Question: Here is the problem!!! Write out the full decision tree that includes both the insurance and reinforcement decisions. Resolve the tree to determine the optimal

Here is the problem!!! Write out the full decision tree that includes both the insurance and reinforcement decisions. Resolve the tree to determine the optimal decisions and calculate the expected value for each alternative. Use expected value as your decision criteria, and the only outcomes of concern are the costs provided in the example. Note that this means that utility(x) = x.

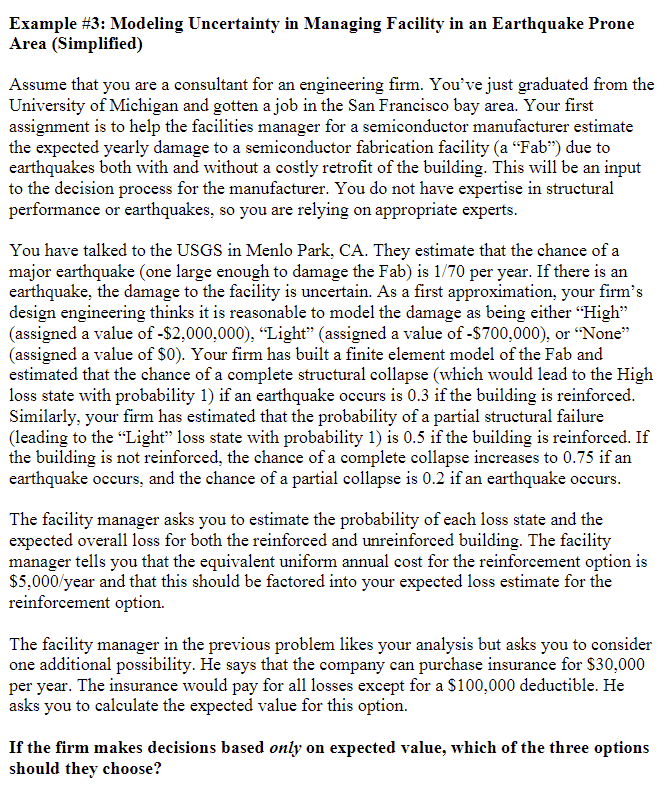

Example \#3: Modeling Uncertainty in Managing Facility in an Earthquake Prone Area (Simplified) Assume that you are a consultant for an engineering firm. You've just graduated from the University of Michigan and gotten a job in the San Francisco bay area. Your first assignment is to help the facilities manager for a semiconductor manufacturer estimate the expected yearly damage to a semiconductor fabrication facility (a "Fab") due to earthquakes both with and without a costly retrofit of the building. This will be an input to the decision process for the manufacturer. You do not have expertise in structural performance or earthquakes, so you are relying on appropriate experts. You have talked to the USGS in Menlo Park, CA. They estimate that the chance of a major earthquake (one large enough to damage the Fab ) is 1/70 per year. If there is an earthquake, the damage to the facility is uncertain. As a first approximation, your firm's design engineering thinks it is reasonable to model the damage as being either "High" (assigned a value of $2,000,000 ), "Light" (assigned a value of $700,000 ), or "None" (assigned a value of \$0). Your firm has built a finite element model of the Fab and estimated that the chance of a complete structural collapse (which would lead to the High loss state with probability 1) if an earthquake occurs is 0.3 if the building is reinforced. Similarly, your firm has estimated that the probability of a partial structural failure (leading to the "Light" loss state with probability 1 ) is 0.5 if the building is reinforced. If the building is not reinforced, the chance of a complete collapse increases to 0.75 if an earthquake occurs, and the chance of a partial collapse is 0.2 if an earthquake occurs. The facility manager asks you to estimate the probability of each loss state and the expected overall loss for both the reinforced and unreinforced building. The facility manager tells you that the equivalent uniform annual cost for the reinforcement option is $5,000 /year and that this should be factored into your expected loss estimate for the reinforcement option. The facility manager in the previous problem likes your analysis but asks you to consider one additional possibility. He says that the company can purchase insurance for $30,000 per year. The insurance would pay for all losses except for a $100,000 deductible. He asks you to calculate the expected value for this option. If the firm makes decisions based only on expected value, which of the three options should they choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts