Question: help with part b 1 and 2 please On January 1, 2013, Porsche Company acquired 100% of Saab Company's stock for $453,060 cash. The fair

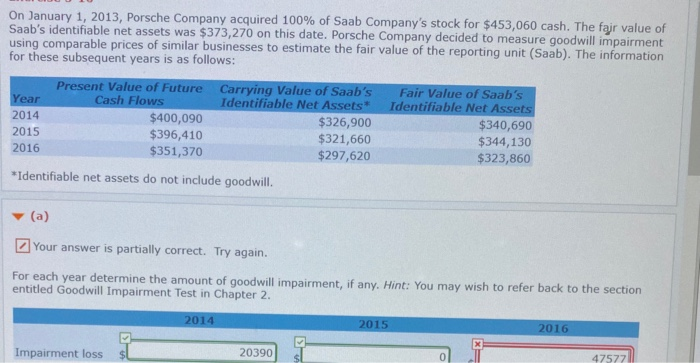

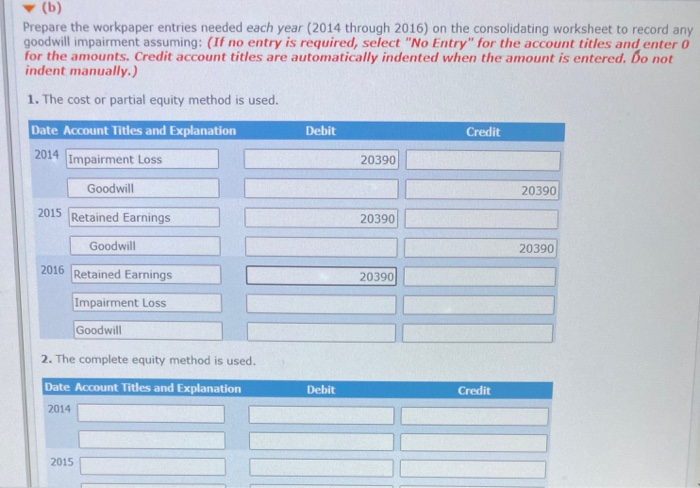

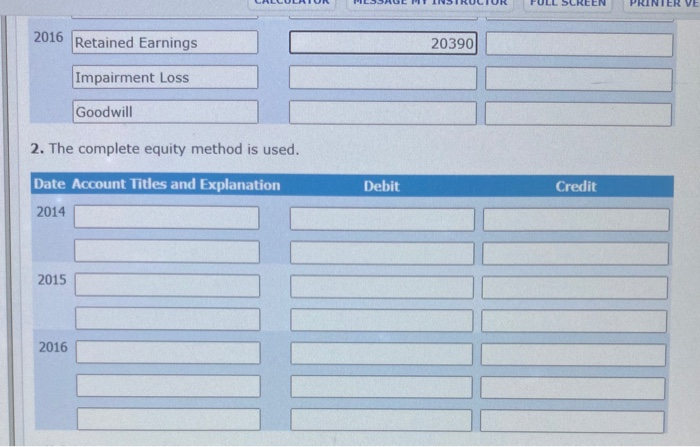

On January 1, 2013, Porsche Company acquired 100% of Saab Company's stock for $453,060 cash. The fair value of Saab's identifiable net assets was $373,270 on this date. Porsche Company decided to measure goodwill impairment using comparable prices of similar businesses to estimate the fair value of the reporting unit (Saab). The information for these subsequent years is as follows: Present Value of Future Carrying Value of Saab's Fair Value of Saab's Year Cash Flows Identifiable Net Assets Identifiable Net Assets 2014 $400,090 $326,900 $340,690 2015 $396,410 $321,660 $344,130 2016 $351,370 $297,620 $323,860 *Identifiable net assets do not include goodwill. (a) Your answer is partially correct. Try again. For each year determine the amount of goodwill impairment, if any. Hint: You may wish to refer back to the section entitled Goodwill Impairment Test in Chapter 2. 2014 2015 2016 > Impairment loss 20390 =X 0 47577 (b) Prepare the workpaper entries needed each year (2014 through 2016) on the consolidating worksheet to record any goodwill impairment assuming: (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Bo not indent manually.) 1. The cost or partial equity method is used. Date Account Titles and Explanation Debit Credit 2014 Impairment Loss 20390 20390 20390 Goodwill 2015 Retained Earnings Goodwill 2016 Retained Earnings 20390 20390 Impairment Loss Goodwill 2. The complete equity method is used. Date Account Titles and Explanation Debit Credit 2014 2015 TER VE 2016 Retained Earnings 20390 Impairment Loss Goodwill 2. The complete equity method is used. Date Account Titles and Explanation Debit Credit 2014 2015 2016 On January 1, 2013, Porsche Company acquired 100% of Saab Company's stock for $453,060 cash. The fair value of Saab's identifiable net assets was $373,270 on this date. Porsche Company decided to measure goodwill impairment using comparable prices of similar businesses to estimate the fair value of the reporting unit (Saab). The information for these subsequent years is as follows: Present Value of Future Carrying Value of Saab's Fair Value of Saab's Year Cash Flows Identifiable Net Assets Identifiable Net Assets 2014 $400,090 $326,900 $340,690 2015 $396,410 $321,660 $344,130 2016 $351,370 $297,620 $323,860 *Identifiable net assets do not include goodwill. (a) Your answer is partially correct. Try again. For each year determine the amount of goodwill impairment, if any. Hint: You may wish to refer back to the section entitled Goodwill Impairment Test in Chapter 2. 2014 2015 2016 > Impairment loss 20390 =X 0 47577 (b) Prepare the workpaper entries needed each year (2014 through 2016) on the consolidating worksheet to record any goodwill impairment assuming: (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Bo not indent manually.) 1. The cost or partial equity method is used. Date Account Titles and Explanation Debit Credit 2014 Impairment Loss 20390 20390 20390 Goodwill 2015 Retained Earnings Goodwill 2016 Retained Earnings 20390 20390 Impairment Loss Goodwill 2. The complete equity method is used. Date Account Titles and Explanation Debit Credit 2014 2015 TER VE 2016 Retained Earnings 20390 Impairment Loss Goodwill 2. The complete equity method is used. Date Account Titles and Explanation Debit Credit 2014 2015 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts