Question: help with project plz Lodger (Continued) Ledger for Requirements 2, 5, & 10 Note:Ledger includes the balance of each acoount as of November 30 for

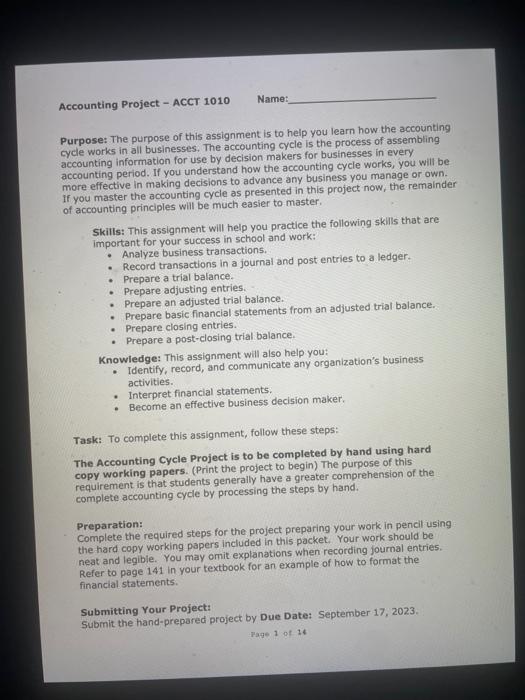

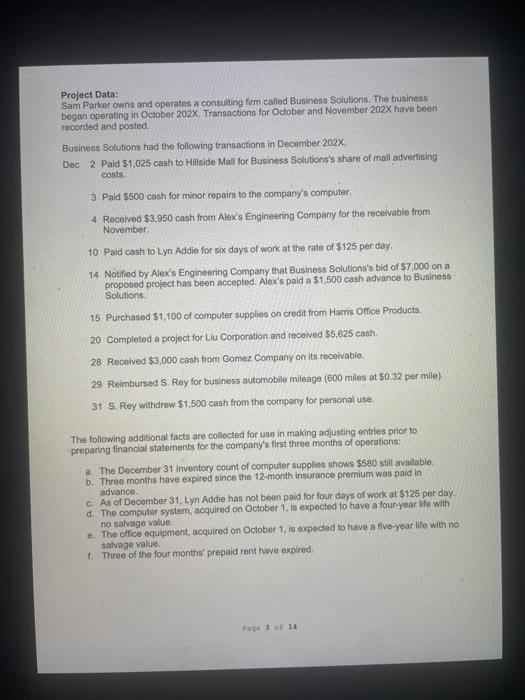

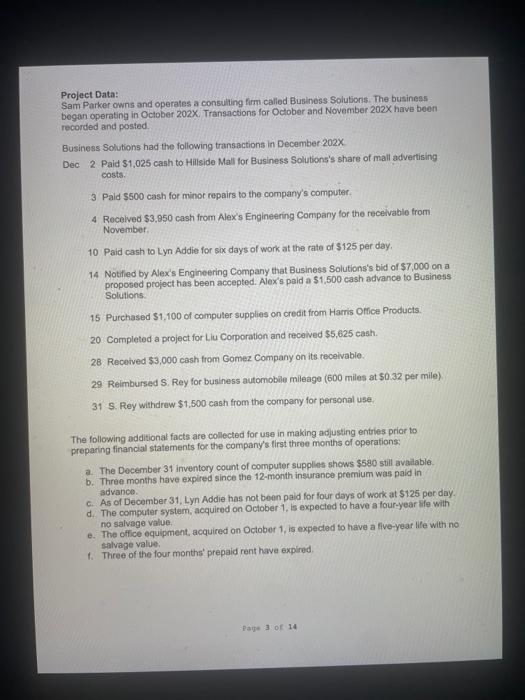

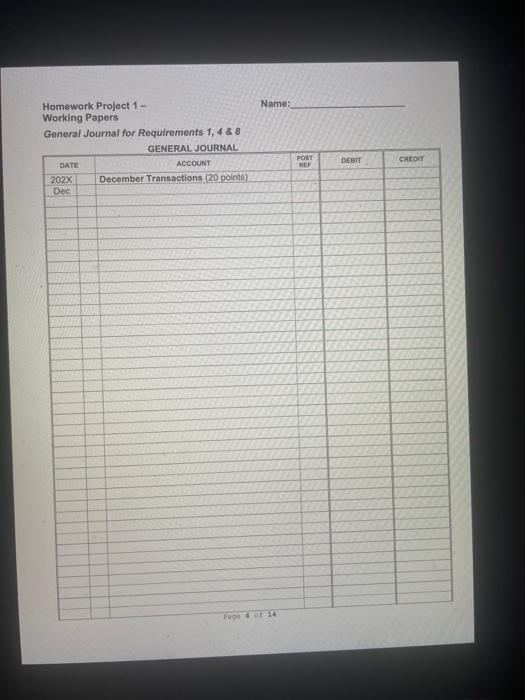

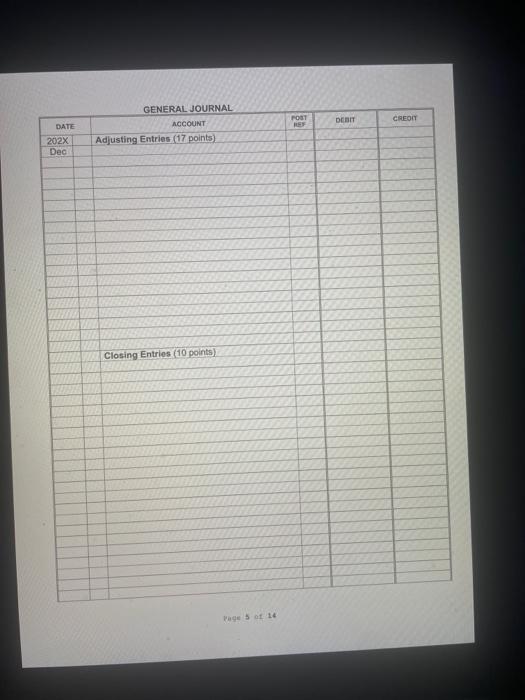

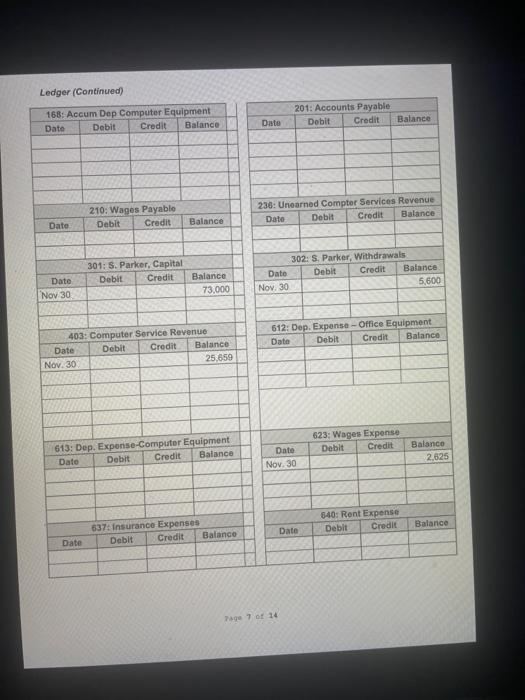

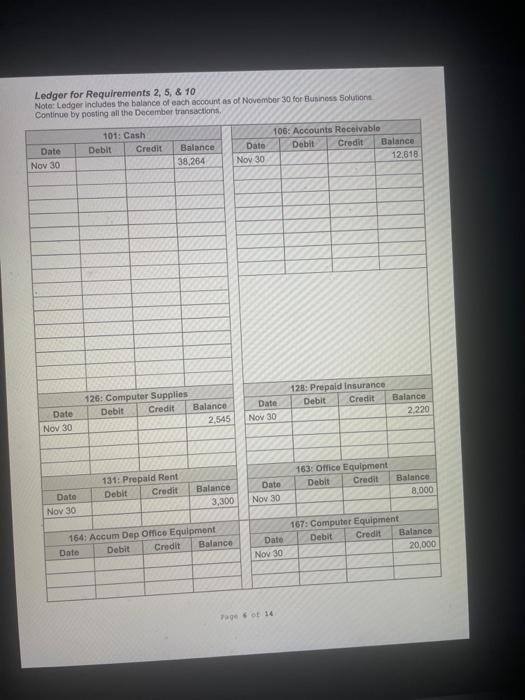

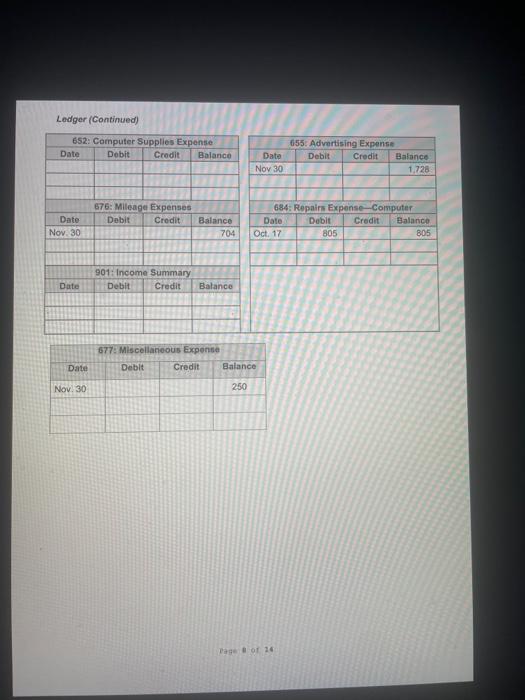

Lodger (Continued) Ledger for Requirements 2, 5, \& 10 Note:Ledger includes the balance of each acoount as of November 30 for Eusiness Solutiont Ledger (Continued) \begin{tabular}{|l|l|l|l|} \hline \multicolumn{5}{|c|}{ 201: Accounts Payable } \\ \hline Date & Dobit & Credit & Batance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} 236: Unoarned Comptor Services Revenue 403: Computer Service Revenue \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 403: Computer } \\ \hline Date & Debit & Credit & Balance \\ \hline Nov. 30 & & & 25,659 \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{4}{|c|}{ 612: Dep. Expense - Office Equipment } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline 613: Dep. Expense-Computer Equipment & \\ \hline Date & Dobit & Credit & Baiance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline \multicolumn{4}{|c|}{ 623: Wages Expense } \\ \hline Date & Debit & Credit & Balanco \\ \hline Nov. 30 & & & 2.625 \\ \hline & & & \\ \hline & & & \\ \hline & \multicolumn{3}{|c|}{ 640: Rent Expense } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} rage 7 of 24 Homework Project 1 - Name: Working Papers Generat Journal for Requirements 1,4 \& 8 GENERAL JOURNAL Project Data: Sam Parker owns and operales a consulting firm called Business Solutions. The business began operating in October 202X. Transactions for Oclober and November 202 have been recorded and posted. Business Solutions had the following transactions in December 202X Dec 2 Paid \$1,025 cash to Hillside Mall for Business Solutions's share of mall advertising costs. 3 Paid $500 cash for minor repairs to the company's computer. 4 Recelved $3,950 cash from Alex's Engineering Company for the receivable from November. 10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day. 14 Notifed by Alex's Engineering Company that Business Solutions's bid of $7,000 on a proposed project has been accepted. Alex's paid a \$1,500 cash advance to Business Solutions. 15 Purchased $1,100 of computer supplies on credit from Harris Office Products. 20 Completed a project for Liu Corporation and received $5,625 cash. 28 Received $3,000 cash from Gomez Company on its receivable. 29 Reimbursed S. Rey for business automobile mileage ( 600 miles at $0.32 per mile) 31 S. Rey withdrew $1,500 cash from the company for personal use. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months of operations: a. The December 31 inventory count of computer supplies shows $580 still available. b. Three months have expired since the 12 -month insurance premium was paid in sdvance. c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The computer systam, acquired on October 1 , is expected to have a four-year lfe with no salvage value. e. The office equipment, acquired on October 1 , is expected to have a five-year life with no salvage value. f. Three of the four months' prepaid rent have expired. Working Paper for Requirement 3 3 points Business Solutions Working Papers for Roquirement 10 Business Solutions GENERAL JOURNAL vage 5 of 14 Project Data: Sam Parker owns and operales a consulting firm called Business Solutions. The business began operating in October 202X. Transactions for Oclober and November 202 have been recorded and posted. Business Solutions had the following transactions in December 202X Dec 2 Paid \$1,025 cash to Hillside Mall for Business Solutions's share of mall advertising costs. 3 Paid $500 cash for minor repairs to the company's computer. 4 Recelved $3,950 cash from Alex's Engineering Company for the receivable from November. 10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day. 14 Notifed by Alex's Engineering Company that Business Solutions's bid of $7,000 on a proposed project has been accepted. Alex's paid a \$1,500 cash advance to Business Solutions. 15 Purchased $1,100 of computer supplies on credit from Harris Office Products. 20 Completed a project for Liu Corporation and received $5,625 cash. 28 Received $3,000 cash from Gomez Company on its receivable. 29 Reimbursed S. Rey for business automobile mileage ( 600 miles at $0.32 per mile) 31 S. Rey withdrew $1,500 cash from the company for personal use. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months of operations: a. The December 31 inventory count of computer supplies shows $580 still available. b. Three months have expired since the 12 -month insurance premium was paid in sdvance. c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The computer systam, acquired on October 1 , is expected to have a four-year lfe with no salvage value. e. The office equipment, acquired on October 1 , is expected to have a five-year life with no salvage value. f. Three of the four months' prepaid rent have expired. urpose: The purpose of this assignment is to help you learn how the accounting cle works in all businesses. The accounting cycle is the process of assembling ccounting information for use by decision makers for businesses in every coounting period. If you understand how the accounting cycle works, you will be pore effective in making decisions to advance any business you manage or own. you master the accounting cycle as presented in this project now, the remainder f accounting principles will be much easier to master. Skills: This assignment will help you practice the following skills that are important for your success in school and work: - Analyze business transactions. - Record transactions in a journal and post entries to a ledger. - Prepare a trial balance. - Prepare adjusting entries. - Prepare an adjusted trial balance. - Prepare basic financial statements from an adjusted trial balance. - Prepare closing entries. - Prepare a post-closing trial balance. Knowiedge: This assignment will also help you: - Identify, record, and communicate any organization's business activities. - Interpret financial statements. - Become an effective business decision maker. Task: To complete this assignment, follow these steps: The Accounting Cycle Project is to be completed by hand using hard copy working papers. (Print the project to begin) The purpose of this requirement is that students generally have a greater comprehension of the complete accounting cycle by processing the steps by hand. Preparation: Complete the required steps for the project preparing your work in pencil using the hard copy working papers included in this packet. Your work should be neat and legible. You may omit explanations when recording journal entries. Refer to page 141 in your textbook for an example of how to format the financial statements. Submitting Your Project: Submit the hand-prepared project by Due Date: September 17, 2023. rage 1 of 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts