Question: Here are selected basic data for Wilson Company: Estimated manufacturing overhead Estimated labor hours Actual direct labor hours Estimated direct labor cost Actual direct labor

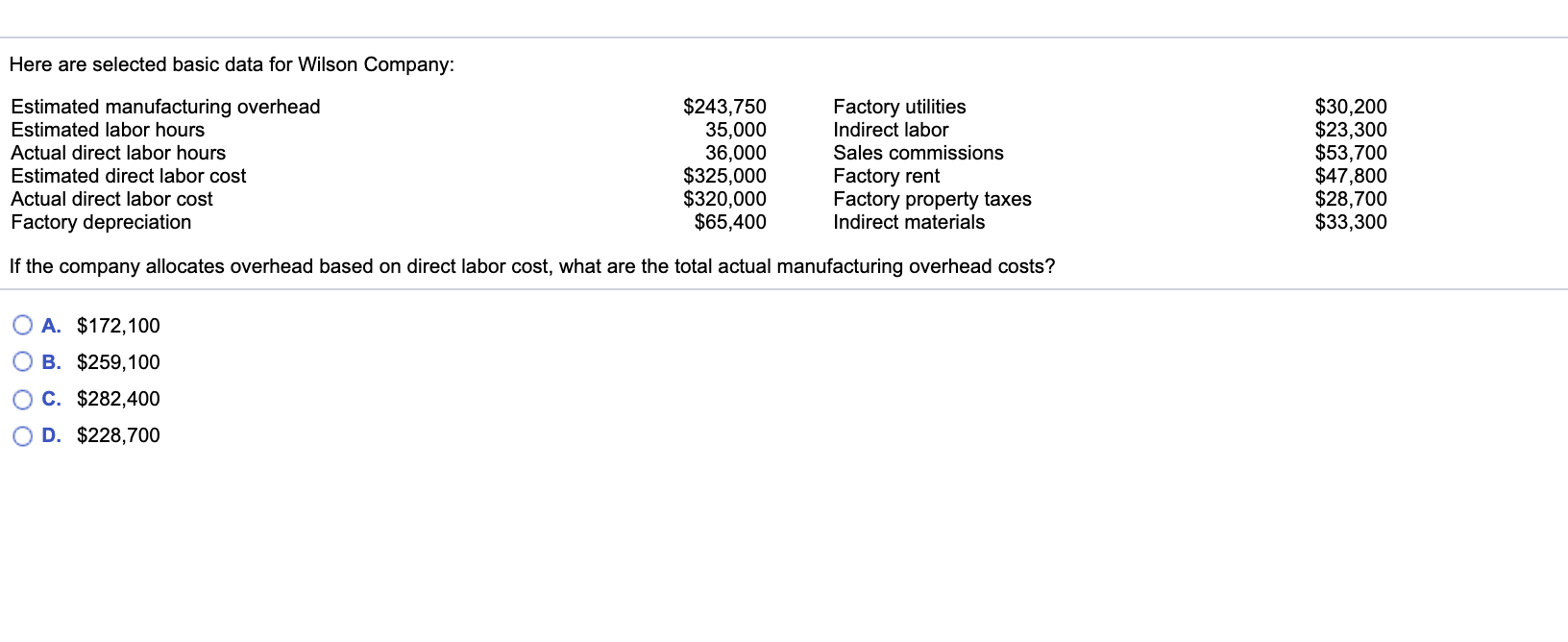

Here are selected basic data for Wilson Company: Estimated manufacturing overhead Estimated labor hours Actual direct labor hours Estimated direct labor cost Actual direct labor cost Factory depreciation $243,750 35,000 36,000 $325,000 $320,000 $65,400 Factory utilities Indirect labor Sales commissions Factory rent Factory property taxes Indirect materials $30,200 $23,300 $53,700 $47,800 $28,700 $33,300 If the company allocates overhead based on direct labor cost, what are the total actual manufacturing overhead costs? O A. $172,100 O B. $259,100 OC. $282,400 OD. $228,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts