Question: = Help WyLab Homework: HW7 - Chapter 25 Leasing Question 5, P25-9 (similar to) Part 1 of 3 HW Score: 0%, 0 of 100 points

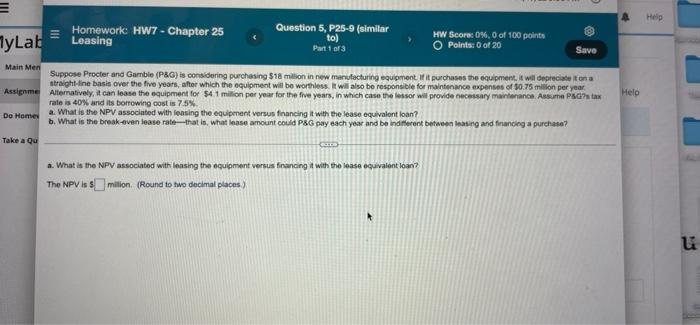

= Help WyLab Homework: HW7 - Chapter 25 Leasing Question 5, P25-9 (similar to) Part 1 of 3 HW Score: 0%, 0 of 100 points O Points: 0 of 20 Save Help Main Men Suppose Procter and Gamble (P&G) is considering purchasing $18 million in new manufacturing equipment. If it purchases the equipment, it wil depreciation straight-line basis over the five years, after which the equipment will be worthless. It will also be responsible for maintenance expenses of $0.75 milion per year Assignme Alternatively, it can lease the equipment for $4.1 million per year for the five years, in which case the lessor will provide necessary maintenance Assume Pad?s tax rate is 40% and its borrowing cost is 7.5% Do Homes a. What is the NPV associated with leasing the equipment versus financing it with the lease equivalent loan? b. What is the break-even boate rate that is what ease amount could P&G pay each year and be indifferent between leasing and financing a purchase? Take a qu GO a. What is the NPV associated with leasing the equipment versus financing it with the lease equivalent loan? The NPV is smilion (Round to two decimal places) u

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts