Question: HERE IS A SAMPLE SOLUTION WITH DIFFERENT VALUES, BE VERY CAREFUL MAKE SURE YOU USE THE VALUES FOR THIS QUESTION IN THE BELOW WORKING, WILL

HERE IS A SAMPLE SOLUTION WITH DIFFERENT VALUES, BE VERY CAREFUL MAKE SURE YOU USE THE VALUES FOR THIS QUESTION IN THE BELOW WORKING, WILL UPVOTE FOR CORRECT ANSWERS.

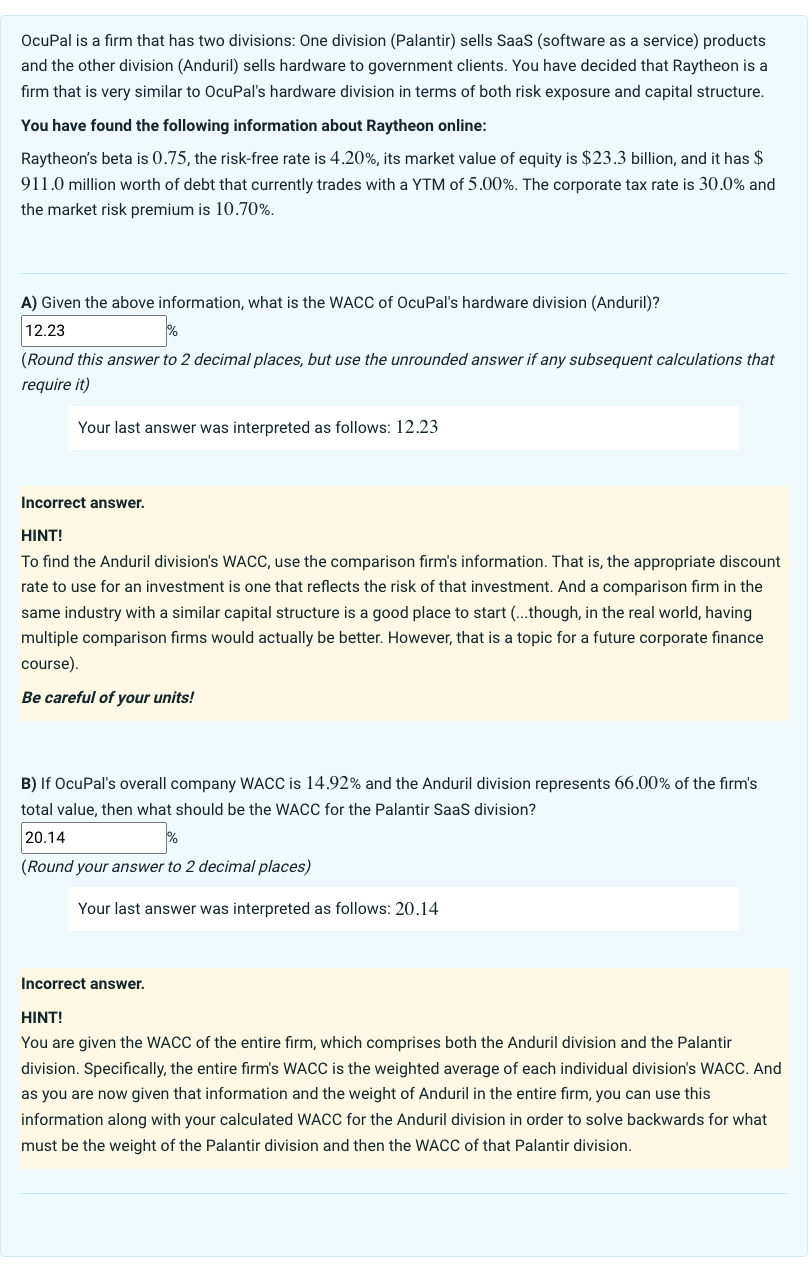

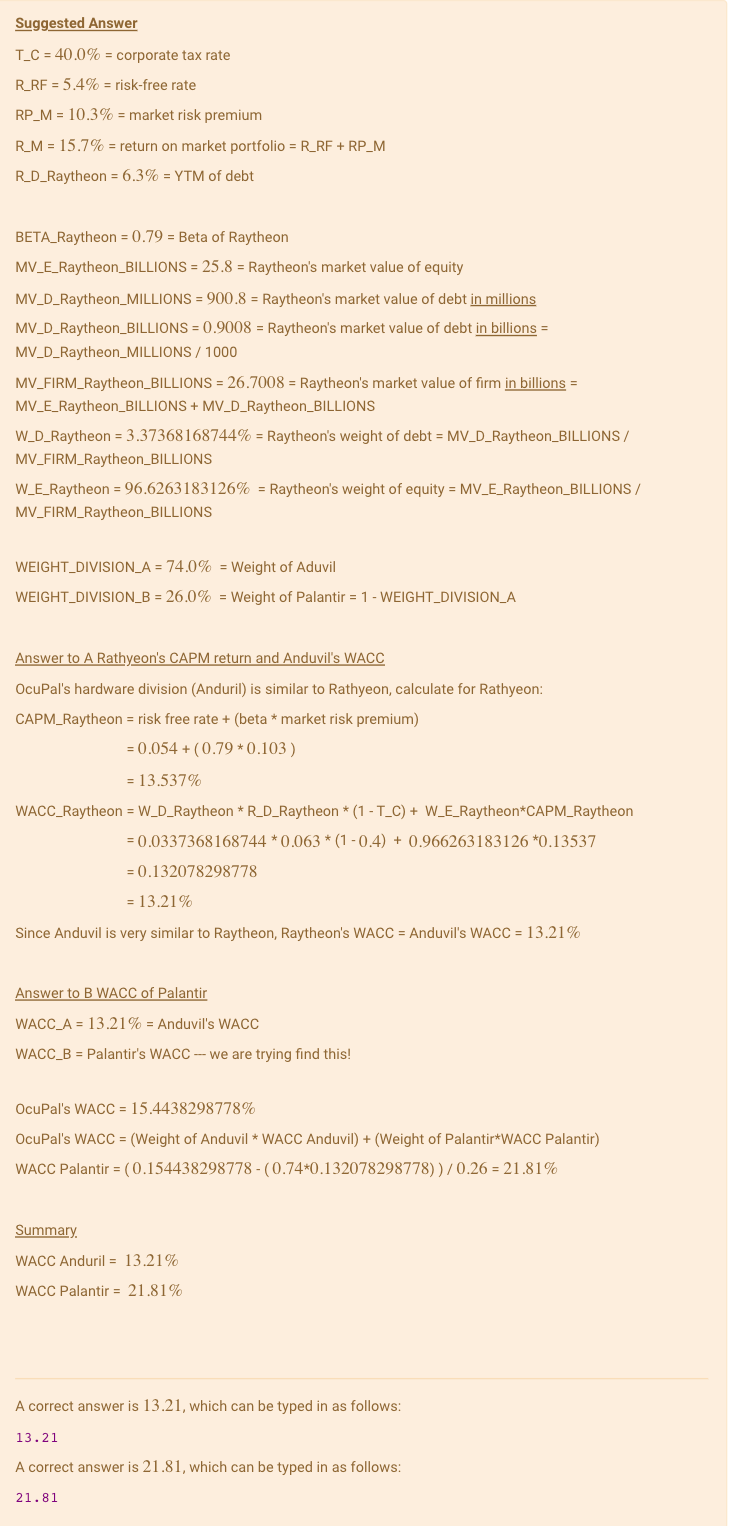

OcuPal is a firm that has two divisions: One division (Palantir) sells SaaS (software as a service) products and the other division (Anduril) sells hardware to government clients. You have decided that Raytheon is a firm that is very similar to OcuPal's hardware division in terms of both risk exposure and capital structure. You have found the following information about Raytheon online: Raytheon's beta is 0.75 , the risk-free rate is \4.20, its market value of equity is \\( \\$ 23.3 \\) billion, and it has \\( \\$ \\) 911.0 million worth of debt that currently trades with a YTM of \5.00. The corporate tax rate is \30.0 and the market risk premium is \10.70. A) Given the above information, what is the WACC of OcuPal's hardware division (Anduril)? \ (Round this answer to 2 decimal places, but use the unrounded answer if any subsequent calculations that require it) Incorrect answer. HINT! To find the Anduril division's WACC, use the comparison firm's information. That is, the appropriate discount rate to use for an investment is one that reflects the risk of that investment. And a comparison firm in the same industry with a similar capital structure is a good place to start (...though, in the real world, having multiple comparison firms would actually be better. However, that is a topic for a future corporate finance course). Be careful of your units! B) If OcuPal's overall company WACC is \14.92 and the Anduril division represents \66.00 of the firm's total value, then what should be the WACC for the Palantir SaaS division? \ (Round your answer to 2 decimal places) Your last answer was interpreted as follows: 20.14 Incorrect answer. HINT! You are given the WACC of the entire firm, which comprises both the Anduril division and the Palantir division. Specifically, the entire firm's WACC is the weighted average of each individual division's WACC. And as you are now given that information and the weight of Anduril in the entire firm, you can use this information along with your calculated WACC for the Anduril division in order to solve backwards for what must be the weight of the Palantir division and then the WACC of that Palantir division. Suggested Answer T_C \=40.0 corporate tax rate \\( \\mathrm{R} \\_\\mathrm{RF}=5.4 \\%= \\) risk-free rate RP_M \=10.3 market risk premium \RM=15.7 = return on market portfolio \\( =R \\_R F+R P \\_M \\) R_D_Raytheon \=6.3 YTM of debt BETA_Raytheon \\( =0.79= \\) Beta of Raytheon MV_E_Raytheon_BILLIONS = 25.8 = Raytheon's market value of equity MV_D_Raytheon_MILLIONS \\( =900.8= \\) Raytheon's market value of debt in millions MV_D_Raytheon_BILLIONS \\( =0.9008= \\) Raytheon's market value of debt \\( \\underline{\\text { in billions }}= \\) MV_D_Raytheon_MILLIONS / 1000 MV_FIRM_Raytheon_BILLIONS \\( =26.7008 \\) = Raytheon's market value of firm in billions \\( = \\) MV_E_Raytheon_BILLIONS + MV_D_Raytheon_BILLIONS W_D_Raytheon \=3.37368168744 = Raytheon's weight of debt = MV_D_Raytheon_BILLIONS \\( / \\) MV_FIRM_Raytheon_BILLIONS W_E_Raytheon \=96.6263183126 = Raytheon's weight of equity = MV_E_Raytheon_BILLIONS \\( / \\) MV_FIRM_Raytheon_BILLIONS WEIGHT_DIVISION_A \=74.0 Weight of Aduvil WEIGHT_DIVISION_B \=26.0 Weight of Palantir \\( =1- \\) WEIGHT_DIVISION_A Answer to A Rathyeon's CAPM return and Anduvil's WACC OcuPal's hardware division (Anduril) is similar to Rathyeon, calculate for Rathyeon: CAPM_Raytheon \\( = \\) risk free rate \\( +( \\) beta * market risk premium \\( ) \\) \beginarrayl=0.054+(0.790.103)=13.537 WACC_Raytheon = W_D_Raytheon * R_D_Raytheon * \\( (1 \\) - T_C \\( )+ \\) W_E_Raytheon*CAPM_Raytheon \beginarrayl=0.03373681687440.063(10.4)+0.9662631831260.13537=0.132078298778=13.21 Since Anduvil is very similar to Raytheon, Raytheon's WACC \\( = \\) Anduvil's WACC \=13.21 Answer to B WACC of Palantir WACC_A \=13.21 Anduvil's WACC WACC_B = Palantir's WACC - we are trying find this! OcuPal's WACC \=15.4438298778 OcuPal's WACC \\( =( \\) Weight of Anduvil * WACC Anduvil \\( )+( \\) Weight of Palantir*WACC Palantir \\( ) \\) WACC Palantir \=(0.154438298778(0.740.132078298778))/0.26=21.81 Summary. WACC Anduril \=13.21 WACC Palantir \=21.81 A correct answer is 13.21 , which can be typed in as follows: 13.21 A correct answer is 21.81 , which can be typed in as follows: 21.81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts