Question: help with question Homework Help - Q&A from x | ecampus: Home * | Z Content x connect * @ Home - Canva * |

help with question

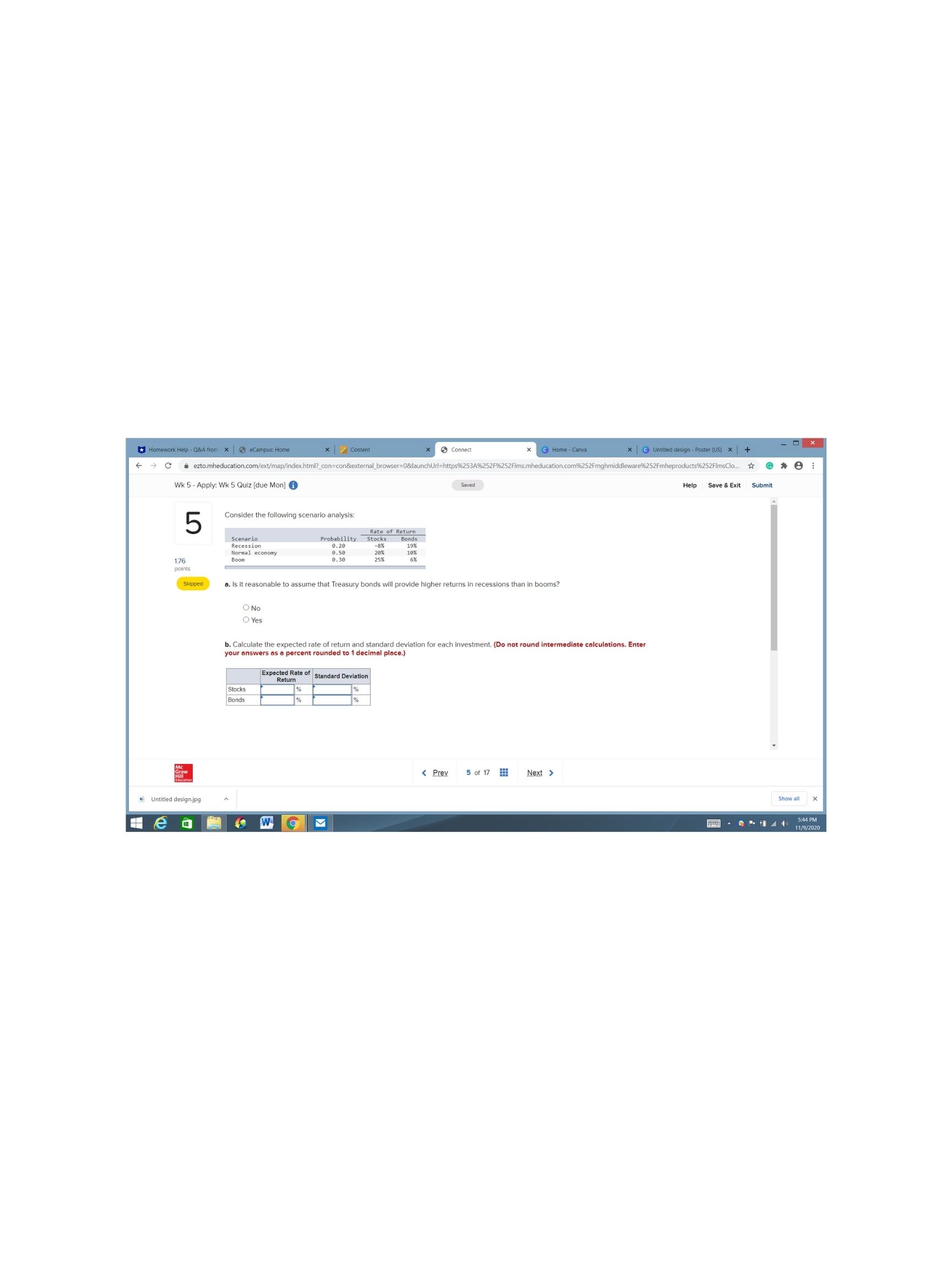

Homework Help - Q&A from x | ecampus: Home * | Z Content x connect * @ Home - Canva * | @ Untitled design - Poster (US) * | + 1 X + + C * ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F6252Fims.mheducation.com%252Fmghmiddleware%252Fmheproducts6252FimsClo.. # @ # : Wk 5 - Apply: Wk 5 Quiz [due Mon] Saved Help Save & Exit Submit 5 Consider the following scenario analysis: Scenario skate of Return Normal economy 76 points Skipped a. Is it reasonable to assume that Treasury bonds will provide higher returns in r ecessions than in booms? O No Yes b. Calculate the expected rate of return and standard deviation for each investment. (Do not round interm your answers as a percent rounded to 1 decimal place.) ediate calculations. Enter Expected Rate of standard Deviation Stocks Bonds Untitled design.jpg Show all x Heaway Q - 71 4 1 5:44 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts