Question: Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley. Assume you are thinking about buying these bonds. Answer

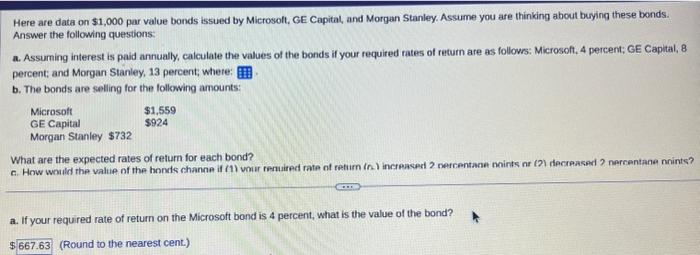

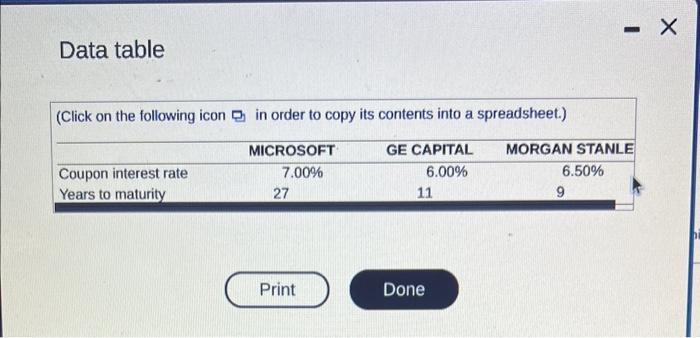

Here are data on \$1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley. Assume you are thinking about buying these bonds. Answer the following questions: a. Assurning interest is paid annually, calculate the values of the bonds if your required rates of return are as followrs: Microsoft. 4 percent; GE Capltal, 8 percent; and Morgan Stanley, 13 percent; where: b. The bonds are selling for the following amounts: What are the expected rates of return for each bond? c. How wnuld the value of the honds channe if (1) vour remuired rate of tetim (n) increased 2 nefcentache noirts nr (2) decreased ? nercentane nnints? a. If your required rate of retum on the Microsoft bond is 4 percent, what is the value of the bond? Data table (Click on the following icon pr in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts