ 2,120.00 $228,500.00 $ 85,000.00 $ 16,000.00 $ 2,200.00 CR $ 21.07 $ 3,808.33 $ 223.54 $ 1,645.00 $ 1,469.21 $ 561.00 $ 90,900.00 $113,250.00 $182.350.00 $406.610.00 $406,610.00 $ 13,632.15 S 13.,632.15 $417,943,15 5417,943.15 $ 12,857.15 S 23,715.00 $405.086.00 $394,228.15 $ 10,857.85 $ 10,857.85 $ 23,715.00 5 23,715.00 $405.086.00 $405.086.00 Step 2 Journalizing the Transactions Using your unique transactions record the corresponding general journal entry, rounding to two decimal places, =Round(value,2). Step 3 Using the Worksheet as a reference, prepare the Income Statement, Statement of Changes in Owner's Equity and the Balance Sheet. Step 4 Record the closing entries to the Income Summary and then the capital accounts. Number Name 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip. 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip. 1411 Building 1412 Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Hudson Bloom, Capital 3300 Hudson Bloom, Withdrawals Income Summary Computer & Consulting Revenue Rent Expense Salary Expense 3400 4100 5010 5020 5030 5040 Advertising Expense Repairs & Maint. Expense Oil & Gas Expense Supplies Expense Interest Expense 5100 Insurance Expense 5110 5050 5080 5090 Depreciation Expense Normal Balance Debit Debit Debit Debit Debit Debit Credit Debit Credit Debit Credit Debit Credit Credit Credit Credit Credit Credit Credit Credit Debit Credit Credit Debit Debit Debit Debit Debit Debit Debit Debit Debit Revenues: Computer & Consulting Revenue Expenses: Rent Expense Salaries Expense Advertising Expense Repairs & Maintenance Expense Oil & Gas Expense Supplies Expense Interest Expense Insurance Expense Depreciation Expense Total Expenses Net Income Balance, Beginning of Period Investment by the owner Net Income Hudson Bloom, Withdrawls Balance, End of Period Assets Current Assets Cash Accounts Receivable Prepaid Insurance Prepaid Rent Office Supplies Total Byte of Accounting Income Statement For Month Ending June 30, 2021 Long-Term Assets Liabilities Byte of Accounting Statement of Changes in Owners' Equity For Month Ending June 30, 2021 Byte of Accounting Balance Sheet As of June 30, 2021 Office Equipment Accum. Depreciation-Office Equipment Computer Equipment Accum. Depreciation Computer Equipment Building Cost Accum. Depreciation-Building Land Total Long-Term Assets Total Assets $ S $ S $ $ $ S S S $ $ S $ S 1,700.00 2,431.00 375.00 1,240.00 990.00 385.00 1,469.21 214.00 4,052.94 2,120.00 (21.07) $2,098.93 228,500.00 (3,808.33) $ 224,691.67 85,000.00 (223.54) $ 84,776.46 $ 16,000.00 $ 23,715.00 $ 12,857.15 $ 10,857.85 Total $ $ 182,350.00 $ 10,857.85 $ 193,207.85 $ (2,200.00) $191,007.85 $ 54,573.00 $6,401.00 S 4,922.00 5,100.00 5 $ 270.00 $71,266.00 $ 327,567.06 $ 398,833.06 Assets Current Assets Cash Long-Term Assets Accounts Receivable Prepaid Insurance Prepaid Rent Office Supplies Total Total Assets Office Equipment Accum. Depreciation Office Equipment Computer Equipment Liabilities Current Liabilities P Accum, Depreciation Computer Equipment Building Cost Accum. Depreciation Building Land Total Long-Term Assets Of A Long-Term Liabilities Mortgage Payable Notes Payable Total Total Liabilities Land A Owner's Equity www Accounts Payable Advanced Payament Hudson Bloom, Capital Total Total Liabilities and Stockholder's Equity Interest Payable Salaries Payable Total Comp Acc S SASFLOR 1 LI ELINA FARR 400.00 21000 SUSU 1 BLO LI S LA Byte of Accounting Balance Sheet As of June 30, 2021 18.00 A S Wurtzba A Decader EL 1 LOR IN 21 $ JUA LAW 1 2325 SLAZ MAL U $ $ S $ $ $ $ S $ $ 5 $ SA A 200.00 SCALD 10000 Les 2,120.00 (21.07) $ 2,098.93 228,500.00 (3,808.33) $ 224,691.67 85,000.00 (223.54) $ 84,776,46 $ 16,000.00 1,645.00 1,469.21 561,00 90,900.00 113,250,00 ER L SEL za LEZ 14100 JA M $ 3,675.21 $ 204,150.00 $191,007.85 LIBUR $ 54,573.00 $ 6,401.00 $ 4,922.00 $ 5,100.00 $ 270.00 $ 71,266.00 $ 327,567.06 $398,833.06 $207,825.21 $191,007.85 $ 398,833.06 AN LUN SILS LIM In Z R 212.34 LAR CARLES SALO BILLE Account Title Cash Accounts Receivables Prepaid Insurance Prepaid Rent Office Supplies Office Equipment Accum. Depreciation - Office Computer Equipment Accum. Depreciation Comp. Building cost Accum. Depreciation Build. Land Accounts Payable Advanced Payments Interest Payable Salaries Payable Mortgage Payable Notes Payable Hudson Bloom, Capital Hudson Bloom, Withdrawals Computer & Consulting Rev. Rent expense Salaries expense Advertising Expense Repairs & Maint. Expense Oil & Gas Expense Supplies Expense Interest Expense Insurance Expense Depreciation Expense Total Net Income Unadjusted Trial Balance DR CR $ 54,573.00 $ 1.151.00 $ 5,136.00 $ 6,800.00 $ 655.00 $ 2.120.00 $228,500.00 $ 85,000.00 $ 16,000.00 $ 2.200.00 $ 1.870.00 $ 375.00 $ 1.240.00 5 990.00 5 1,645.00 $ 90,900.00 $113,250.00 $182.350.00 $18.465.00 Worksheet At December 31, 2021 Adjusting Entries DR $ 5,250,00 5 1,700.00 $ 561.00 $ 385.00 1,469.21 5 5 214.00 $4,052.94 5 $ S S CR $ 3,808.33 1,700.00 $ 385.00 $ $ 6,401.00 214.00 $ 4,922.00 5,100.00 270.00 $ 2.120.00 21.07 $ 223.54 $ 1,469.21 561.00 $ Adjusted Trial Balance CR $ 5.250.00 DR $ 54,573.00 $228,500.00 $ 85,000.00 $ 16,000.00 $ 2,200.00 $ 1,700.00 $ 2,431.00 $ 375.00 $ 1,240.00 $ 990.00 $ 385.00 $ 1,469.21 $ 214.00 $ 4,052.94 $ 21.07 $ 3,808.33 $ 223.54 $ 1,645.00 $ $ 1,469.21 561.00 $ 90,900.00 $113,250.00 $182,350.00 $ 23,715.00 Income Statement DR $ 1,700.00 $ 2,431.00 $ 375.00 $ 1.240.00 990.00 385.00 $ $ $ 1,469.21 S 214.00 $ 4,052.94 CR $ 23,715.00 Balance Sheet DR $ 54,573.00 $ 6,401.00 $ 4,922.00 $ 5,100.00 S 270.00 $ 2,120.00 $228,500.00 $ 85,000.00 $ 16,000.00 $ 2,200.00 CR $ 21.07 $ 3,808.33 $ 223.54 $ 1,645.00 $ 1,469.21 $ 561.00 $ 90,900.00 $113,250.00 $182.350.00 $406.610.00 $406,610.00 $ 13,632.15 S 13.,632.15 $417,943,15 5417,943.15 $ 12,857.15 S 23,715.00 $405.086.00 $394,228.15 $ 10,857.85 $ 10,857.85 $ 23,715.00 5 23,715.00 $405.086.00 $405.086.00 Step 2 Journalizing the Transactions Using your unique transactions record the corresponding general journal entry, rounding to two decimal places, =Round(value,2). Step 3 Using the Worksheet as a reference, prepare the Income Statement, Statement of Changes in Owner's Equity and the Balance Sheet. Step 4 Record the closing entries to the Income Summary and then the capital accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts