Question: help with the ones i got wrong please Question 5 Partially correct Mark 0.50 out of 1.00 P Flag question Edit question Ratios Compared with

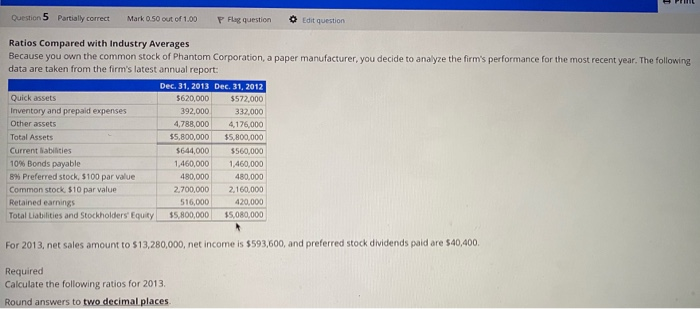

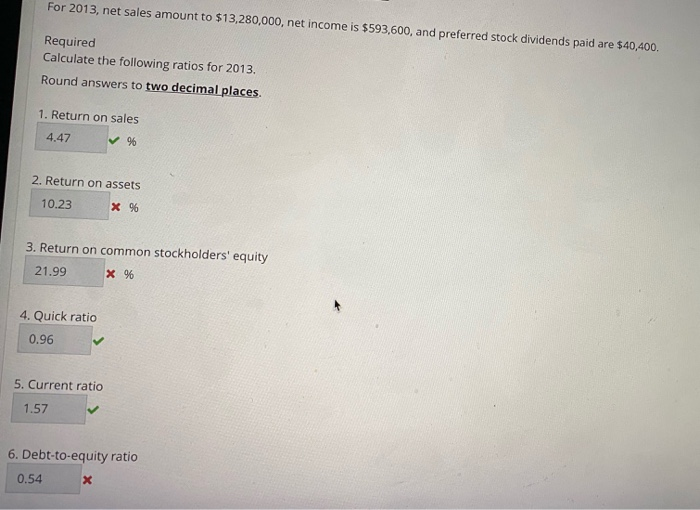

Question 5 Partially correct Mark 0.50 out of 1.00 P Flag question Edit question Ratios Compared with Industry Averages Because you own the common stock of Phantom Corporation, a paper manufacturer, you decide to analyze the firm's performance for the most recent year. The following data are taken from the firm's latest annual report: Dec 31, 2013 Dec 31, 2012 Quick assets 5620,000 $572,000 Inventory and prepaid expenses 392.000 332,000 Other assets 4,788,000 4,176,000 Total Assets $5.800,000 $5,800,000 Current abilities $644,000 $560,000 10% Bonds payable 1,460,000 1,460,000 8% Preferred stock, 5100 par value 480,000 480.000 Common stock $10 par value 2,700,000 2,160,000 Retained earnings 516,000 420,000 Total Liabilities and Stockholders' Equity $5,800,000 $5,080,000 For 2013, net sales amount to $13,280,000, net income is $593,600, and preferred stock dividends paid are $40,400 Required Calculate the following ratios for 2013 Round answers to two decimal places For 2013, net sales amount to $13,280,000, net income is $593,600, and preferred stock dividends paid are $40,400. Required Calculate the following ratios for 2013. Round answers to two decimal places. 1. Return on sales 4.47 % 2. Return on assets 10.23 x % 3. Return on common stockholders' equity 21.99 * % 4. Quick ratio 0.96 5. Current ratio 1.57 6. Debt-to-equity ratio 0.54 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts