Question: help with problems d and e. the answer in d is incorrect. (Bond valuation) You own a bond that pays $120 In annual Interest, with

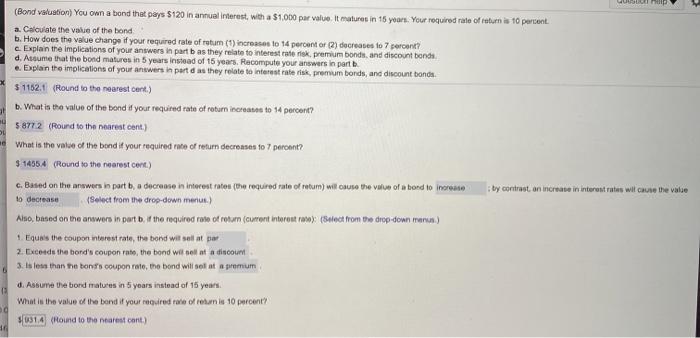

(Bond valuation) You own a bond that pays $120 In annual Interest, with a $1.000 par value. It matures in 16 years. Your required rate of return is 10 percent a. Calculate the value of the bond b. How does the value change if your required rate of rotum (1) increases to 14 percent or (2) decreases to 7 percent? c. Explain the implications of your answers in part b as they relate to interest rate risk, premium bonds, and discount bonds d. Assume that the bond matures in 5 years instead of 15 years, Recompute your answers in part e. Explain the implications of your answers in part d as they relate to interest rate risk, premium bonds, and discount bonds $ 1162.1 (Round to the nearestent.) b. What is the value of the bond if your required rate of retum increase to 14 percent? 58772 (Round to the nearest cont.) What is the value of the bond if your required rate of retur decreases to 7 percent? $14354 (Round to the nearest cont.) c. Based on the answers in part b, a decrease in interest rates the required rate of retum) willows the value of a bond to increase by contrast an increase in interest rates wit cause the value to decrease Select from the drop-down menus Also, based on the answers in part b. if the required rate of rotum (current interest raday (Select from the drop-down manun) 1 Equss the coupon Interest rate, the bond wit sal at par 2. Exced the band's coupon rato, the bond wil sell at a discount 3. Is less than the bonis coupon rate, the bond will sel at spremum d. Assume the bond matures in 5 years instead of 15 years What is the value of the bond if your required role of return is 10 percent? 5631.4 (Round to the nearest cont.) 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts