Question: help!! with work please! 5 points Save Answer Ann turned 71% on April 15th of Year 2. Her profit-sharing account balance was $500,000 at the

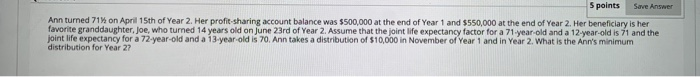

5 points Save Answer Ann turned 71% on April 15th of Year 2. Her profit-sharing account balance was $500,000 at the end of Year 1 and $550,000 at the end of Year 2. Her beneficiary is her favorite granddaughter, joe, who turned 14 years old on June 23rd of Year 2. Assume that the joint life expectancy factor for a 71 year old and a 12-year-old is 71 and the joint life expectancy for a 72-year-old and a 13-year-old is 70. Ann takes a distribution of $10,000 in November of Year 1 and in Year 2. What is the Ann's minimum distribution for Year 27 5 points Save Answer Ann turned 71% on April 15th of Year 2. Her profit-sharing account balance was $500,000 at the end of Year 1 and $550,000 at the end of Year 2. Her beneficiary is her favorite granddaughter, joe, who turned 14 years old on June 23rd of Year 2. Assume that the joint life expectancy factor for a 71 year old and a 12-year-old is 71 and the joint life expectancy for a 72-year-old and a 13-year-old is 70. Ann takes a distribution of $10,000 in November of Year 1 and in Year 2. What is the Ann's minimum distribution for Year 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts