Question: help with this one asap help with this question asap Exercise Problem #1 (slide 7) Use the Bloomberg bond description above (as of April 22,

help with this one asap

help with this question asap

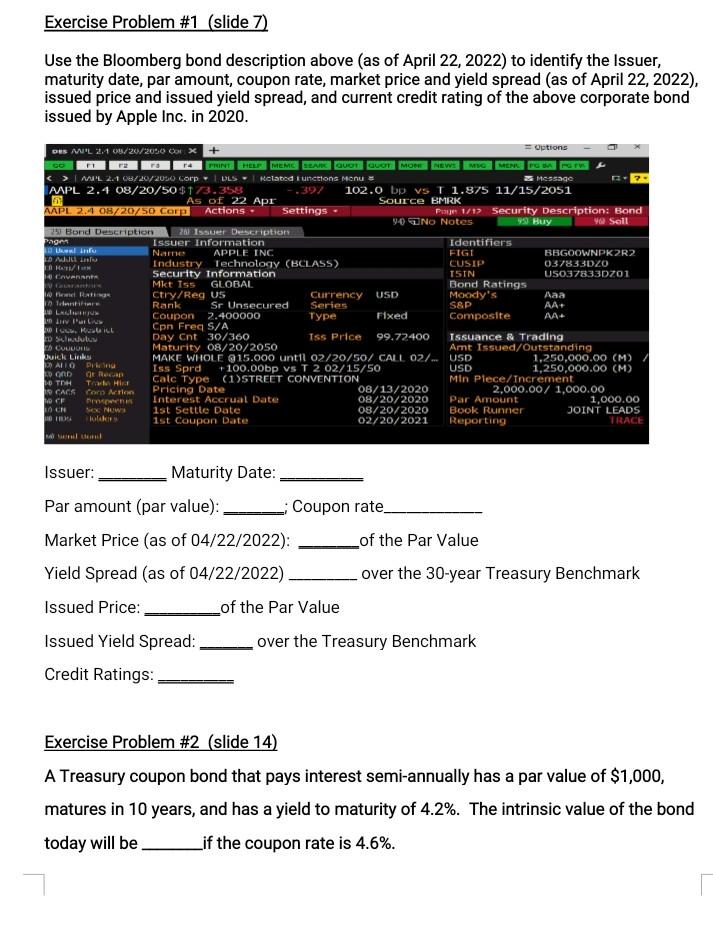

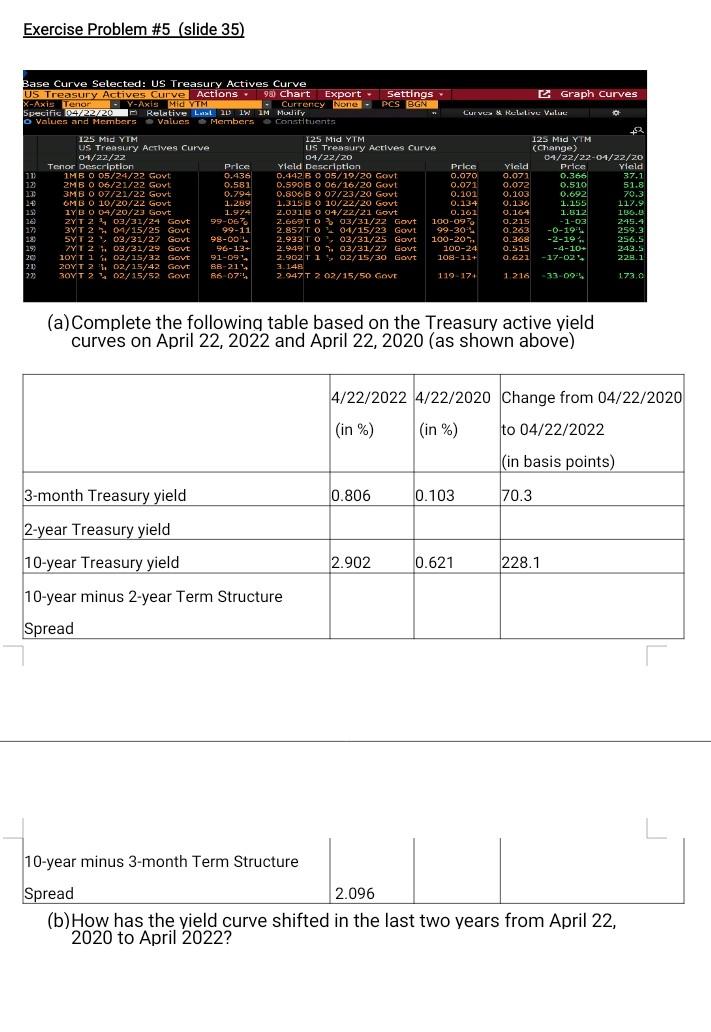

Exercise Problem #1 (slide 7) Use the Bloomberg bond description above (as of April 22, 2022) to identify the Issuer, maturity date, par amount, coupon rate, market price and yield spread (as of April 22, 2022). issued price and issued yield spread, and current credit rating of the above corporate bond issued by Apple Inc. in 2020. DES MIL 2.168/20/2050 o X + Options HELMEM DEARG QUOTQUOT MORE NEWS MOMENE MPL 2.4 03/20/2010 corp - DLS - Melated tunctions Menu Thessage AAPL 2.4 08/20/50$173.358 102.0 bp vs T 1.875 11/15/2051 As of 22 Apr Source BMRK AAPL 2008/20/50. COLD Actions - Settings Pon 1/12 Security Description: Bond 90 No Notes 99 Buy 92 Sell 351 Bord Description 20 Issue Description Tags Issuer Information Identifiers linifu Naine APPLE INC FIGI BBGOOWNPK2R2 D ALL / Industry Technology (BCLASS) CUSIP 037833DZO Cnvents Security Information ISIN U5037833D701 NAR Mkt Iss GLOBAL Bond Ratings we RATE Ctry/Reg US Currency USD Moody's Aaa A Tobnim Rank Sr Unsecured Series S&P AA+ 10 LEI Coupon 2.400000 Fixed Type an Iuris Composite AA ct, Metai Con Freq S/A www Day Cnt 30/360 Iss Price 99.72400 Issuance & Trading CMUUT Maturity 08/20/2050 Amt Issued/Outstanding Juick Liriku MAKE WHOLE @15.000 until 02/20/50/ CALL 02/. USD 1,250,000.00 (M) PALIO POR Iss Sprd +100.00bp vs T 2 02/15/50 USD 1,250,000.00 (M) DOOD O Recan Tor HIRT Calc Type (1)STREET CONVENTION Min Plece/Increment I CACS Corn Milan Pricing Date 08/13/2020 2,000.00/ 1,000.00 BCF Pro Interest Accrual Date 08/20/2020 Par Amount 1,000.00 BAON 1st Settle Date 08/20/2020 Book Runner JOINT LEADS 1st Coupon Date 02/20/2021 Reporting TRACE 10 Issuer: Maturity Date: Par amount (par value): Coupon rate Market Price (as of 04/22/2022): of the Par Value Yield Spread (as of 04/22/2022) over the 30-year Treasury Benchmark Issued Price: of the Par Value Issued Yield Spread: over the Treasury Benchmark Credit Ratings: Exercise Problem #2 (slide 14) A Treasury coupon bond that pays interest semi-annually has a par value of $1,000, matures in 10 years, and has a yield to maturity of 4.2%. The intrinsic value of the bond today will be Lif the coupon rate is 4.6%. Exercise Problem #5 (slide 35) Base Curve Selected: US Treasury Actives Curve US Treasury Actives Curve Actions. 98 Chart Export Settings - ) - E Graph Curves K-Axis Tenor - Y-Axis Mid YTM - Currency None PCS BGN Specific 04/22/20 - Relative Last 2 IN 1M Modify LUV Rolutive Value O Values and Members Values Members Constituents 125 Mid YTM 125 Mid YTM 125 Mid YTM US Treasury Actives Curve US Treasury Actives Curve (Change) 04/22/22 04/22/20 04/22/22-04/22/20 Tenor Description Price Yield Description Price Yield Price Yield 11) IMBO 05/24/22 Govt 0.436 0.4426 0 05/19/20 Govt 0.070 0.071 0.366 37.1 3 123 2MB O 06/21/22 Govt 0.581 0.590B O 06/16/20 Govt 0.071 0.072 0.510 51.8 3MBO 07/21/22 Govt 0.794 0.806B O 07/23/20 Govt 0.101 0.103 0.692 70.3 14 6MB O 10/20/22 Govt 1.289 1.315 B O 10/22/20 Govt 0.134 0.130 1.155 117.9 15 1YBO 04/20/23 Govt 1.974 2.0310 0 04/22/21 Govt 0.101 0.164 1.812 136.6 12 ZYT 24 03/31/24 Govt 99-067 2.669 TO 03/31/22 Govt 100-090 0.215 -1-03 245.4 17) 3YT 2. 01/15/25 Govt 99-11 2.857TO01/15/23 Govi 99-30 0.263 -0-19 259.3 SYT 2 03/31/27 Govt 99-00 2.933 TO 03/31/25 Govt 100-20 0.368 -2-19 256.5 19 7Y12. 03/31/29 Govt 96-13+ ** 100-24 2.949101. 03/31/27 Govt 0.515 -4-10- 243.5 20 101 102/15/32 Govt 91-09 2.9021 102/15/30 Govt 108-11+ 0.621 -17-02'. 228.1 20 20VT 21 02/15/42 Govt 88-211 3.145 221 30VT 2102/15/52 GOVT R6071 2.947T 2 02/15/50 GOVE 119-174 1 216 33-09 1720 (a) Complete the following table based on the Treasury active yield curves on April 22, 2022 and April 22, 2020 (as shown above) 4/22/2022 4/22/2020 Change from 04/22/2020 (in %) (in %) to 04/22/2022 (in basis points) 3-month Treasury yield 0.806 0.103 70.3 2-year Treasury yield 2.902 0.621 228.1 10-year Treasury yield 10-year minus 2-year Term Structure Spread 10-year minus 3-month Term Structure Spread 2.096 (b) How has the yield curve shifted in the last two years from April 22, 2020 to April 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts