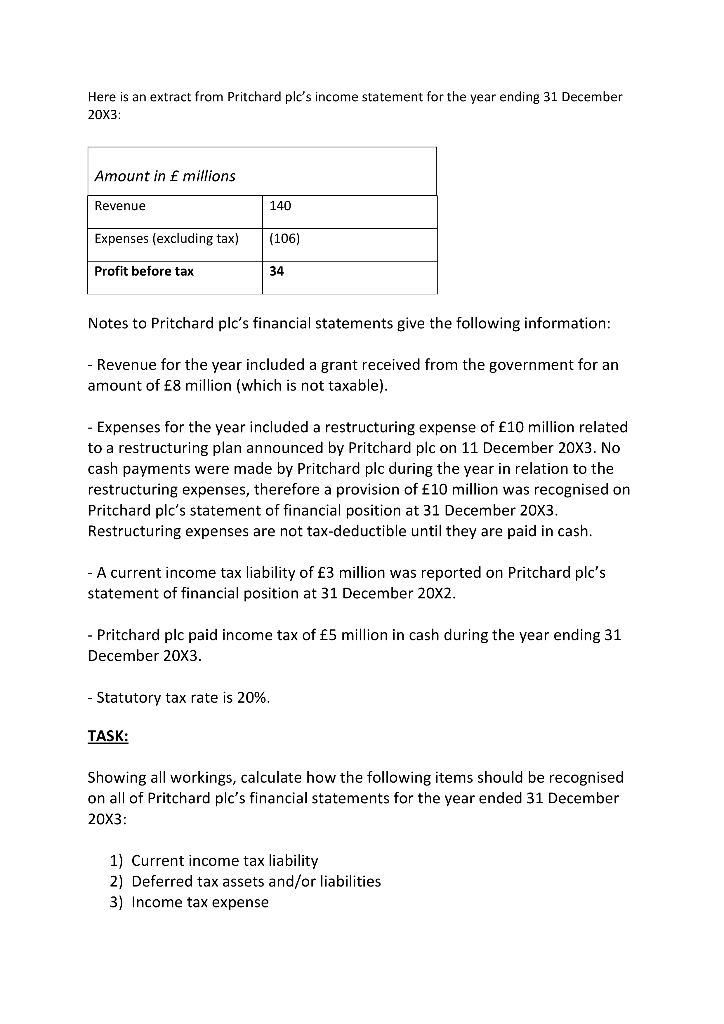

Question: Here is an extract from Pritchard ple's income statement for the year ending 31 December 20X3: Amount in millions Revenue 140 Expenses (excluding tax) (106)

Here is an extract from Pritchard ple's income statement for the year ending 31 December 20X3: Amount in millions Revenue 140 Expenses (excluding tax) (106) Profit before tax Notes to Pritchard ple's financial statements give the following information: - Revenue for the year included a grant received from the government for an amount of 8 million (which is not taxable). - Expenses for the year included a restructuring expense of 10 million related to a restructuring plan announced by Pritchard plc on 11 December 20X3. No cash payments were made by Pritchard plc during the year in relation to the restructuring expenses, therefore a provision of 10 million was recognised on Pritchard plc's statement of financial position at 31 December 20X3. Restructuring expenses are not tax-deductible until they are paid in cash. - A current income tax liability of 3 million was reported on Pritchard plc's statement of financial position at 31 December 20X2. - Pritchard plc paid income tax of 5 million in cash during the year ending 31 December 20X3. - Statutory tax rate is 20%. TASK: Showing all workings, calculate how the following items should be recognised on all of Pritchard plc's financial statements for the year ended 31 December 20x3: 1) Current income tax liability 2) Deferred tax assets and/or liabilities 3) Income tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts