Question: help with numbers 13-17 please 13) Seaside issues a bond with a stated interest rate of 10%, face value of $50,000, and due in 5

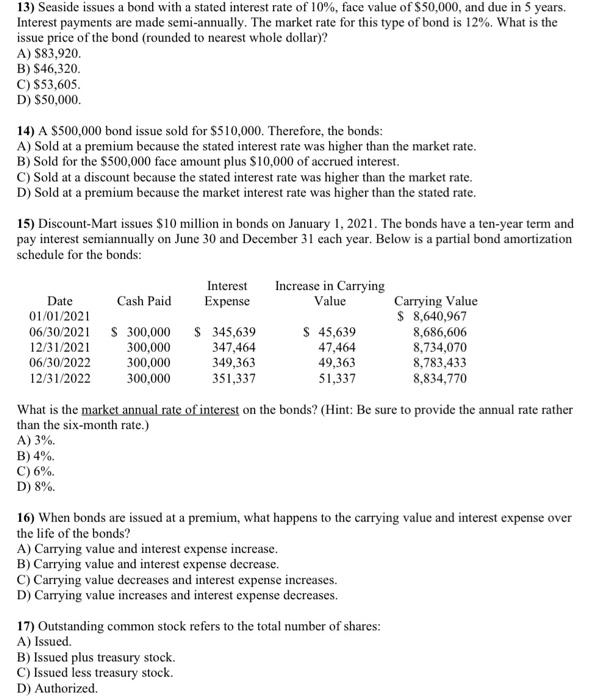

13) Seaside issues a bond with a stated interest rate of 10%, face value of $50,000, and due in 5 years. Interest payments are made semi-annually. The market rate for this type of bond is 12%. What is the issue price of the bond (rounded to nearest whole dollar)? A) S83,920 B) $46,320 C) $53,605. D) $50,000 14) A $500,000 bond issue sold for $510,000. Therefore, the bonds: A) Sold at a premium because the stated interest rate was higher than the market rate. B) Sold for the $500,000 face amount plus $10,000 of accrued interest C) Sold at a discount because the stated interest rate was higher than the market rate. D) Sold at a premium because the market interest rate was higher than the stated rate. 15) Discount-Mart issues $10 million in bonds on January 1, 2021. The bonds have a ten-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds: Interest Expense Increase in Carrying Value Date Cash Paid 01/01/2021 06/30/2021 S 300,000 12/31/2021 300,000 06/30/2022 300,000 12/31/2022 300,000 $ 345,639 347,464 349,363 351,337 $ 45,639 47,464 49,363 51,337 Carrying Value $ 8,640,967 8,686,606 8,734,070 8,783,433 8,834,770 What is the market annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate.) A) 3%. B) 4% C) 6% D) 8%. 16) When bonds are issued at a premium, what happens to the carrying value and interest expense over the life of the bonds? A) Carrying value and interest expense increase. B) Carrying value and interest expense decrease. C) Carrying value decreases and interest expense increases. D) Carrying value increases and interest expense decreases. 17) Outstanding common stock refers to the total number of shares: A) Issued. B) Issued plus treasury stock. C) Issued less treasury stock. D) Authorized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts