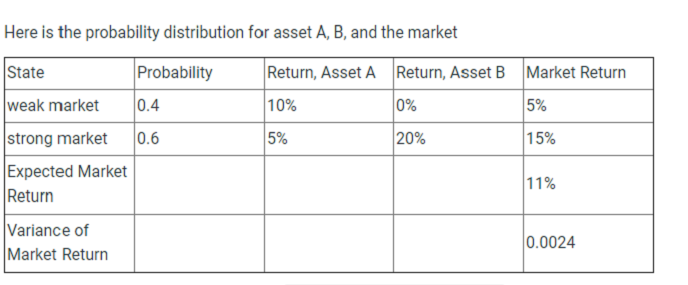

Question: Here is the probability distribution for asset A, B, and the market Return, Asset A Return, Asset B Market Return 10% 0% 5% State Probability

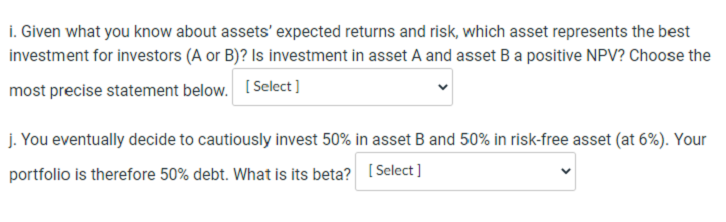

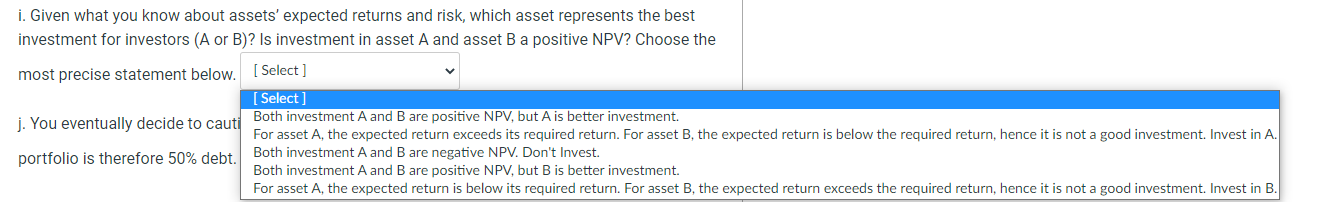

Here is the probability distribution for asset A, B, and the market Return, Asset A Return, Asset B Market Return 10% 0% 5% State Probability weak market 0.4 strong market 0.6 Expected Market Return 5% 20% 15% 11% Variance of Market Return 0.0024 . Given what you know about assets' expected returns and risk, which asset represents the best investment for investors (A or B)? Is investment in asset A and asset B a positive NPV? Choose the most precise statement below. [Select] j. You eventually decide to cautiously invest 50% in asset B and 50% in risk-free asset (at 6%). Your portfolio is therefore 50% debt. What is its beta? [Select] i. Given what you know about assets' expected returns and risk, which asset represents the best investment for investors (A or B)? Is investment in asset A and asset B a positive NPV? Choose the most precise statement below. [Select ] [ Select] j. You eventually decide to cauti Both investment A and B are positive NPV, but A is better investment. For asset A, the expected return exceeds its required return. For asset B, the expected return is below the required return, hence it is not a good investment. Invest in A. portfolio is therefore 50% debt. Both investment A and B are negative NPV. Don't Invest. Both investment A and B are positive NPV, but B is better investment. For asset A, the expected return is below its required return. For asset B, the expected return exceeds the required return, hence it is not a good investment. Invest in B. j. You eventually decide to cautiously invest 50% in asset B and 50% in risk-free asset (at 6%). Your portfolio is therefore 50% debt. What is its beta? (Select] [Select] 1 2 0 0.5 -1 Here is the probability distribution for asset A, B, and the market Return, Asset A Return, Asset B Market Return 10% 0% 5% State Probability weak market 0.4 strong market 0.6 Expected Market Return 5% 20% 15% 11% Variance of Market Return 0.0024 . Given what you know about assets' expected returns and risk, which asset represents the best investment for investors (A or B)? Is investment in asset A and asset B a positive NPV? Choose the most precise statement below. [Select] j. You eventually decide to cautiously invest 50% in asset B and 50% in risk-free asset (at 6%). Your portfolio is therefore 50% debt. What is its beta? [Select] i. Given what you know about assets' expected returns and risk, which asset represents the best investment for investors (A or B)? Is investment in asset A and asset B a positive NPV? Choose the most precise statement below. [Select ] [ Select] j. You eventually decide to cauti Both investment A and B are positive NPV, but A is better investment. For asset A, the expected return exceeds its required return. For asset B, the expected return is below the required return, hence it is not a good investment. Invest in A. portfolio is therefore 50% debt. Both investment A and B are negative NPV. Don't Invest. Both investment A and B are positive NPV, but B is better investment. For asset A, the expected return is below its required return. For asset B, the expected return exceeds the required return, hence it is not a good investment. Invest in B. j. You eventually decide to cautiously invest 50% in asset B and 50% in risk-free asset (at 6%). Your portfolio is therefore 50% debt. What is its beta? (Select] [Select] 1 2 0 0.5 -1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts