Question: Help with part 2, please Intro A corporate bond pays interest annually and has 3 years to maturity, a face value of $1,000 and a

Help with part 2, please

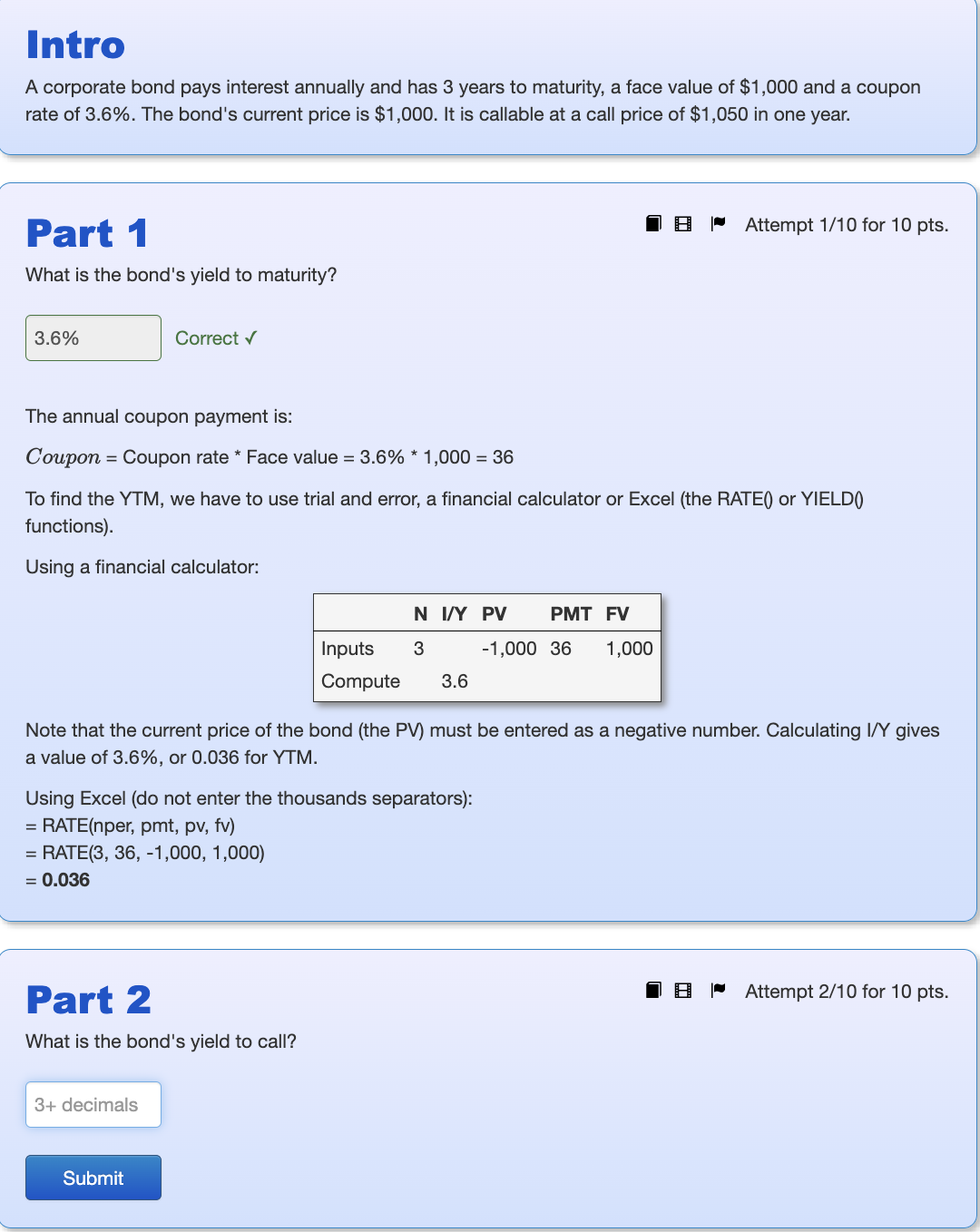

Intro A corporate bond pays interest annually and has 3 years to maturity, a face value of $1,000 and a coupon rate of 3.6%. The bond's current price is $1,000. It is callable at a call price of $1,050 in one year. Part 1 Attempt 1/10 for 10 pts. What is the bond's yield to maturity? Correct The annual coupon payment is: Coupon = Coupon rate * Face value =3.6%1,000=36 To find the YTM, we have to use trial and error, a financial calculator or Excel (the RATE0 or YIELD0 functions). Using a financial calculator: Note that the current price of the bond (the PV) must be entered as a negative number. Calculating I/Y gives a value of 3.6%, or 0.036 for YTM. Using Excel (do not enter the thousands separators): =RATE(n per, pmt, pv, fv) =RATE(3,36,1,000,1,000) =0.036 Part 2 Attempt 2/10 for 10 pts. What is the bond's yield to call? Intro A corporate bond pays interest annually and has 3 years to maturity, a face value of $1,000 and a coupon rate of 3.6%. The bond's current price is $1,000. It is callable at a call price of $1,050 in one year. Part 1 Attempt 1/10 for 10 pts. What is the bond's yield to maturity? Correct The annual coupon payment is: Coupon = Coupon rate * Face value =3.6%1,000=36 To find the YTM, we have to use trial and error, a financial calculator or Excel (the RATE0 or YIELD0 functions). Using a financial calculator: Note that the current price of the bond (the PV) must be entered as a negative number. Calculating I/Y gives a value of 3.6%, or 0.036 for YTM. Using Excel (do not enter the thousands separators): =RATE(n per, pmt, pv, fv) =RATE(3,36,1,000,1,000) =0.036 Part 2 Attempt 2/10 for 10 pts. What is the bond's yield to call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts