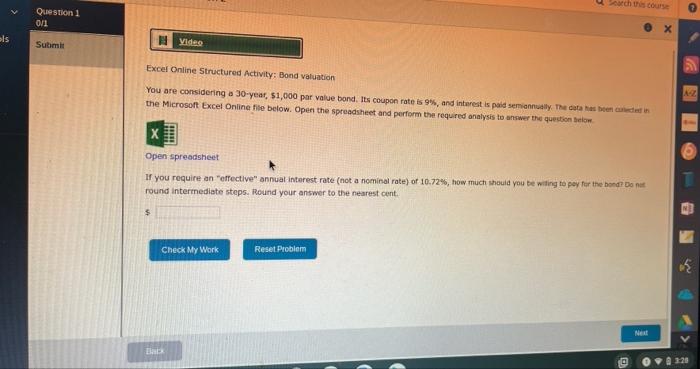

Question: Question 1 on1 els Submit 1 Video Excel Online Structured Activity: Bond valuation AZ You are considering a 30-year, $1,000 par value bond. Its coupon

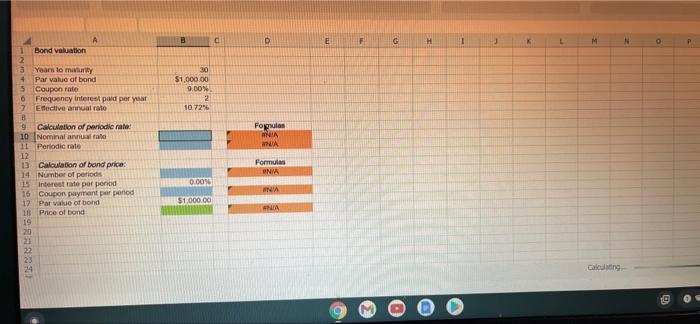

Question 1 on1 els Submit 1 Video Excel Online Structured Activity: Bond valuation AZ You are considering a 30-year, $1,000 par value bond. Its coupon rate is 9%, and interest is paid semanaly. The other creden the Microsoft Excel Online Hebelow. Open the spreadsheet and perform the required analysis to answer the question below Open Spreadsheet If you require an effective" annual interest rate (not a nominal rate) of 10.72%, how much should you be willing to pay for the band? Do not round Intermediate steps. Round your answer to the nearest cont. $ Check My Work Reset Problem Next El 3:28 A B c D F G H 1 M N Bond valuation a Yoans to my Par value of bond 5 Coupon rate 0 Frequency interest podpory 7 Efective annual rate 30 $1,000.00 0.00% 2 10.72" Fogulas Formulas ONIA 9 Calculation of perioderate 10 Nominal annar 11 Periodic rate 12 13 Calculation of bond price 14 Number of periods 15 Interest rate per poned 16 Coupon payment per poned 17 Par vale of bond 18 Price of bond 19 20 0.00% NA $1.000.00 NA 495RRRR 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts