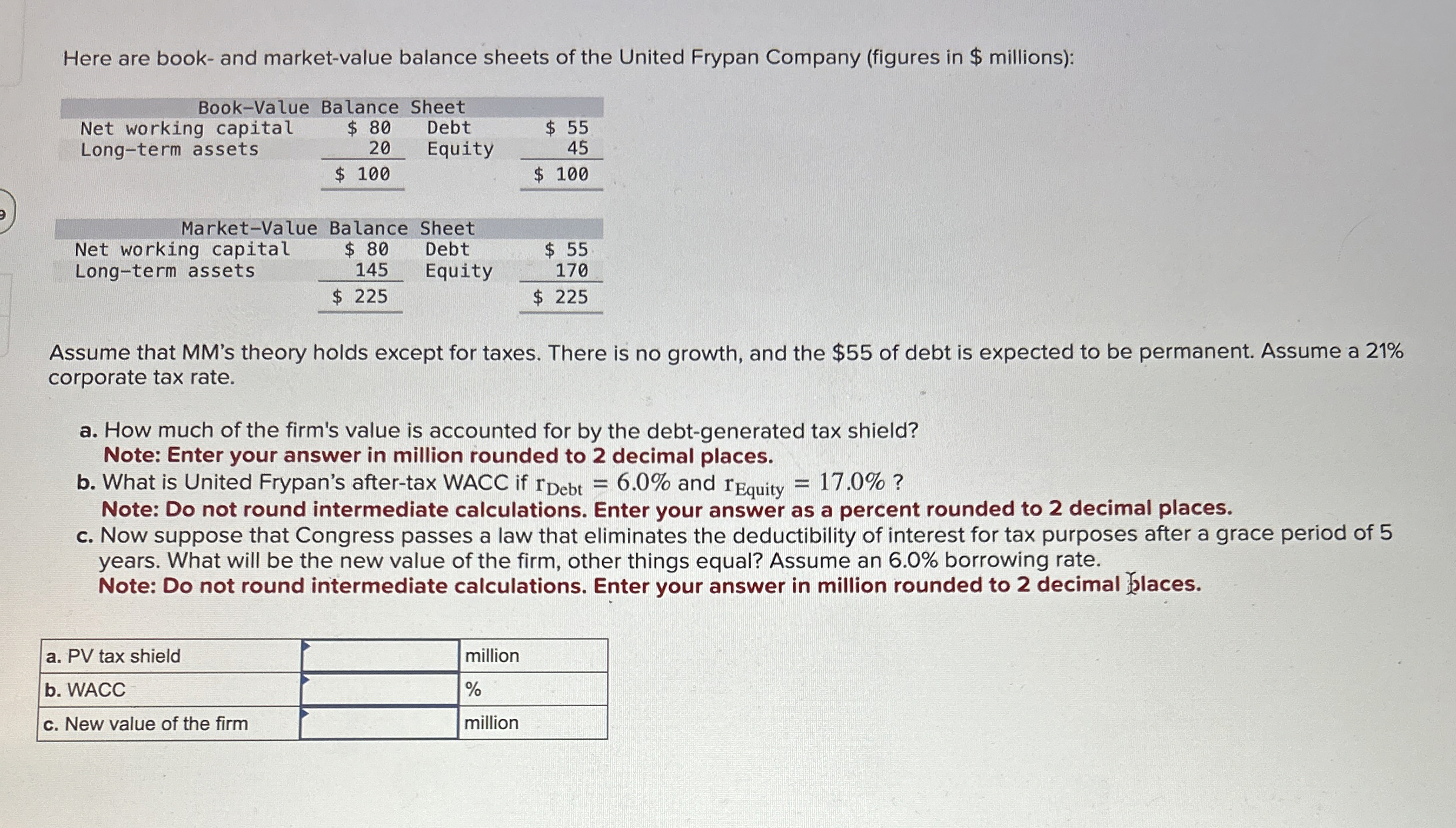

Question: Here are book - and market - value balance sheets of the United Frypan Company ( figures in $ millions ) : table [

Here are book and marketvalue balance sheets of the United Frypan Company figures in $ millions:

tableBookValue,Balance,Sheet,Net working capital,$ Debt,$ Longterm assets,Equity,$ $

tableMarketValue Balance SheetNet working capital,$ Debt,$ Longterm assets,Equity,$ $

Assume that MMs theory holds except for taxes. There is no growth, and the $ of debt is expected to be permanent. Assume a corporate tax rate.

a How much of the firm's value is accounted for by the debtgenerated tax shield?

Note: Enter your answer in million rounded to decimal places.

b What is United Frypan's aftertax WACC if and

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

c Now suppose that Congress passes a law that eliminates the deductibility of interest for tax purposes after a grace period of years. What will be the new value of the firm, other things equal? Assume an borrowing rate.

Note: Do not round intermediate calculations. Enter your answer in million rounded to decimal flaces.

tablea PV tax shield,,millionb WACC,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock