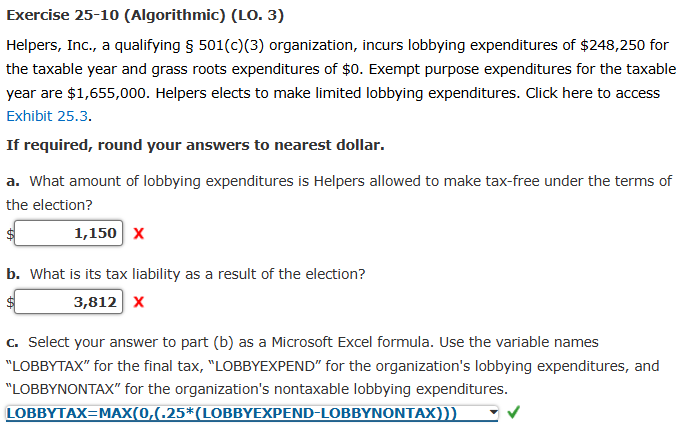

Question: Helpers, Inc., a qualifying 5 0 1 ( c ) ( 3 ) organization, incurs lobbying expenditures of $ 2 4 8 , 2 5

Helpers, Inc., a qualifying c organization, incurs lobbying expenditures of $ for the taxable year and grass roots expenditures of $ Exempt purpose expenditures for the taxable year are $ Helpers elects to make limited lobbying expenditures. Click here to access Exhibit

If required, round your answers to nearest dollar.

aWhat amount of lobbying expenditures is Helpers allowed to make taxfree under the terms of the election?

$

bWhat is its tax liability as a result of the election?

$

Exercise AlgorithmicLO

Helpers, Inc., a qualifying c organization, incurs lobbying expenditures of $ for the taxable year and grass roots expenditures of $ Exempt purpose expenditures for the taxable year are $ Helpers elects to make limited lobbying expenditures. Click here to access Exhibit

If required, round your answers to nearest dollar.

a What amount of lobbying expenditures is Helpers allowed to make taxfree under the terms of the election?

$

b What is its tax liability as a result of the election?

ddagger

c Select your answer to part b as a Microsoft Excel formula. Use the variable names "LOBBYTAX" for the final tax, "LOBBYEXPEND" for the organization's lobbying expenditures, and "LOBBYNONTAX" for the organization's nontaxable lobbying expenditures.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock