Question: help with part 2 and 3 please Intro A national restaurant chain needs to buy 30,300 bushels of onions in 3 months (a bushel is

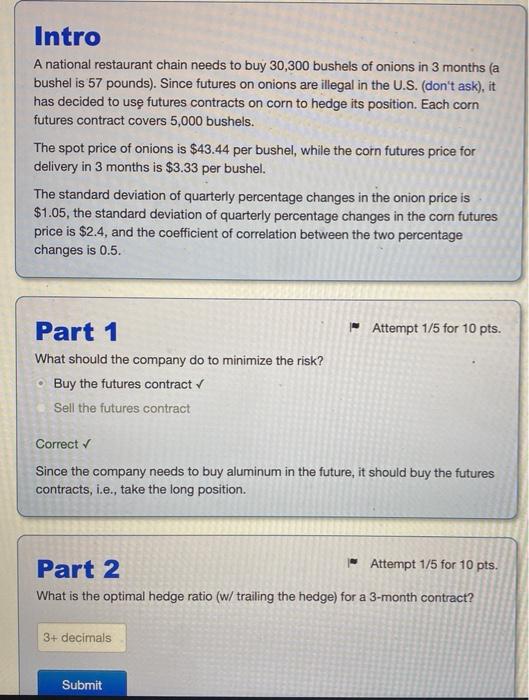

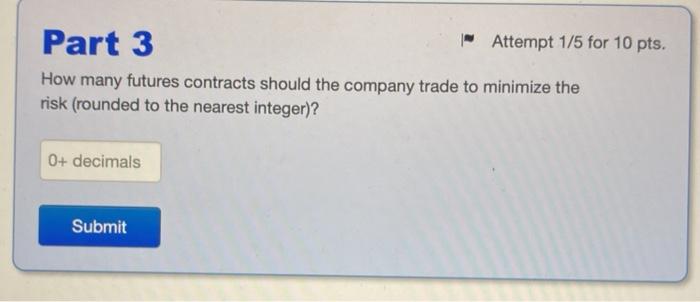

Intro A national restaurant chain needs to buy 30,300 bushels of onions in 3 months (a bushel is 57 pounds). Since futures on onions are illegal in the U.S. (don't ask), it has decided to use futures contracts on corn to hedge its position. Each corn futures contract covers 5,000 bushels. The spot price of onions is $43.44 per bushel, while the corn futures price for delivery in 3 months is $3.33 per bushel. The standard deviation of quarterly percentage changes in the onion price is $1.05, the standard deviation of quarterly percentage changes in the corn futures price is $2.4, and the coefficient of correlation between the two percentage changes is 0.5. Attempt 1/5 for 10 pts. Part 1 What should the company do to minimize the risk? Buy the futures contract Sell the futures contract Correct Since the company needs to buy aluminum in the future, it should buy the futures contracts, i.e., take the long position. Part 2 Attempt 1/5 for 10 pts. What is the optimal hedge ratio (w/ trailing the hedge) for a 3-month contract? 3+ decimals Submit Part 3 Attempt 175 for 10 pts. How many futures contracts should the company trade to minimize the risk (rounded to the nearest integer)? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts