Question: help with part c Cullumber Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on

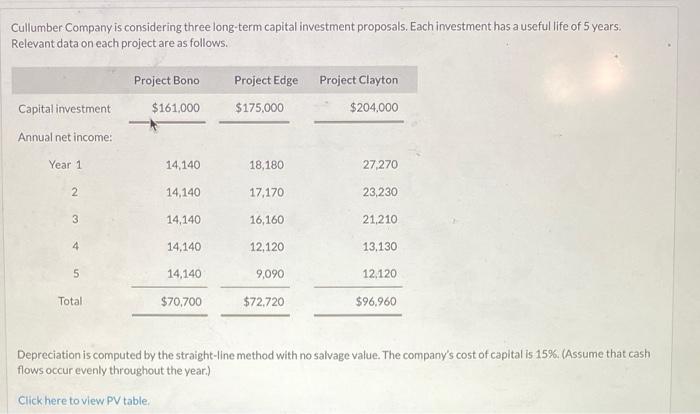

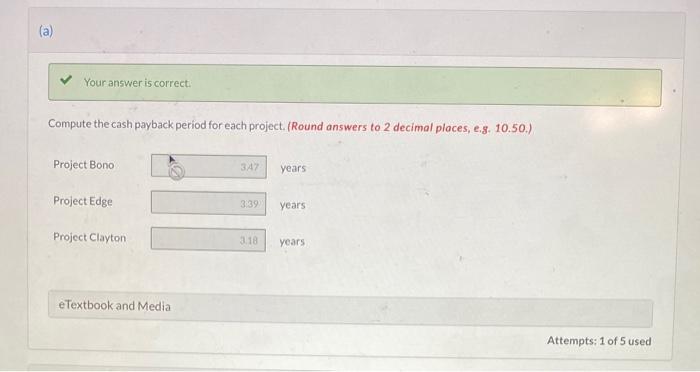

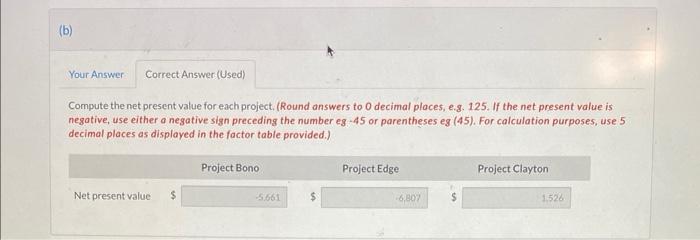

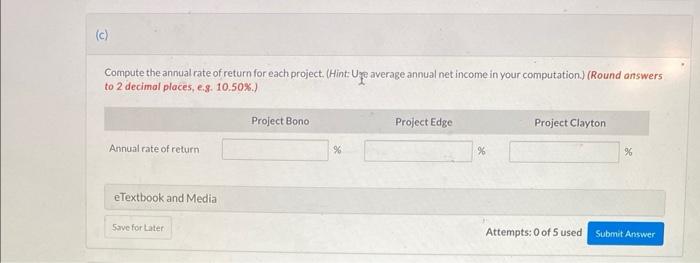

Cullumber Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15% (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) Project Bono years Project Edge years Project Clayton years Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg - 45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Compute the annual rate of return for each project. (Hint: UYe average annual net income in your computation.) (Round onswers to 2 decimal places, e.8. 10.50\%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts