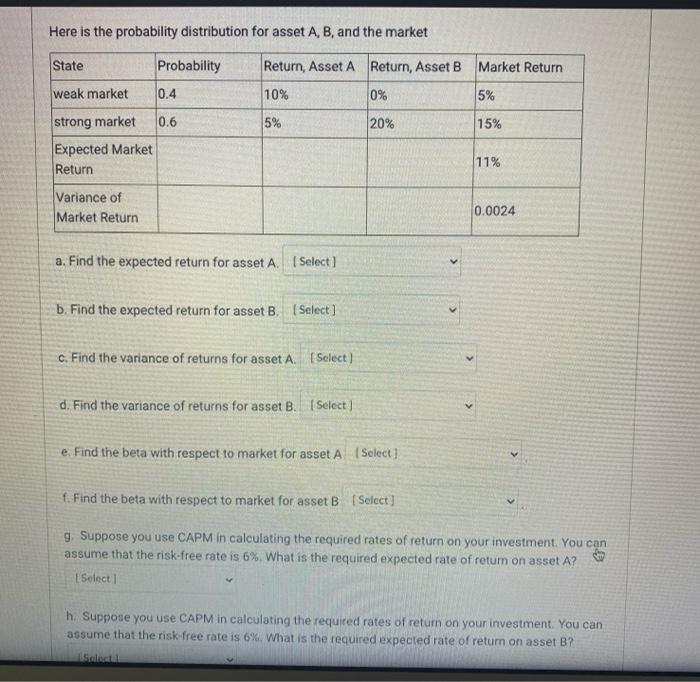

Question: Here is the probability distribution for asset A, B, and the market State Probability Return, Asset A Return, Asset B Market Return weak market 0.4

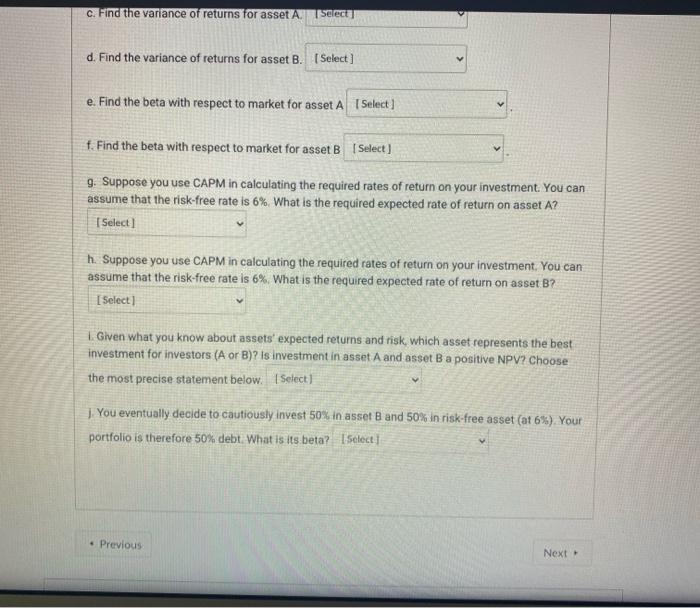

Here is the probability distribution for asset A, B, and the market State Probability Return, Asset A Return, Asset B Market Return weak market 0.4 10% 0% 5% 0.6 5% 20% 15% strong market Expected Market Return 11% Variance of Market Return 0.0024 a. Find the expected return for asset A. (Select) b. Find the expected return for asset B. (Select] c. Find the variance of returns for asset A. [Select] d. Find the variance of returns for asset B. [Select] e. Find the beta with respect to market for asset A Select] f. Find the beta with respect to market for asset B Select] g. Suppose you use CAPM in calculating the required rates of return on your investment. You can assume that the risk-free rate is 6%. What is the required expected rate of retum on asset A? Select h. Suppose you use CAPM in calculating the required rates of return on your investment. You can assume that the risk-free rate is 6%. What is the required expected rate of retum on asset B? Saat c. Find the variance of returns for asset A. Select d. Find the variance of returns for asset B. (Select] e. Find the beta with respect to market for asset A Select f. Find the beta with respect to market for asset B Select) 9. Suppose you use CAPM in calculating the required rates of return on your investment. You can assume that the risk-free rate is 6%. What is the required expected rate of return on asset A? Select) h. Suppose you use CAPM in calculating the required rates of return on your investment. You can assume that the risk-free rate is 6% What is the required expected rate of return on asset B? Select) 1. Given what you know about assets' expected returns and risk, which asset represents the best investment for investors (A or B)? Is Investment in asset A and asset B a positive NPV? Choose the most precise statement below. Select) You eventually decide to cautiously invest 50% in asset 8 and 50% in risk-free asset (at 6%). Your portfolio is therefore 50% debt. What is its beta? 1Select Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts