Question: Help with problem 23-2 cash flows statement and calculations. Step by step walkthrough of the calculations and not just the answer please. Thank you. 1384

Help with problem 23-2 cash flows statement and calculations. Step by step walkthrough of the calculations and not just the answer please. Thank you.

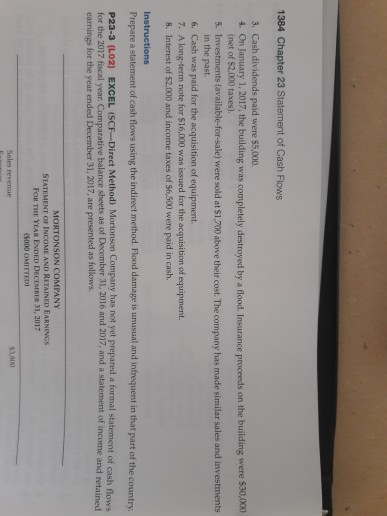

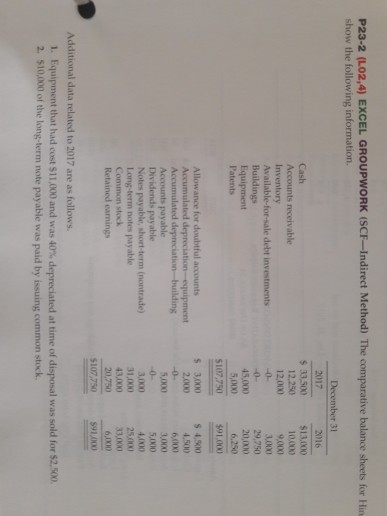

1384 Chapter 23 Statement of Cash Flows 3. Cash dividends paid were $5,000. 4. On January 1, 2017, the building was completely destroyed by a flood. Insurance proceeds on the building were $30,000 (net of $2.000 taxes). 5. Investments (available-for-sale) were sold at $1,700 above their cost. The company has made similar sales and investments in the past. 6. Cash was paid for the acquisition of equipment 7. A long-term note for $16,000 was issued for the acquisition of equipment. 8. Interest of $2,000 and income taxes of $6,500 were paid in cash. Instructions Prepare a statement of cash flows using the indirect method. Flood damage is unusual and infrequent in that part of the country P23-3 (Lo2) EXCEL (SCF-Direct Method) Mortonson Company has not yet prepared a formal statement of cash flows for the 2017 fiscal year. Comparative balance sheets as of December 31, 2016 and 2017, and a statement of income and retained earnings for the year ended December 31, 2017, are presented as follows. MORTONSON COMPANY STATEMENT OF INCOME AND RETAINED EARNINGSs FOR THE YEAR ENDED DECEMBER 31, 2017 S000 OMITTED) Sales revenue 53,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts