Question: help with part b and can you explain part a with the steps please Apr 25 at 1:58 PM Sat, Apr 25, 2020, 1:58:07 PM

help with part b and can you explain part a with the steps please

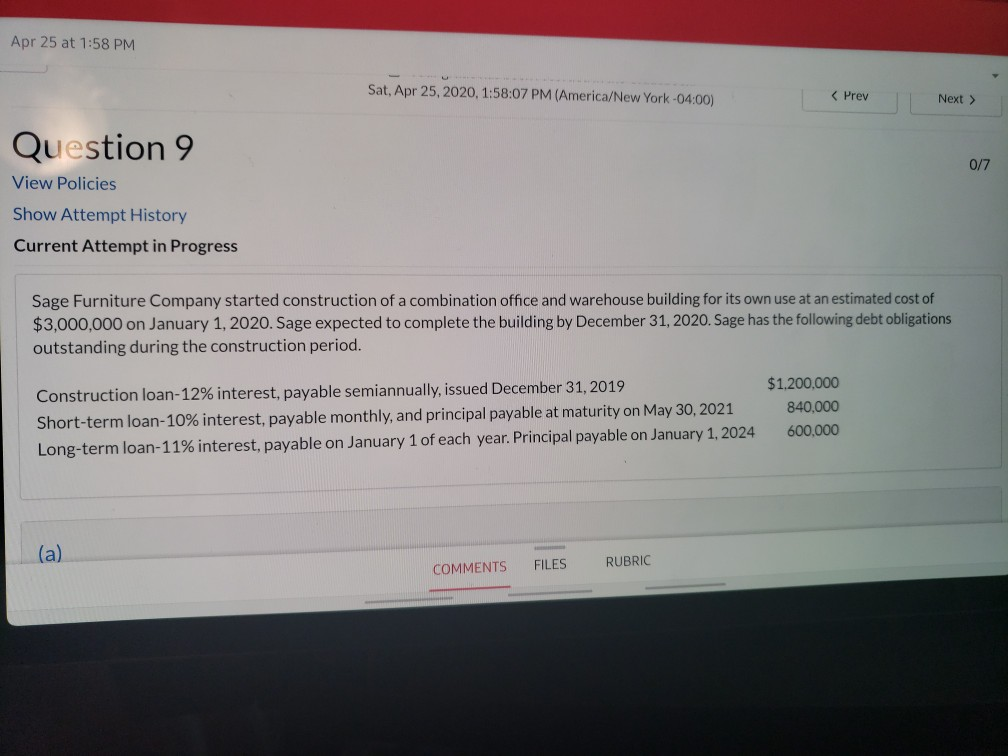

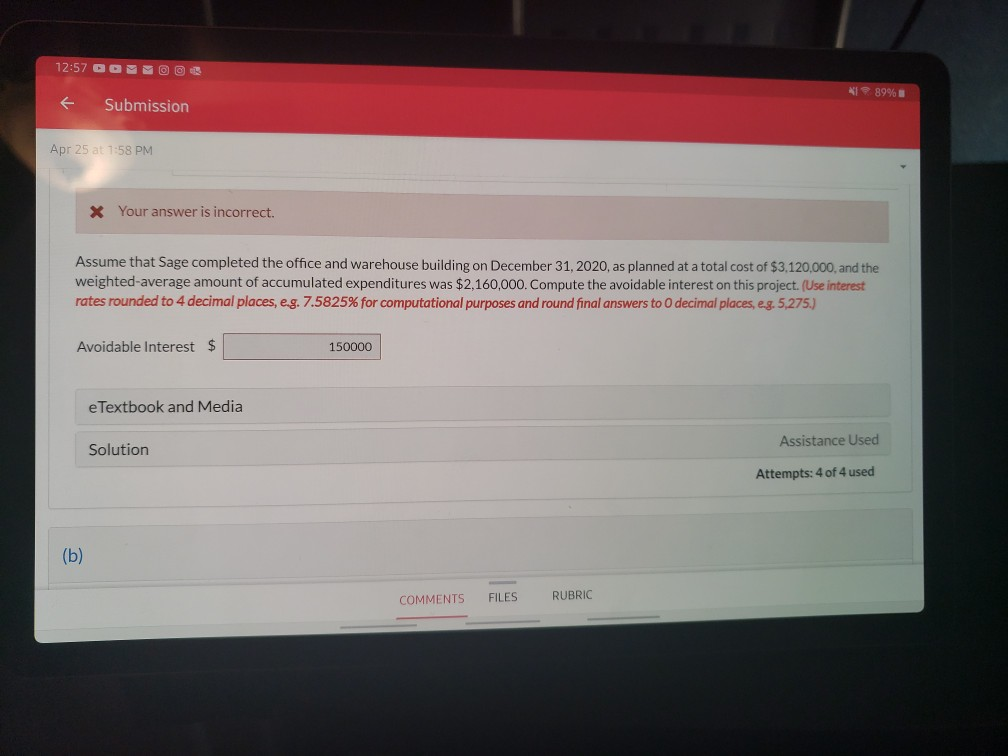

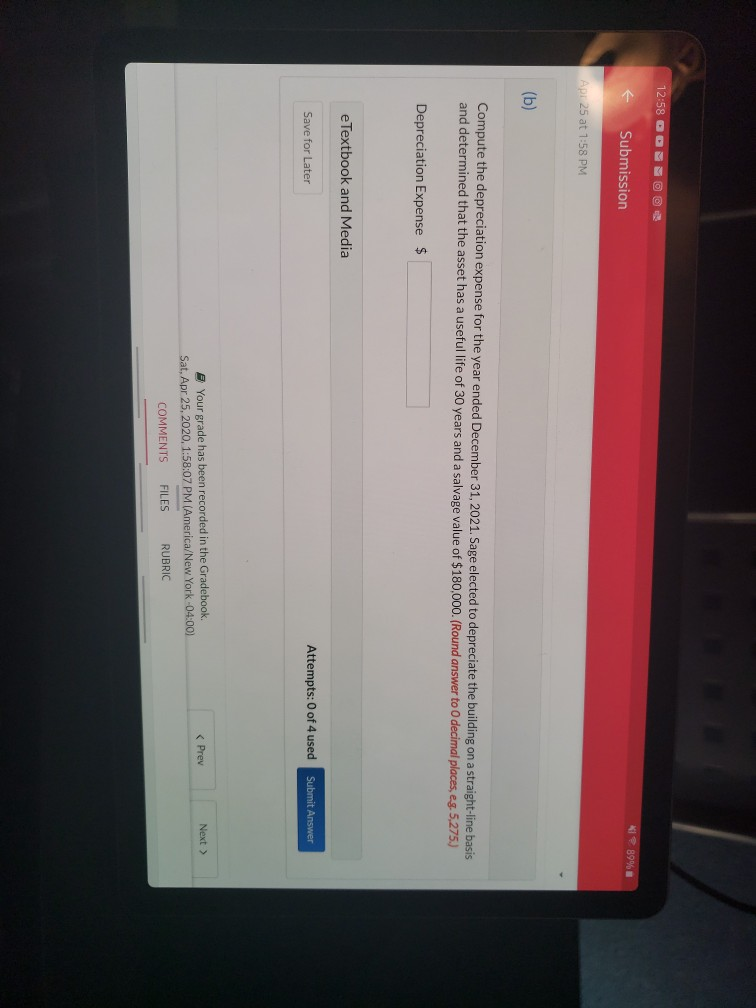

Apr 25 at 1:58 PM Sat, Apr 25, 2020, 1:58:07 PM (America/New York-04:00) 0/7 Question 9 View Policies Show Attempt History Current Attempt in Progress Sage Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $3,000,000 on January 1, 2020. Sage expected to complete the building by December 31, 2020. Sage has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2019 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2021 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2024 $1,200,000 840,000 600,000 COMMENTS FILES RUBRIC 12:57 DOO 1 89% + Submission Apr 25 at 1:58 PM X Your answer is incorrect Assume that Sage completed the office and warehouse building on December 31, 2020, as planned at a total cost of $3,120,000, and the weighted average amount of accumulated expenditures was $2,160,000. Compute the avoidable interest on this project. (Use interest rates rounded to 4 decimal places, e.g. 7.5825% for computational purposes and round final answers to 0 decimal places, eg. 5,275.) Avoidable Interest $ 150000 e Textbook and Media Assistance Used Solution Attempts: 4 of 4 used COMMENTS FILES RUBRIC 12:58 OOSE 89% Submission Apr 25 at 1:58 PM (b) Compute the depreciation expense for the year ended December 31, 2021. Sage elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $180,000. (Round answer to decimal places, es 5.2750 Depreciation Expense $ e Textbook and Media Attempts: 0 of 4 used Submit Answer Save for Later Your grade has been recorded in the Gradebook. Sat. Apr 25, 2020, 1:58:07 PM (America/New York-04:00) COMMENTS FILES RUBRIC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts