Question: help with the true or false plsss TRUE/FALSE. Write T' if the statement is true and 'F' if the statement is false. TF 1. Under

help with the true or false plsss

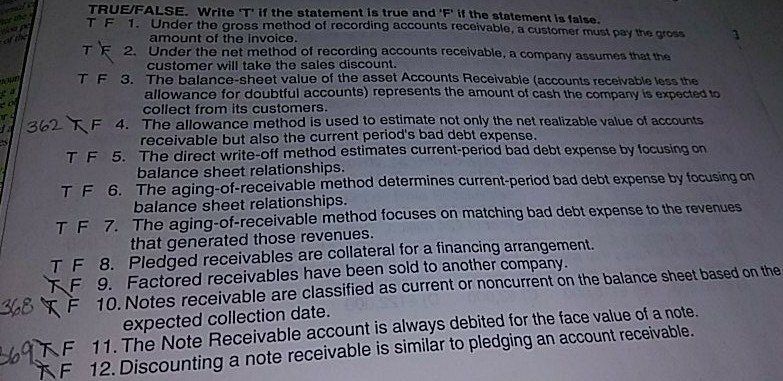

TRUE/FALSE. Write T' if the statement is true and 'F' if the statement is false. TF 1. Under the gross method of recording accounts receivable, a customer must amount of the invoice T F 2. Under the net method of recording accounts receivable, a company assumes that pay the gross customer will take the sales discount. TF3. The balance-sheet value of the asset Accounts Receivable (accounts receivable less the allowance for doubtful accounts) represents the amount of cash the company is expected to collect from its customers. receivable but also the current period's bad debt expense balance sheet relationships 302% F 4. The allowance method is used to estimate not only the net realizable value of accounts T F 5. The direct write-off method estimates current-period bad debt expense by focusing on f-receivable method determines current-period bad debt expense ty focusing on balance sheet relationships. The aging-of-receivable method focuses on matching bad debt expense to the revenues that generated those revenues. Pledged receivables are collateral for a financing arrangement. T F 7. 8. TF F 9. Factored receivables have been sold to another company 10. Notes receivable are classified as current or noncurrent on the balance sheet based on the 368F F 11. The Note Receivable account is always debited for the face value of a note. F 12. Disco expected collection date 2 unting a note receivable is similar to pledging an account receivable. TRUE/FALSE. Write T' if the statement is true and 'F' if the statement is false. TF 1. Under the gross method of recording accounts receivable, a customer must amount of the invoice T F 2. Under the net method of recording accounts receivable, a company assumes that pay the gross customer will take the sales discount. TF3. The balance-sheet value of the asset Accounts Receivable (accounts receivable less the allowance for doubtful accounts) represents the amount of cash the company is expected to collect from its customers. receivable but also the current period's bad debt expense balance sheet relationships 302% F 4. The allowance method is used to estimate not only the net realizable value of accounts T F 5. The direct write-off method estimates current-period bad debt expense by focusing on f-receivable method determines current-period bad debt expense ty focusing on balance sheet relationships. The aging-of-receivable method focuses on matching bad debt expense to the revenues that generated those revenues. Pledged receivables are collateral for a financing arrangement. T F 7. 8. TF F 9. Factored receivables have been sold to another company 10. Notes receivable are classified as current or noncurrent on the balance sheet based on the 368F F 11. The Note Receivable account is always debited for the face value of a note. F 12. Disco expected collection date 2 unting a note receivable is similar to pledging an account receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts