Question: help with the last part please Expert Q&A Done Ameye..ke Al IMO Below are the prices al DRMO strategy Lepice CALIS Ape Jah Od 17)

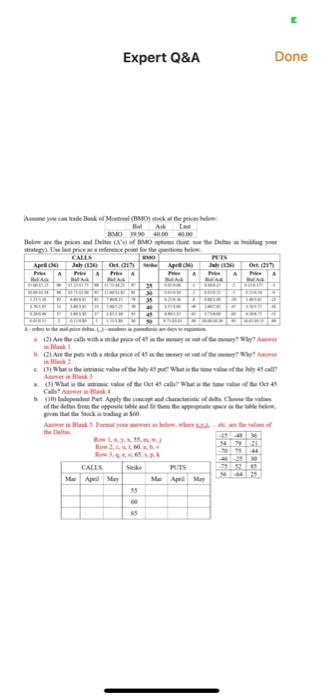

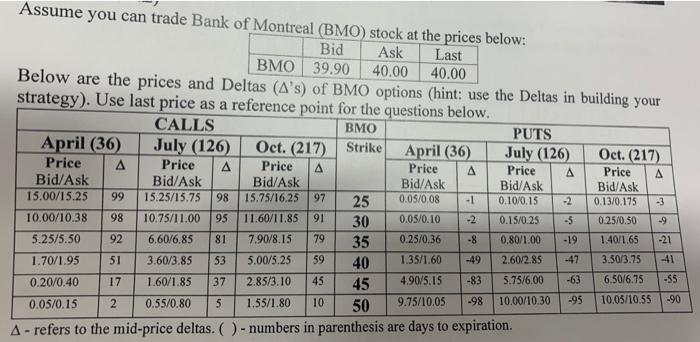

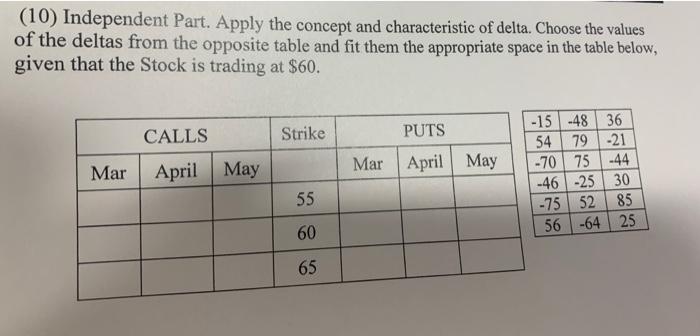

Expert Q&A Done Ameye..ke Al IMO Below are the prices al DRMO strategy Lepice CALIS Ape Jah Od 17) PA Hall M . An the call with the price of the Arte wie 45 What is the way that they call Aik What is the sale of the Oct 15 What C. lindependent Pet Apply the chance dails asteries, the . CALES Mar Api May PUTS Me Apel 60 65 Assume you can trade Bank of Montreal (BMO) stock at the prices below: Bid Ask Last BMO 39.90 Below are the prices and Deltas (A's) of BMO options (hint: use the Deltas in building your 40.00 40.00 strategy). Use last price as a reference point for the questions below. CALLS BMO PUTS April (36) July (126) Oct. (217) Strike April (36) July (126) Oct. (217) Price Price A Price Price Price A Price A Bid/Ask Bid/Ask Bid/Ask Bid/Ask Bid/Ask Bid/Ask 15.00/15.25 99 15.25/15.75 98 15.75/16.25 97 25 0.05/0.08 -1 0.10/0.15 -2 0.13/0.175 10.00/10.38 98 10.75/11.00 95 11.60/11.85 91 30 0.05/0.10 -2 0.15/0.25 -5 0.25/0.50 5.25/5.50 92 6.60/6.85 81 7.90/8.15 79 35 0.25/0.36 -8 0.80/1.00 -19 1.40/1.65 -21 51 1.70/1.95 3.60/3.85 53 5.00/5.25 59 1.35/1.60 40 -49 -47 2.60/2.85 -41 3.50/3.75 17 0.20/0.40 1.60/1.85 37 2.85/3.10 45 4.90/5.15 -83 5.75/6.00 -63 -55 6.50/6.75 45 0.05/0.15 2 $ -90 0.55/0.80 1.55/1.80 10 -95 -98 10.00/10.30 10.05/10.55 9.75/10.05 50 A-refers to the mid-price deltas. () - numbers in parenthesis are days to expiration. -3 -9 (10) Independent Part. Apply the concept and characteristic of delta. Choose the values of the deltas from the opposite table and fit them the appropriate space in the table below, given that the Stock is trading at $60. CALLS Strike PUTS Mar April May Mar April May -15 -48 36 54 79 -21 -70 75 -44 -46-25 30 -75 52 85 56 -64 25 55 60 65 Expert Q&A Done Ameye..ke Al IMO Below are the prices al DRMO strategy Lepice CALIS Ape Jah Od 17) PA Hall M . An the call with the price of the Arte wie 45 What is the way that they call Aik What is the sale of the Oct 15 What C. lindependent Pet Apply the chance dails asteries, the . CALES Mar Api May PUTS Me Apel 60 65 Assume you can trade Bank of Montreal (BMO) stock at the prices below: Bid Ask Last BMO 39.90 Below are the prices and Deltas (A's) of BMO options (hint: use the Deltas in building your 40.00 40.00 strategy). Use last price as a reference point for the questions below. CALLS BMO PUTS April (36) July (126) Oct. (217) Strike April (36) July (126) Oct. (217) Price Price A Price Price Price A Price A Bid/Ask Bid/Ask Bid/Ask Bid/Ask Bid/Ask Bid/Ask 15.00/15.25 99 15.25/15.75 98 15.75/16.25 97 25 0.05/0.08 -1 0.10/0.15 -2 0.13/0.175 10.00/10.38 98 10.75/11.00 95 11.60/11.85 91 30 0.05/0.10 -2 0.15/0.25 -5 0.25/0.50 5.25/5.50 92 6.60/6.85 81 7.90/8.15 79 35 0.25/0.36 -8 0.80/1.00 -19 1.40/1.65 -21 51 1.70/1.95 3.60/3.85 53 5.00/5.25 59 1.35/1.60 40 -49 -47 2.60/2.85 -41 3.50/3.75 17 0.20/0.40 1.60/1.85 37 2.85/3.10 45 4.90/5.15 -83 5.75/6.00 -63 -55 6.50/6.75 45 0.05/0.15 2 $ -90 0.55/0.80 1.55/1.80 10 -95 -98 10.00/10.30 10.05/10.55 9.75/10.05 50 A-refers to the mid-price deltas. () - numbers in parenthesis are days to expiration. -3 -9 (10) Independent Part. Apply the concept and characteristic of delta. Choose the values of the deltas from the opposite table and fit them the appropriate space in the table below, given that the Stock is trading at $60. CALLS Strike PUTS Mar April May Mar April May -15 -48 36 54 79 -21 -70 75 -44 -46-25 30 -75 52 85 56 -64 25 55 60 65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts