Question: Please help me answer these questions. Problem 1) LO (various) Beerbe began fiscal year 2021 with no plant assets. On January 1, 2021, Beerbe purchased

Please help me answer these questions.

Please help me answer these questions.

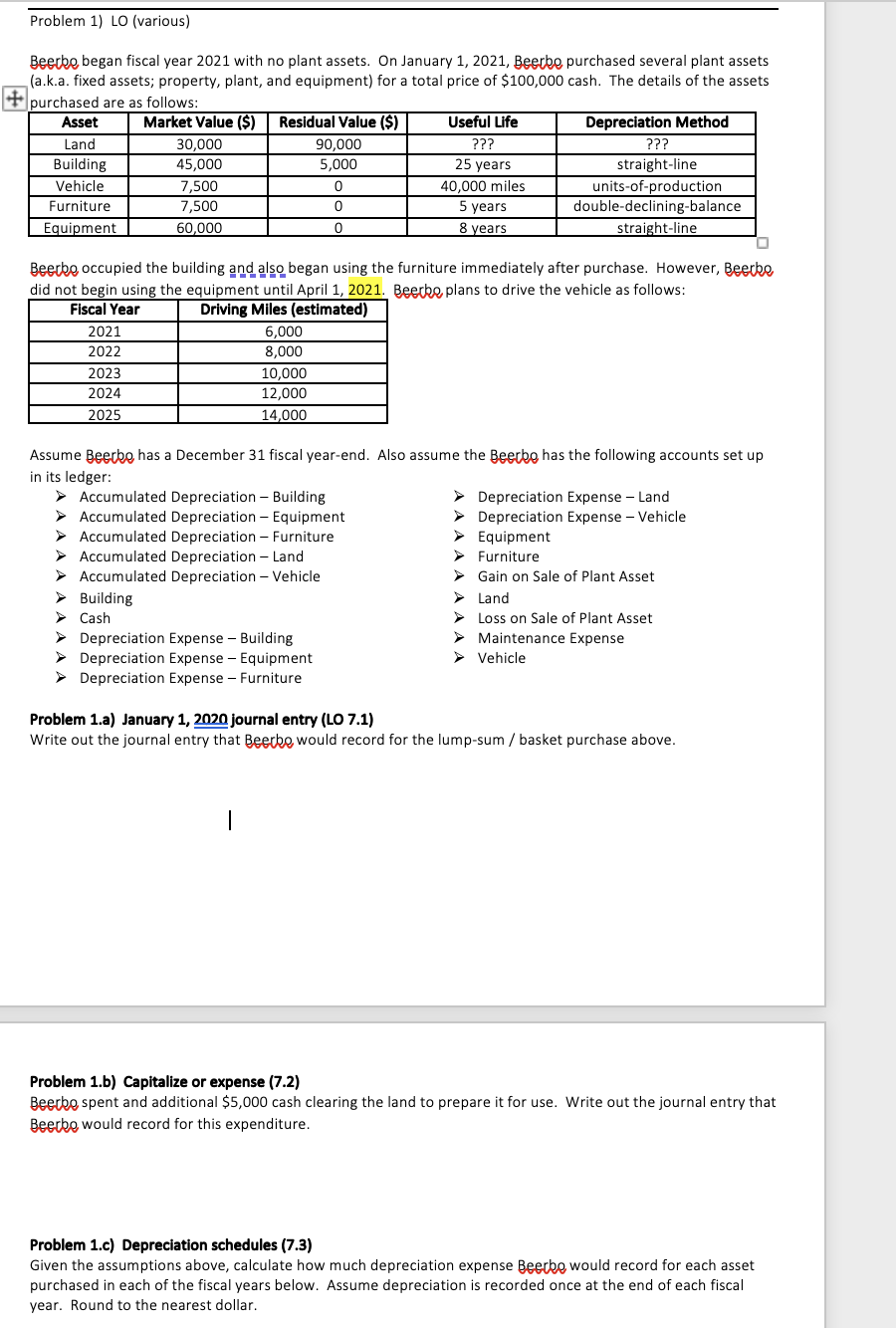

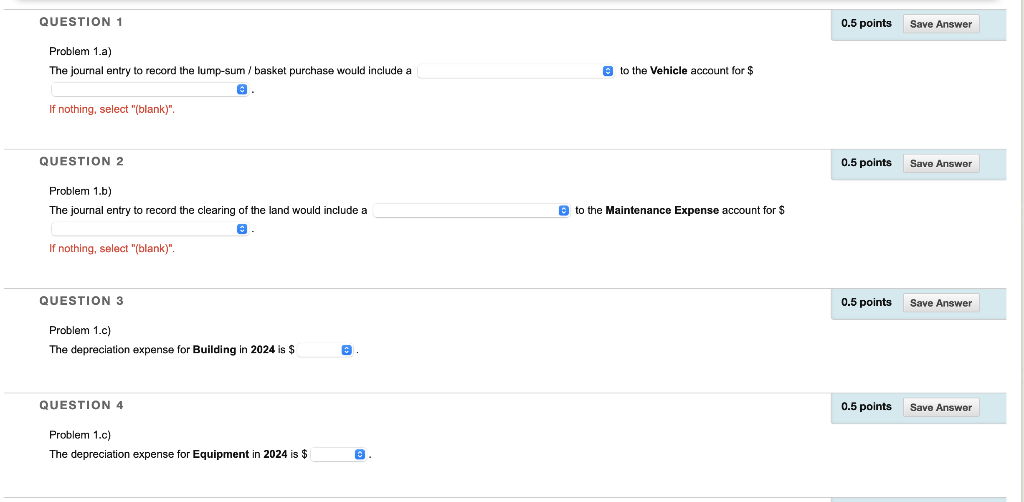

Problem 1) LO (various) Beerbe began fiscal year 2021 with no plant assets. On January 1, 2021, Beerbe purchased several plant assets (a.k.a. fixed assets; property, plant, and equipment) for a total price of $100,000 cash. The details of the assets purchased are as follows: Asset Market Value ($) Residual Value ($) Useful Life Depreciation Method Land 30,000 90,000 ??? Building 45,000 5,000 25 years straight-line Vehicle 7,500 0 40,000 miles units-of-production Furniture 7,500 0 5 years double-declining-balance Equipment 60,000 0 8 years straight-line ??? Beerbo occupied the building and also began using the furniture immediately after purchase. However, Beerbe did not begin using the equipment until April 1, 2021. Beecke plans to drive the vehicle as follows: Fiscal Year Driving Miles (estimated) 2021 6,000 2022 8,000 2023 10,000 2024 12,000 2025 14,000 Assume Beecbe has a December 31 fiscal year-end. Also assume the Beerbo has the following accounts set up in its ledger: > Accumulated Depreciation - Building Depreciation Expense - Land > Accumulated Depreciation - Equipment > Depreciation Expense - Vehicle > Accumulated Depreciation - Furniture Equipment Accumulated Depreciation - Land Furniture Accumulated Depreciation - Vehicle > Gain on Sale of Plant Asset Building Land Cash > Loss on Sale of Plant Asset > Depreciation Expense - Building Maintenance Expense Depreciation Expense - Equipment Vehicle Depreciation Expense - Furniture Problem 1.a) January 1, 2020 journal entry (LO 7.1) Write out the journal entry that Beecbe would record for the lump-sum / basket purchase above. | Problem 1.b) Capitalize or expense (7.2) Beerbe spent and additional $5,000 cash clearing the land to prepare it for use. Write out the journal entry that Beerbo would record for this expenditure. Problem 1.c) Depreciation schedules (7.3) Given the assumptions above, calculate how much depreciation expense Beerbo would record for each asset purchased in each of the fiscal years below. Assume depreciation is recorded once at the end of each fiscal year. Round to the nearest dollar. QUESTION 1 0.5 points Save Answer A to the Vehicle account for $ Problem 1.a) The journal entry to record the lump-sum / basket purchase would include a @ If nothing, select "(blank)" QUESTION 2 0.5 points Save Answer Problem 1.b) The journal entry to record the clearing of the land would include a to the Maintenance Expense account for $ If nothing, select "blank)". QUESTION 3 0.5 points Save Answer Problem 1.c) The depreciation expense for Building in 2024 is $ QUESTION 4 0.5 points Save Answer Problem 1.c) The depreciation expense for Equipment in 2024 is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts