Question: Here are some numbers that may helpful to solve equations. Invoice Price = 220.000 Cost Per Unit = 104 Sales Price Per Unit = 204

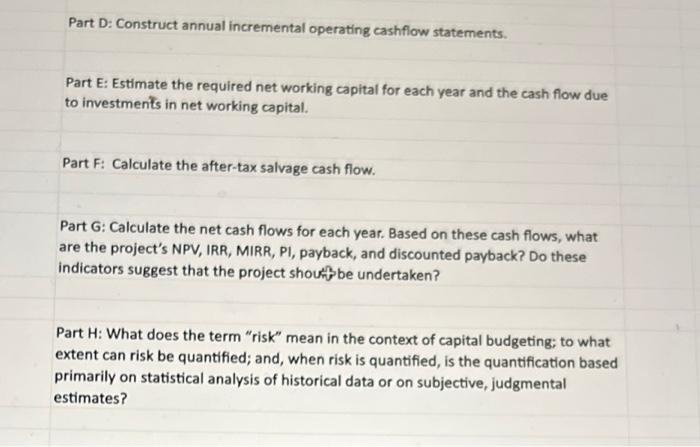

Part D: Construct annual incremental operating cashflow statements. Part E: Estimate the required net working capital for each year and the cash flow due to investmenits in net working capital. Part F: Calculate the after-tax salvage cash flow. Part G: Calculate the net cash flows for each year. Based on these cash flows, what are the project's NPV, IRR, MIRR, PI, payback, and discounted payback? Do these indicators suggest that the project shouif be undertaken? Part H: What does the term "risk" mean in the context of capital budgeting; to what extent can risk be quantified; and, when risk is quantified, is the quantification based primarily on statistical analysis of historical data or on subjective, judgmental estimates? Part D: Construct annual incremental operating cashflow statements. Part E: Estimate the required net working capital for each year and the cash flow due to investmenits in net working capital. Part F: Calculate the after-tax salvage cash flow. Part G: Calculate the net cash flows for each year. Based on these cash flows, what are the project's NPV, IRR, MIRR, PI, payback, and discounted payback? Do these indicators suggest that the project shouif be undertaken? Part H: What does the term "risk" mean in the context of capital budgeting; to what extent can risk be quantified; and, when risk is quantified, is the quantification based primarily on statistical analysis of historical data or on subjective, judgmental estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts