Question: Here is Question 1 with a better image quality : Question 1 10 Points Consider the following mutually exclusive projects: ... Cash flows C2 Co

Here is Question 1 with a better image quality :

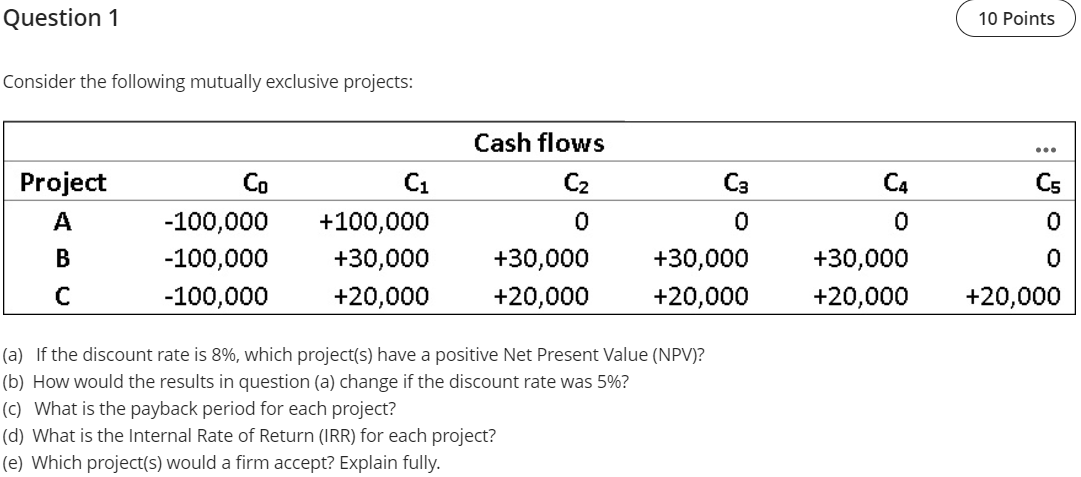

Question 1 10 Points Consider the following mutually exclusive projects: ... Cash flows C2 Co Ca C4 C5 Project 0 0 0 0 C1 +100,000 +30,000 +20,000 -100,000 -100,000 -100,000 B 0 +30,000 +20,000 +30,000 +20,000 +30,000 +20,000 C +20,000 (a) If the discount rate is 8%, which project(s) have a positive Net Present Value (NPV)? (b) How would the results in question (a) change if the discount rate was 5%? (C) What is the payback period for each project? (d) What is the Internal Rate of Return (IRR) for each project? (e) Which project(s) would a firm accept? Explain fully

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts