Question: HERE IS A SAMPLE SOLUTION WITH DIFFERENT VALUES, BE VERY CAREFUL MAKE SURE YOU USE THE VALUES FOR THIS QUESTION IN THE ABOVE WORKING, WILL

HERE IS A SAMPLE SOLUTION WITH DIFFERENT VALUES, BE VERY CAREFUL MAKE SURE YOU USE THE VALUES FOR THIS QUESTION IN THE ABOVE WORKING, WILL UPVOTE FOR CORRECT ANSWERS.

HERE IS A SAMPLE SOLUTION WITH DIFFERENT VALUES, BE VERY CAREFUL MAKE SURE YOU USE THE VALUES FOR THIS QUESTION IN THE ABOVE WORKING, WILL UPVOTE FOR CORRECT ANSWERS.

HERE IS A SAMPLE SOLUTION WITH DIFFERENT VALUES, BE VERY CAREFUL MAKE SURE YOU USE THE VALUES FOR THIS QUESTION IN THE ABOVE WORKING, WILL UPVOTE FOR CORRECT ANSWERS.

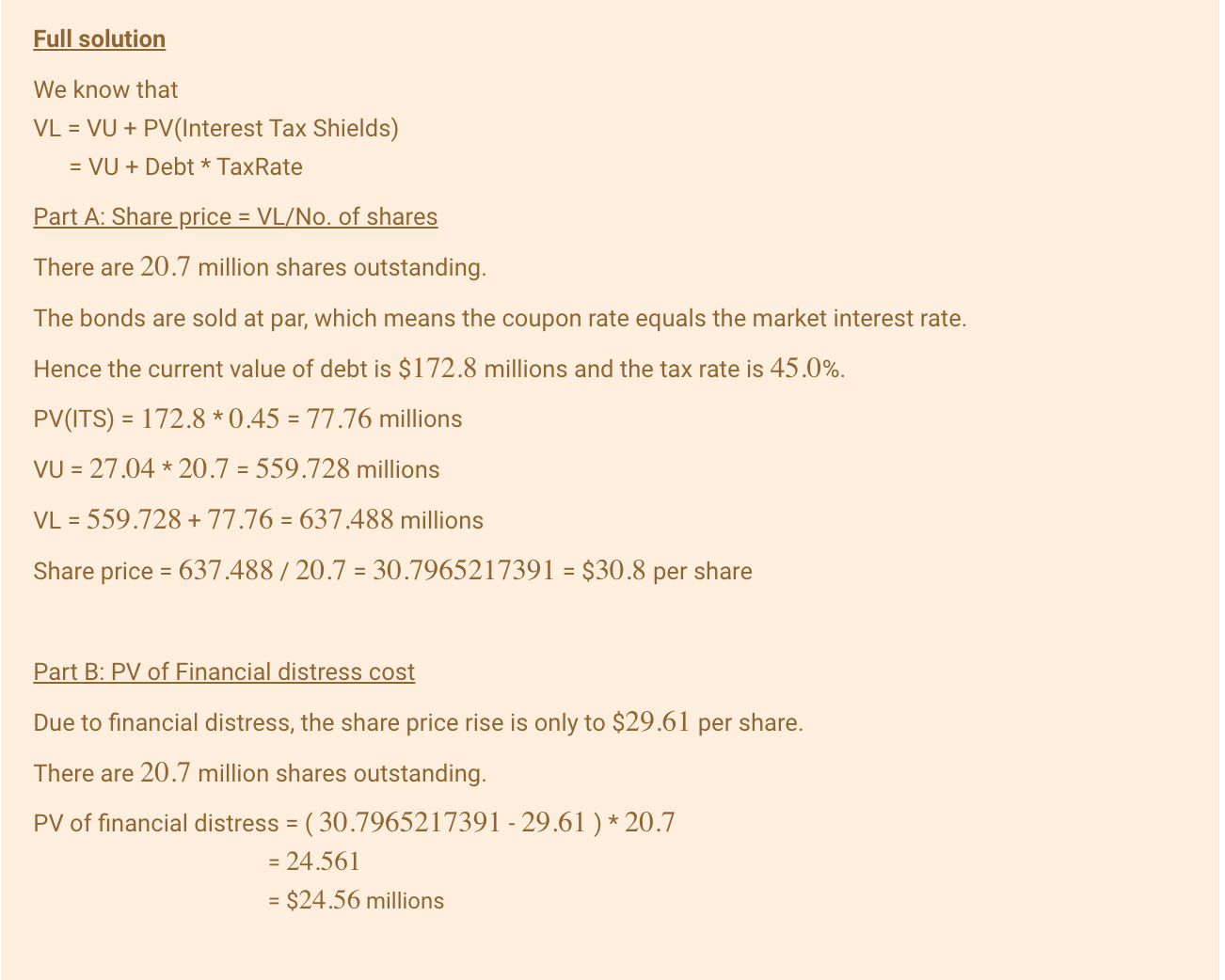

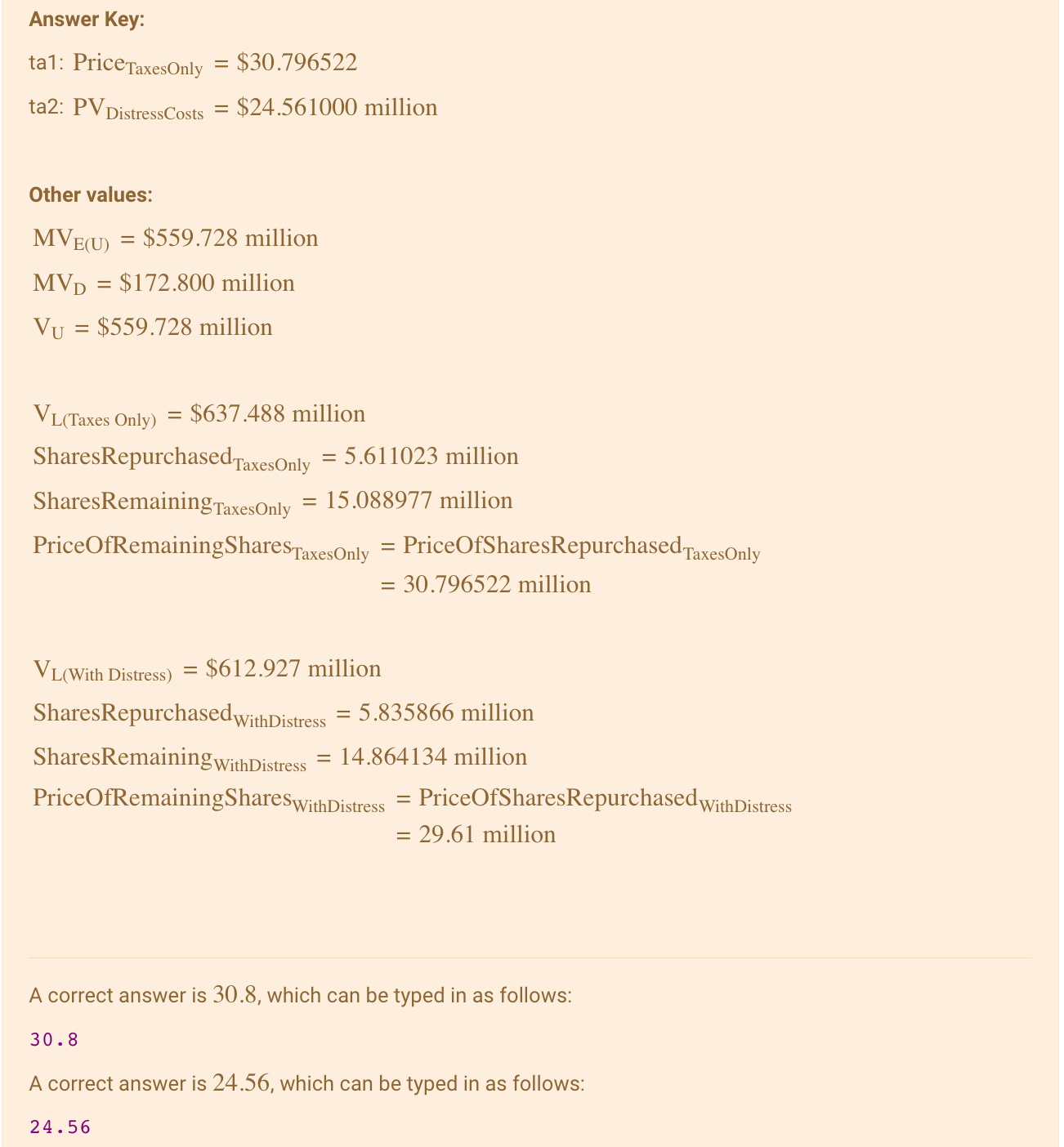

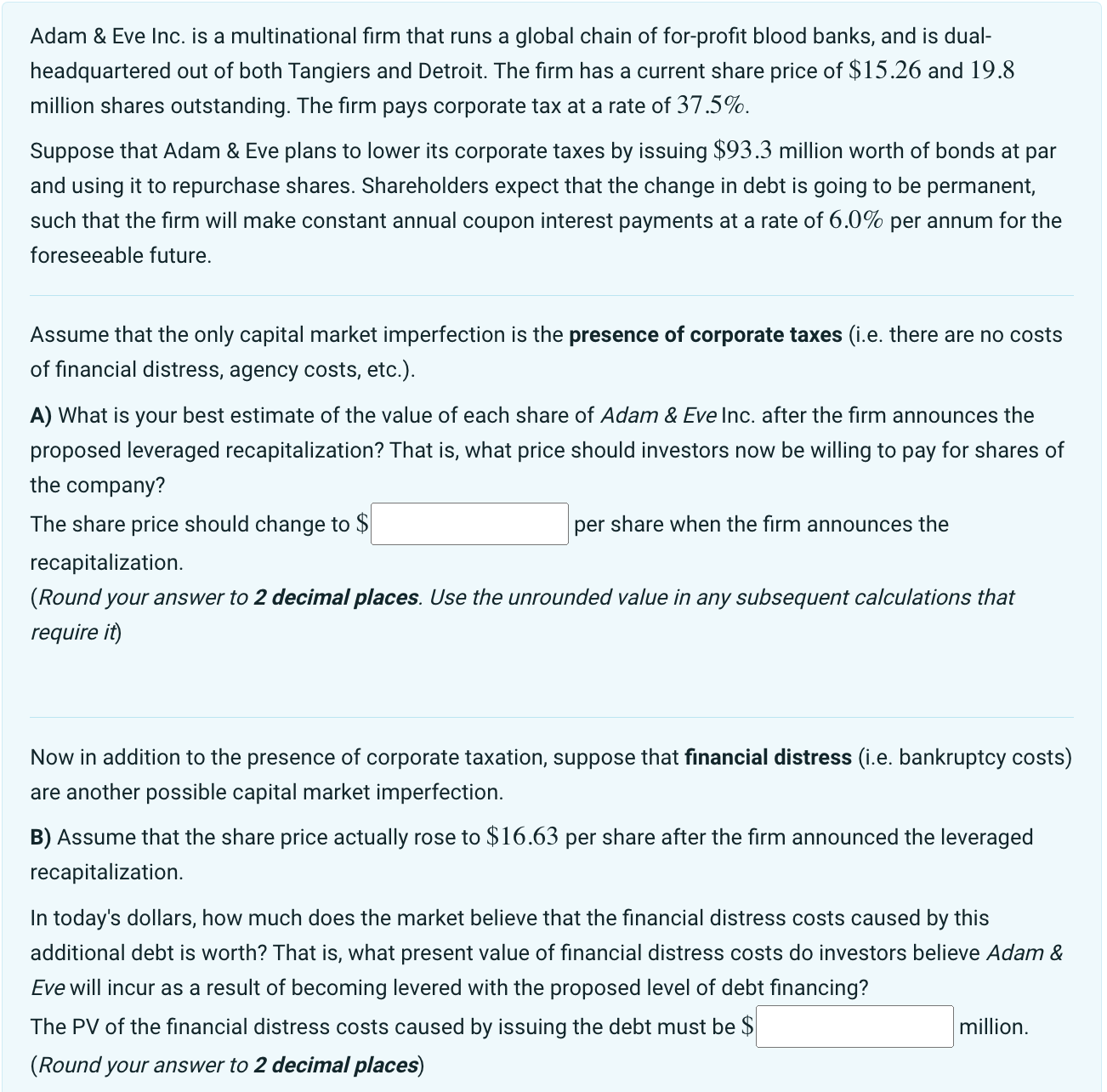

Full solution We know that \\[ \\begin{aligned} \\mathrm{VL} & =\\mathrm{VU}+\\mathrm{PV}(\\text { Interest Tax Shields }) \\\\ & =\\mathrm{VU}+\\text { Debt * TaxRate } \\end{aligned} \\] Part A: Share price \\( =\\mathrm{VL} / \\) No. of shares There are 20.7 million shares outstanding. The bonds are sold at par, which means the coupon rate equals the market interest rate. Hence the current value of debt is \\( \\$ 172.8 \\) millions and the tax rate is \45.0. \\[ \\begin{array}{l} \\mathrm{PV}(\\mathrm{ITS})=172.8 * 0.45=77.76 \\text { millions } \\\\ \\mathrm{VU}=27.04 * 20.7=559.728 \\text { millions } \\\\ \\mathrm{VL}=559.728+77.76=637.488 \\text { millions } \\end{array} \\] Share price \\( =637.488 / 20.7=30.7965217391=\\$ 30.8 \\) per share Part B: PV of Financial distress cost Due to financial distress, the share price rise is only to \\( \\$ 29.61 \\) per share. There are 20.7 million shares outstanding. \\[ \\begin{aligned} \\text { PV of financial distress } & =(30.7965217391-29.61) * 20.7 \\\\ & =24.561 \\\\ & =\\$ 24.56 \\text { millions } \\end{aligned} \\] ta1: Price \\( _{\\text {TaxesOnly }}=\\$ 30.796522 \\) ta2: \\( \\mathrm{PV}_{\\text {DistressCosts }}=\\$ 24.561000 \\) million Other values: \\[ \\begin{array}{l} \\mathrm{MV}_{\\mathrm{E}(\\mathrm{U})}=\\$ 559.728 \\text { million } \\\\ \\mathrm{MV}_{\\mathrm{D}}=\\$ 172.800 \\text { million } \\\\ \\mathrm{V}_{\\mathrm{U}}=\\$ 559.728 \\text { million } \\end{array} \\] \\[ \\mathrm{V}_{\\mathrm{L}(\\text { Taxes Only })}=\\$ 637.488 \\text { million } \\] SharesRepurchased \\( _{\\text {TaxesOnly }}=5.611023 \\) million SharesRemaining \\( _{\\text {TaxesOnly }}=15.088977 \\) million \\[ \\begin{array}{l} \\text { PriceOfRemainingShares }_{\\text {TaxesOnly }}=\\text { PriceOfSharesRepurchased }_{\\text {TaxesOnly }} \\\\ =30.796522 \\text { million } \\\\ \\end{array} \\] \\[ \\mathrm{V}_{\\mathrm{L}(\\text { With Distress })}=\\$ 612.927 \\text { million } \\] SharesRepurchased \\( _{\\text {WithDistress }}=5.835866 \\) million \\( =29.61 \\) million Adam \\& Eve Inc. is a multinational firm that runs a global chain of for-profit blood banks, and is dualheadquartered out of both Tangiers and Detroit. The firm has a current share price of \\( \\$ 15.26 \\) and 19.8 million shares outstanding. The firm pays corporate tax at a rate of \37.5. Suppose that Adam \\& Eve plans to lower its corporate taxes by issuing \\( \\$ 93.3 \\) million worth of bonds at par and using it to repurchase shares. Shareholders expect that the change in debt is going to be permanent, such that the firm will make constant annual coupon interest payments at a rate of \6.0 per annum for the foreseeable future. Assume that the only capital market imperfection is the presence of corporate taxes (i.e. there are no costs of financial distress, agency costs, etc.). A) What is your best estimate of the value of each share of Adam \\& Eve Inc. after the firm announces the proposed leveraged recapitalization? That is, what price should investors now be willing to pay for shares of the company? The share price should change to \\( \\$ \\) per share when the firm announces the recapitalization. (Round your answer to 2 decimal places. Use the unrounded value in any subsequent calculations that require it) Now in addition to the presence of corporate taxation, suppose that financial distress (i.e. bankruptcy costs) are another possible capital market imperfection. B) Assume that the share price actually rose to \\( \\$ 16.63 \\) per share after the firm announced the leveraged recapitalization. In today's dollars, how much does the market believe that the financial distress costs caused by this additional debt is worth? That is, what present value of financial distress costs do investors believe Adam \\& Eve will incur as a result of becoming levered with the proposed level of debt financing? The PV of the financial distress costs caused by issuing the debt must be \\( \\$ \\) million. (Round your answer to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts