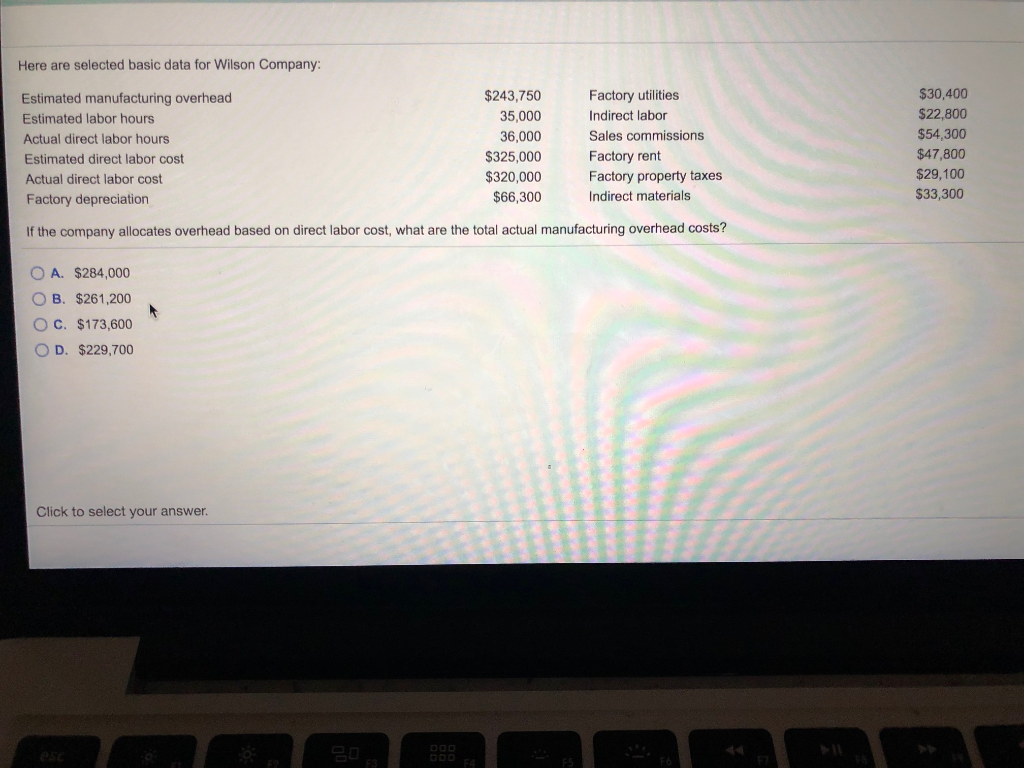

Question: Here are selected basic data for Wilson Company: Estimated manufacturing overhead Estimated labor hours Actual direct labor hours Estimated direct labor cost Actual direct labor

Here are selected basic data for Wilson Company: Estimated manufacturing overhead Estimated labor hours Actual direct labor hours Estimated direct labor cost Actual direct labor cost Factory depreciation $243,750 35,000 36,000 $325,000 $320,000 $66,300 Factory utilities Indirect labor Sales commissions Factory rent Factory property taxes Indirect materials $30,400 $22,800 $54,300 $47,800 $29,100 $33,300 If the company allocates overhead based on direct labor cost, what are the total actual manufacturing overhead costs? O A. $284,000 OB. $261,200 OC. $173,600 OD. $229,700 Click to select your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts