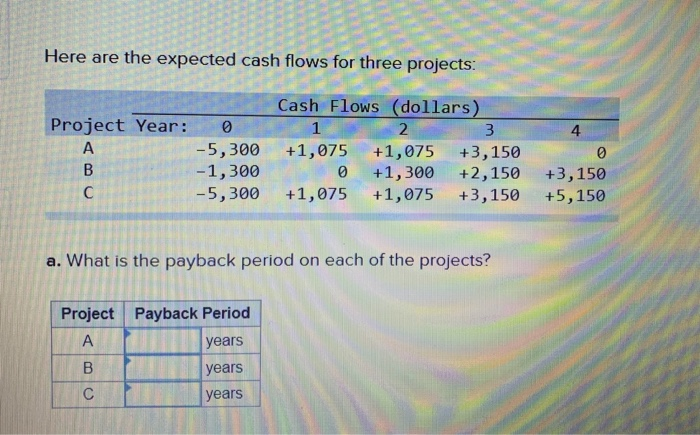

Question: Here are the expected cash flows for three projects: Cash Flows (dollars) Project Year: 1 2 4 -5,300 -1,300 -5,300 +1,075 +1,075 +1,300 +1,075 +3,150

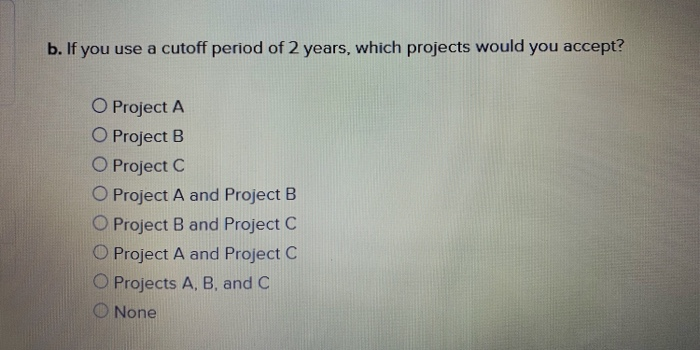

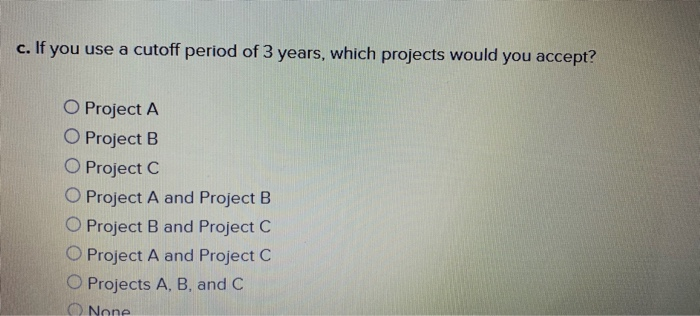

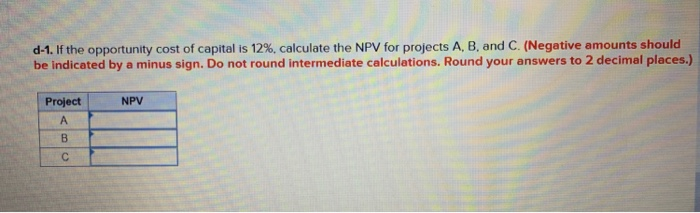

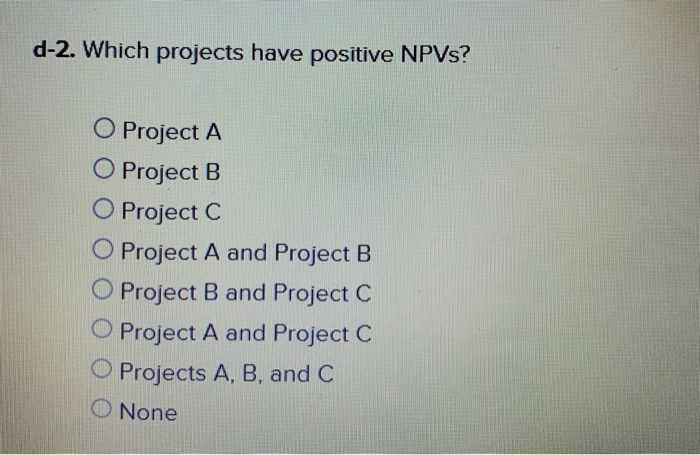

Here are the expected cash flows for three projects: Cash Flows (dollars) Project Year: 1 2 4 -5,300 -1,300 -5,300 +1,075 +1,075 +1,300 +1,075 +3,150 +2,150 +3,150 0 +3,150 +5,150 +1,075 a. What is the payback period on each of the projects? Project Payback Period years A years C years AB C b. If you use a cutoff period of 2 years, which projects would you accept? O Project A O Project B O Project C O Project A and Project B O Project B and Project C O Project A and Project C OProjects A, B, and C None c. If you use a cutoff period of 3 years, which projects would you accept? O Project A O Project B O Project C OProject A and Project B O Project B and Project C OProject A and Project C O Projects A, B, and C ONone d-1. If the opportunity cost of capital is 12 %, calculate the NPV for projects A, B, and C. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) Project NPV A d-2. Which projects have positive NPVS? O Project A O Project B O Project C O Project A and Project B O Project B and Project C O Project A and Project C O Projects A, B, and C None "Payback gives too much weight to cash flows that occur after the cutoff date." True or false? . O True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts