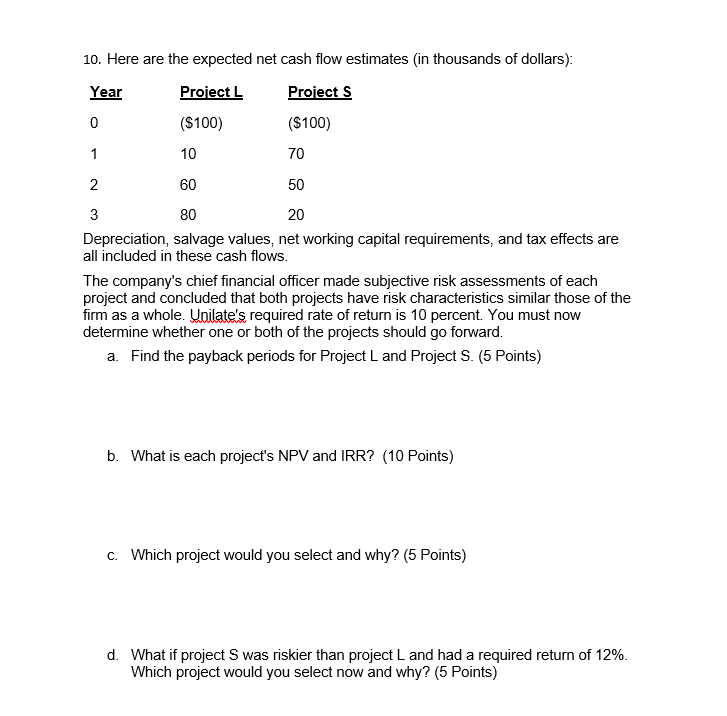

Question: Here are the expected net cash flow estimates ( in thousands of dollars ) : Depreciation, salvage values, net working capital requirements, and tax effects

Here are the expected net cash flow estimates in thousands of dollars:

Depreciation, salvage values, net working capital requirements, and tax effects are

all included in these cash flows.

The company's chief financial officer made subjective risk assessments of each

project and concluded that both projects have risk characteristics similar those of the

firm as a whole. Unilate's required rate of return is percent. You must now

determine whether one or both of the projects should go forward.

a Find the payback periods for Project and Project Points

b What is each project's NPV and IRR? Points

c Which project would you select and why? Points

d What if project was riskier than project and had a required return of

Which project would you select now and why? Points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock