Question: help with part 3 only please Only need help on part 3 Review all the transactions in the next section (Part 1 Transactions). Prepare the

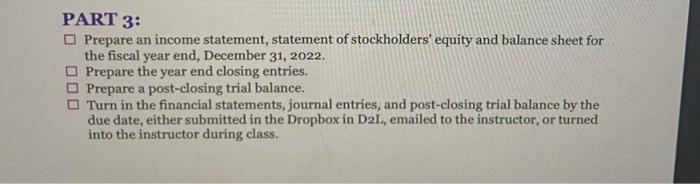

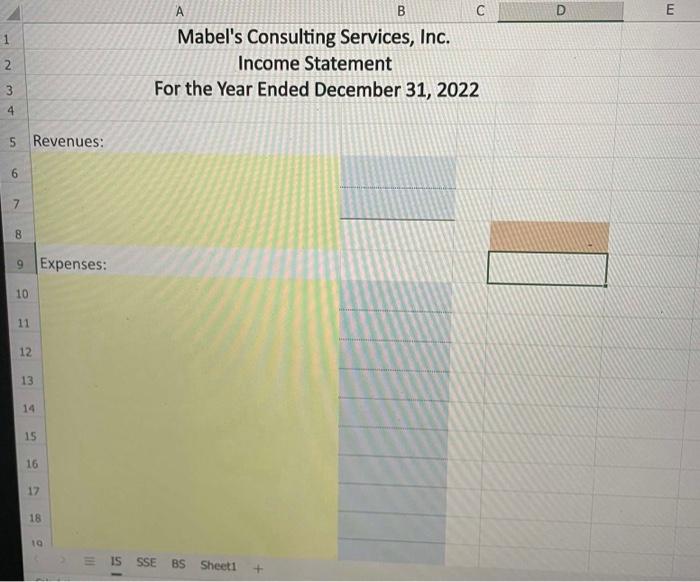

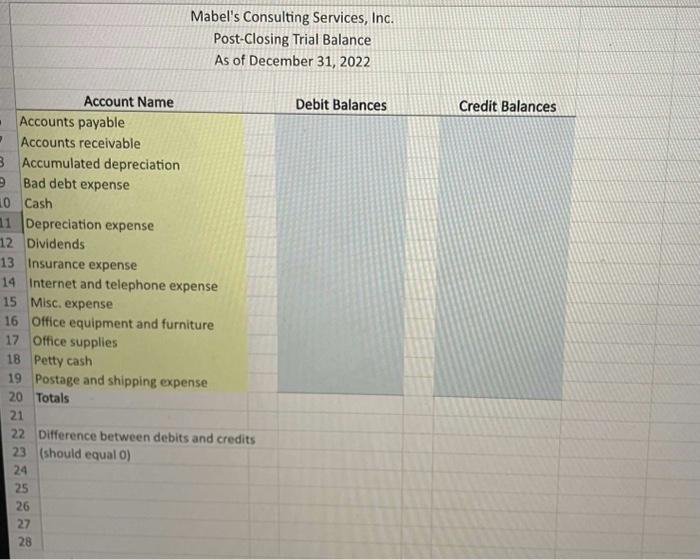

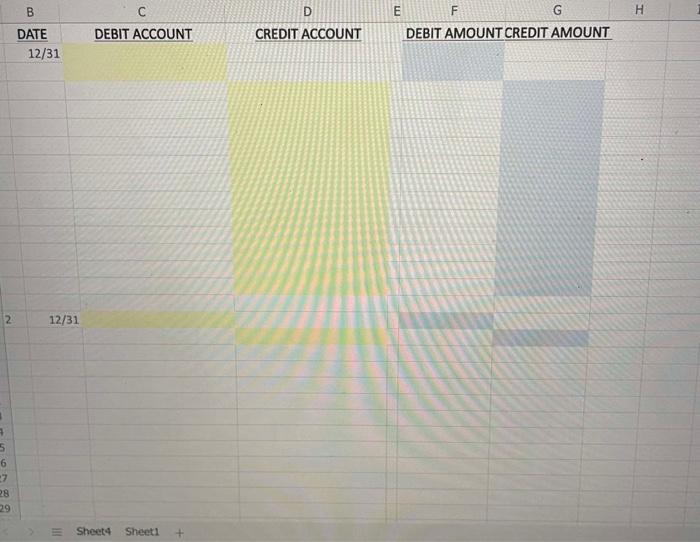

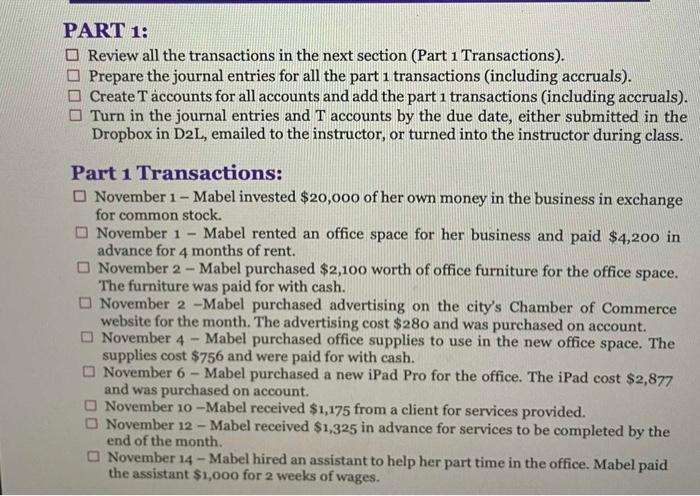

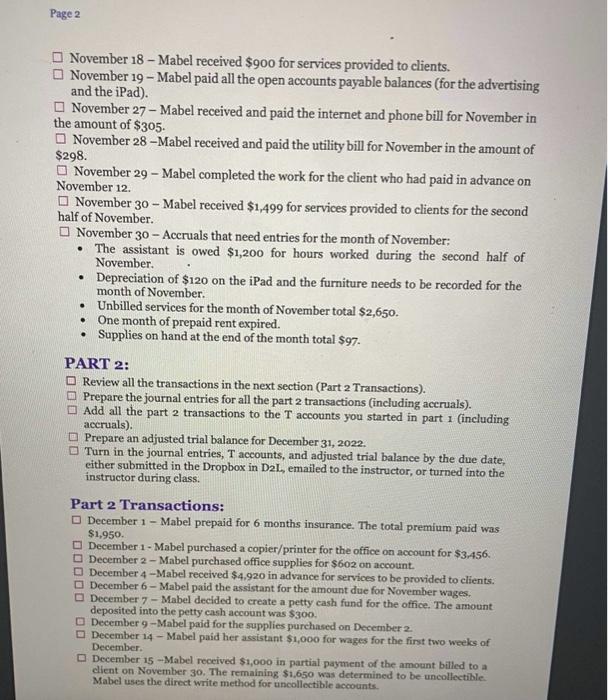

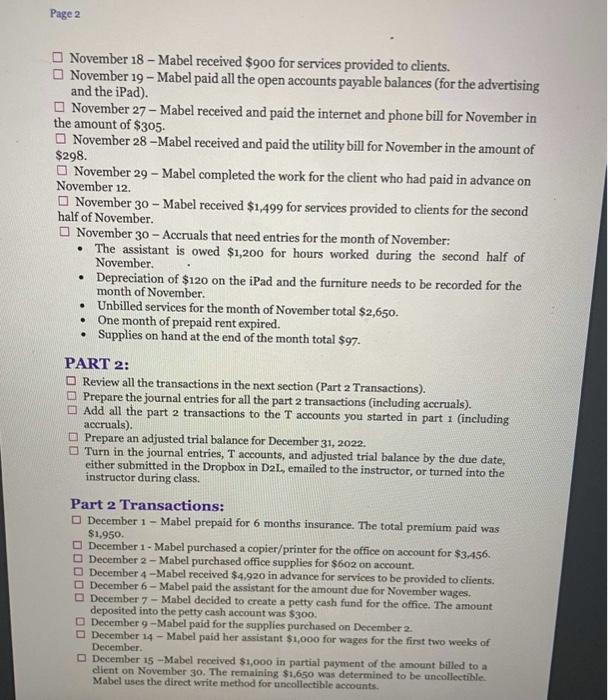

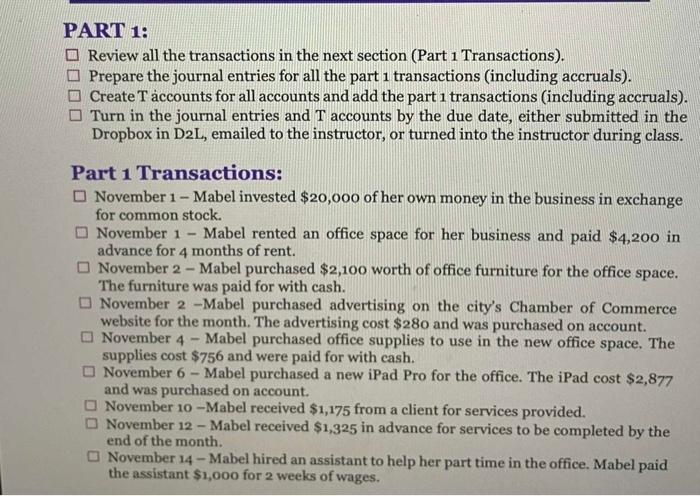

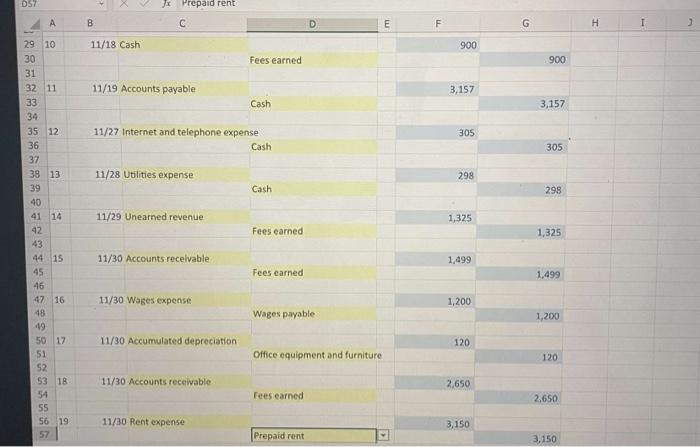

Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including accruals). Create T accounts for all accounts and add the part 1 transactions (including accruals). Turn in the journal entries and T accounts by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 1 Transactions: November 1 - Mabel invested $20,000 of her own money in the business in exchange for common stock. November 1 - Mabel rented an office space for her business and paid $4,200 in advance for 4 months of rent. November 2 - Mabel purchased $2,100 worth of office furniture for the office space. The furniture was paid for with cash. November 2 -Mabel purchased advertising on the city's Chamber of Commerce website for the month. The advertising cost $280 and was purchased on account. November 4 - Mabel purchased office supplies to use in the new office space. The supplies cost $756 and were paid for with cash. November 6 - Mabel purchased a new iPad Pro for the office. The iPad cost $2,877 and was purchased on account. November 10 -Mabel received $1,175 from a client for services provided. November 12 - Mabel received $1,325 in advance for services to be completed by the end of the month. November 14 - Mabel hired an assistant to help her part time in the office. Mabel paid the assistant $1,000 for 2 weeks of wages. November 18 - Mabel received $900 for services provided to clients. November 19 - Mabel paid all the open accounts payable balances (for the advertising and the iPad). November 27 - Mabel received and paid the internet and phone bill for November in the amount of $305. November 28 -Mabel received and paid the utility bill for November in the amount of $298. November 29 - Mabel completed the work for the client who had paid in advance on November 12 . November 30 - Mabel received $1,499 for services provided to clients for the second half of November. November 30 - Accruals that need entries for the month of November: - The assistant is owed $1,200 for hours worked during the second half of November. - Depreciation of $120 on the iPad and the furniture needs to be recorded for the month of November. - Unbilled services for the month of November total $2,650. - One month of prepaid rent expired. - Supplies on hand at the end of the month total $97. PART 2: Review all the transactions in the next section (Part 2 Transactions). Prepare the journal entries for all the part 2 transactions (including accruals). Add all the part 2 transactions to the T accounts you started in part 1 (including accruals). Prepare an adjusted trial balance for December 31, 2022. Turn in the journal entries, T accounts, and adjusted trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 2 Transactions: December 1 - Mabel prepaid for 6 months insurance. The total premium paid was $1,950. December 1 - Mabel purchased a copier/printer for the office on account for $3,456. December 2 - Mabel purchased office supplies for $602 on account. December 4 -Mabel received $4,920 in advance for services to be provided to clients. December 6 - Mabel paid the assistant for the amount due for November wages. December 7 - Mabel decided to create a petty cash fund for the office. The amount deposited into the petty cash account was $300, December 9 -Mabel paid for the supplies purchased on December 2. December 14 - Mabel paid her assistant \$1,000 for wages for the first two weeks of December. December 15 -Mabel received $1,000 in partial payment of the amount billed to a client on November 30 . The remaining $1,650 was determined to be uncollectible. Mabel uses the direct write method for uncollectible accoumts. PART 3: Prepare an income statement, statement of stockholders' equity and balance sheet for the fiscal year end, December 31,2022. Prepare the year end closing entries. Prepare a post-closing trial balance. Turn in the financial statements, journal entries, and post-closing trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. A Mabel's Consulting Services, Inc. Income Statement For the Year Ended December 31, 2022 Revenues: Expenses: 10 11 12 13 14 15 16 17 18 19 \# IS SSE BS Sheet1 + Mabel's Consulting Services, Inc. Post-Closing Trial Balance As of December 31, 2022 Account Name Debit Balances Credit Balances Accounts payable Accounts receivable Accumulated depreciation Bad debt expense Cash Depreciation expense Dividends Insurance expense Internet and telephone expense Misc. expense Office equipment and furniture Office supplies Petty cash Postage and shipping expense Totals Difference between debits and credits (should equal o) 12/31 PART 1: Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including accruals). Create T accounts for all accounts and add the part 1 transactions (including accruals). Turn in the journal entries and T accounts by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 1 Transactions: November 1 - Mabel invested $20,000 of her own money in the business in exchange for common stock. November 1 - Mabel rented an office space for her business and paid \$4,200 in advance for 4 months of rent. November 2 - Mabel purchased $2,100 worth of office furniture for the office space. The furniture was paid for with cash. November 2 -Mabel purchased advertising on the city's Chamber of Commerce website for the month. The advertising cost $280 and was purchased on account. November 4 - Mabel purchased office supplies to use in the new office space. The supplies cost $756 and were paid for with cash. November 6 - Mabel purchased a new iPad Pro for the office. The iPad cost $2,877 and was purchased on account. November 10 -Mabel received $1,175 from a client for services provided. November 12 - Mabel received $1,325 in advance for services to be completed by the end of the month. November 14 - Mabel hired an assistant to help her part time in the office. Mabel paid the assistant \$1,000 for 2 weeks of wages. November 18 - Mabel received $900 for services provided to clients. November 19 - Mabel paid all the open accounts payable balances (for the advertising and the iPad). November 27 - Mabel received and paid the internet and phone bill for November in the amount of $305. November 28 -Mabel received and paid the utility bill for November in the amount of $298. November 29 - Mabel completed the work for the client who had paid in advance on November 12. November 30 - Mabel received $1,499 for services provided to clients for the second half of November. November 30 - Accruals that need entries for the month of November; - The assistant is owed $1,200 for hours worked during the second half of November. - Depreciation of $120 on the iPad and the furniture needs to be recorded for the month of November. - Unbilled services for the month of November total $2,650. - One month of prepaid rent expired. - Supplies on hand at the end of the month total $97. PART 2: Review all the transactions in the next section (Part 2 Transactions). Prepare the journal entries for all the part 2 transactions (including accruals). Add all the part 2 transactions to the T accounts you started in part I (including accruals). Prepare an adjusted trial balance for December 31,2022. Turn in the journal entries, T accounts, and adjusted trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 2 Transactions: December 1 - Mabel prepaid for 6 months insurance. The total premium paid was $1,950. December 1- Mabel purchased a copier/printer for the office on account for $3,456. December 2 - Mabel purchased office supplies for $602 of acces on acco December 4 -Mabel received \$4,920 in advance for services to be provided to clients. December 6 - Mabel paid the assistant for the amount due for November wages. December 7 - Mabel decided to create a petty cash fund for the office. The amount deposited into the petty cash account was $300. December 9 -Mabel paid for the supplies purchased on December 2 Deeember 14 - Mabel paid her assistant $1,000 for wages for the finst two weeks of December. December 15 -Mabel received $1,000 in partial payment of the amount billed to a client on November 30 . The remaining $1,650 was determined to be uncollectible. Mabel uses the direct write method for uncollectible accounts. November 18 - Mabel received $900 for services provided to clients. November 19 - Mabel paid all the open accounts payable balances (for the advertising and the iPad). November 27 - Mabel received and paid the internet and phone bill for November in the amount of $305. November 28 -Mabel received and paid the utility bill for November in the amount of $298. November 29 - Mabel completed the work for the client who had paid in advance on November 12. November 30 - Mabel received $1,499 for services provided to clients for the second half of November. November 30 - Accruals that need entries for the month of November; - The assistant is owed $1,200 for hours worked during the second half of November. - Depreciation of $120 on the iPad and the furniture needs to be recorded for the month of November. - Unbilled services for the month of November total $2,650. - One month of prepaid rent expired. - Supplies on hand at the end of the month total $97. PART 2: Review all the transactions in the next section (Part 2 Transactions). Prepare the journal entries for all the part 2 transactions (including accruals). Add all the part 2 transactions to the T accounts you started in part I (including accruals). Prepare an adjusted trial balance for December 31,2022. Turn in the journal entries, T accounts, and adjusted trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 2 Transactions: December 1 - Mabel prepaid for 6 months insurance. The total premium paid was $1,950. December 1- Mabel purchased a copier/printer for the office on account for $3,456. December 2 - Mabel purchased office supplies for $602 of acces on acco December 4 -Mabel received \$4,920 in advance for services to be provided to clients. December 6 - Mabel paid the assistant for the amount due for November wages. December 7 - Mabel decided to create a petty cash fund for the office. The amount deposited into the petty cash account was $300. December 9 -Mabel paid for the supplies purchased on December 2 Deeember 14 - Mabel paid her assistant $1,000 for wages for the finst two weeks of December. December 15 -Mabel received $1,000 in partial payment of the amount billed to a client on November 30 . The remaining $1,650 was determined to be uncollectible. Mabel uses the direct write method for uncollectible accounts. PART 1: Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including accruals). Create T ccounts for all accounts and add the part 1 transactions (including accruals). Turn in the journal entries and T accounts by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 1 Transactions: November 1 - Mabel invested $20,000 of her own money in the business in exchange for common stock. November 1 - Mabel rented an office space for her business and paid $4,200 in advance for 4 months of rent. November 2 - Mabel purchased $2,100 worth of office furniture for the office space. The furniture was paid for with cash. November 2 -Mabel purchased advertising on the city's Chamber of Commerce website for the month. The advertising cost $280 and was purchased on account. November 4 - Mabel purchased office supplies to use in the new office space. The supplies cost $756 and were paid for with cash. November 6 - Mabel purchased a new iPad Pro for the office. The iPad cost $2,877 and was purchased on account. November 10-Mabel received $1,175 from a client for services provided. November 12 - Mabel received $1,325 in advance for services to be completed by the end of the month. November 14 - Mabel hired an assistant to help her part time in the office. Mabel paid the assistant \$1,000 for 2 weeks of wages. Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including accruals). Create T accounts for all accounts and add the part 1 transactions (including accruals). Turn in the journal entries and T accounts by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 1 Transactions: November 1 - Mabel invested $20,000 of her own money in the business in exchange for common stock. November 1 - Mabel rented an office space for her business and paid $4,200 in advance for 4 months of rent. November 2 - Mabel purchased $2,100 worth of office furniture for the office space. The furniture was paid for with cash. November 2 -Mabel purchased advertising on the city's Chamber of Commerce website for the month. The advertising cost $280 and was purchased on account. November 4 - Mabel purchased office supplies to use in the new office space. The supplies cost $756 and were paid for with cash. November 6 - Mabel purchased a new iPad Pro for the office. The iPad cost $2,877 and was purchased on account. November 10 -Mabel received $1,175 from a client for services provided. November 12 - Mabel received $1,325 in advance for services to be completed by the end of the month. November 14 - Mabel hired an assistant to help her part time in the office. Mabel paid the assistant $1,000 for 2 weeks of wages. November 18 - Mabel received $900 for services provided to clients. November 19 - Mabel paid all the open accounts payable balances (for the advertising and the iPad). November 27 - Mabel received and paid the internet and phone bill for November in the amount of $305. November 28 -Mabel received and paid the utility bill for November in the amount of $298. November 29 - Mabel completed the work for the client who had paid in advance on November 12 . November 30 - Mabel received $1,499 for services provided to clients for the second half of November. November 30 - Accruals that need entries for the month of November: - The assistant is owed $1,200 for hours worked during the second half of November. - Depreciation of $120 on the iPad and the furniture needs to be recorded for the month of November. - Unbilled services for the month of November total $2,650. - One month of prepaid rent expired. - Supplies on hand at the end of the month total $97. PART 2: Review all the transactions in the next section (Part 2 Transactions). Prepare the journal entries for all the part 2 transactions (including accruals). Add all the part 2 transactions to the T accounts you started in part 1 (including accruals). Prepare an adjusted trial balance for December 31, 2022. Turn in the journal entries, T accounts, and adjusted trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 2 Transactions: December 1 - Mabel prepaid for 6 months insurance. The total premium paid was $1,950. December 1 - Mabel purchased a copier/printer for the office on account for $3,456. December 2 - Mabel purchased office supplies for $602 on account. December 4 -Mabel received $4,920 in advance for services to be provided to clients. December 6 - Mabel paid the assistant for the amount due for November wages. December 7 - Mabel decided to create a petty cash fund for the office. The amount deposited into the petty cash account was $300, December 9 -Mabel paid for the supplies purchased on December 2. December 14 - Mabel paid her assistant \$1,000 for wages for the first two weeks of December. December 15 -Mabel received $1,000 in partial payment of the amount billed to a client on November 30 . The remaining $1,650 was determined to be uncollectible. Mabel uses the direct write method for uncollectible accoumts. PART 3: Prepare an income statement, statement of stockholders' equity and balance sheet for the fiscal year end, December 31,2022. Prepare the year end closing entries. Prepare a post-closing trial balance. Turn in the financial statements, journal entries, and post-closing trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. A Mabel's Consulting Services, Inc. Income Statement For the Year Ended December 31, 2022 Revenues: Expenses: 10 11 12 13 14 15 16 17 18 19 \# IS SSE BS Sheet1 + Mabel's Consulting Services, Inc. Post-Closing Trial Balance As of December 31, 2022 Account Name Debit Balances Credit Balances Accounts payable Accounts receivable Accumulated depreciation Bad debt expense Cash Depreciation expense Dividends Insurance expense Internet and telephone expense Misc. expense Office equipment and furniture Office supplies Petty cash Postage and shipping expense Totals Difference between debits and credits (should equal o) 12/31 PART 1: Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including accruals). Create T accounts for all accounts and add the part 1 transactions (including accruals). Turn in the journal entries and T accounts by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 1 Transactions: November 1 - Mabel invested $20,000 of her own money in the business in exchange for common stock. November 1 - Mabel rented an office space for her business and paid \$4,200 in advance for 4 months of rent. November 2 - Mabel purchased $2,100 worth of office furniture for the office space. The furniture was paid for with cash. November 2 -Mabel purchased advertising on the city's Chamber of Commerce website for the month. The advertising cost $280 and was purchased on account. November 4 - Mabel purchased office supplies to use in the new office space. The supplies cost $756 and were paid for with cash. November 6 - Mabel purchased a new iPad Pro for the office. The iPad cost $2,877 and was purchased on account. November 10 -Mabel received $1,175 from a client for services provided. November 12 - Mabel received $1,325 in advance for services to be completed by the end of the month. November 14 - Mabel hired an assistant to help her part time in the office. Mabel paid the assistant \$1,000 for 2 weeks of wages. November 18 - Mabel received $900 for services provided to clients. November 19 - Mabel paid all the open accounts payable balances (for the advertising and the iPad). November 27 - Mabel received and paid the internet and phone bill for November in the amount of $305. November 28 -Mabel received and paid the utility bill for November in the amount of $298. November 29 - Mabel completed the work for the client who had paid in advance on November 12. November 30 - Mabel received $1,499 for services provided to clients for the second half of November. November 30 - Accruals that need entries for the month of November; - The assistant is owed $1,200 for hours worked during the second half of November. - Depreciation of $120 on the iPad and the furniture needs to be recorded for the month of November. - Unbilled services for the month of November total $2,650. - One month of prepaid rent expired. - Supplies on hand at the end of the month total $97. PART 2: Review all the transactions in the next section (Part 2 Transactions). Prepare the journal entries for all the part 2 transactions (including accruals). Add all the part 2 transactions to the T accounts you started in part I (including accruals). Prepare an adjusted trial balance for December 31,2022. Turn in the journal entries, T accounts, and adjusted trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 2 Transactions: December 1 - Mabel prepaid for 6 months insurance. The total premium paid was $1,950. December 1- Mabel purchased a copier/printer for the office on account for $3,456. December 2 - Mabel purchased office supplies for $602 of acces on acco December 4 -Mabel received \$4,920 in advance for services to be provided to clients. December 6 - Mabel paid the assistant for the amount due for November wages. December 7 - Mabel decided to create a petty cash fund for the office. The amount deposited into the petty cash account was $300. December 9 -Mabel paid for the supplies purchased on December 2 Deeember 14 - Mabel paid her assistant $1,000 for wages for the finst two weeks of December. December 15 -Mabel received $1,000 in partial payment of the amount billed to a client on November 30 . The remaining $1,650 was determined to be uncollectible. Mabel uses the direct write method for uncollectible accounts. November 18 - Mabel received $900 for services provided to clients. November 19 - Mabel paid all the open accounts payable balances (for the advertising and the iPad). November 27 - Mabel received and paid the internet and phone bill for November in the amount of $305. November 28 -Mabel received and paid the utility bill for November in the amount of $298. November 29 - Mabel completed the work for the client who had paid in advance on November 12. November 30 - Mabel received $1,499 for services provided to clients for the second half of November. November 30 - Accruals that need entries for the month of November; - The assistant is owed $1,200 for hours worked during the second half of November. - Depreciation of $120 on the iPad and the furniture needs to be recorded for the month of November. - Unbilled services for the month of November total $2,650. - One month of prepaid rent expired. - Supplies on hand at the end of the month total $97. PART 2: Review all the transactions in the next section (Part 2 Transactions). Prepare the journal entries for all the part 2 transactions (including accruals). Add all the part 2 transactions to the T accounts you started in part I (including accruals). Prepare an adjusted trial balance for December 31,2022. Turn in the journal entries, T accounts, and adjusted trial balance by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 2 Transactions: December 1 - Mabel prepaid for 6 months insurance. The total premium paid was $1,950. December 1- Mabel purchased a copier/printer for the office on account for $3,456. December 2 - Mabel purchased office supplies for $602 of acces on acco December 4 -Mabel received \$4,920 in advance for services to be provided to clients. December 6 - Mabel paid the assistant for the amount due for November wages. December 7 - Mabel decided to create a petty cash fund for the office. The amount deposited into the petty cash account was $300. December 9 -Mabel paid for the supplies purchased on December 2 Deeember 14 - Mabel paid her assistant $1,000 for wages for the finst two weeks of December. December 15 -Mabel received $1,000 in partial payment of the amount billed to a client on November 30 . The remaining $1,650 was determined to be uncollectible. Mabel uses the direct write method for uncollectible accounts. PART 1: Review all the transactions in the next section (Part 1 Transactions). Prepare the journal entries for all the part 1 transactions (including accruals). Create T ccounts for all accounts and add the part 1 transactions (including accruals). Turn in the journal entries and T accounts by the due date, either submitted in the Dropbox in D2L, emailed to the instructor, or turned into the instructor during class. Part 1 Transactions: November 1 - Mabel invested $20,000 of her own money in the business in exchange for common stock. November 1 - Mabel rented an office space for her business and paid $4,200 in advance for 4 months of rent. November 2 - Mabel purchased $2,100 worth of office furniture for the office space. The furniture was paid for with cash. November 2 -Mabel purchased advertising on the city's Chamber of Commerce website for the month. The advertising cost $280 and was purchased on account. November 4 - Mabel purchased office supplies to use in the new office space. The supplies cost $756 and were paid for with cash. November 6 - Mabel purchased a new iPad Pro for the office. The iPad cost $2,877 and was purchased on account. November 10-Mabel received $1,175 from a client for services provided. November 12 - Mabel received $1,325 in advance for services to be completed by the end of the month. November 14 - Mabel hired an assistant to help her part time in the office. Mabel paid the assistant \$1,000 for 2 weeks of wages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts