Question: here is the question along with the requirements (Cick the kon to vere the projectid net cach infons). (Click the icoe to vioe the peosent

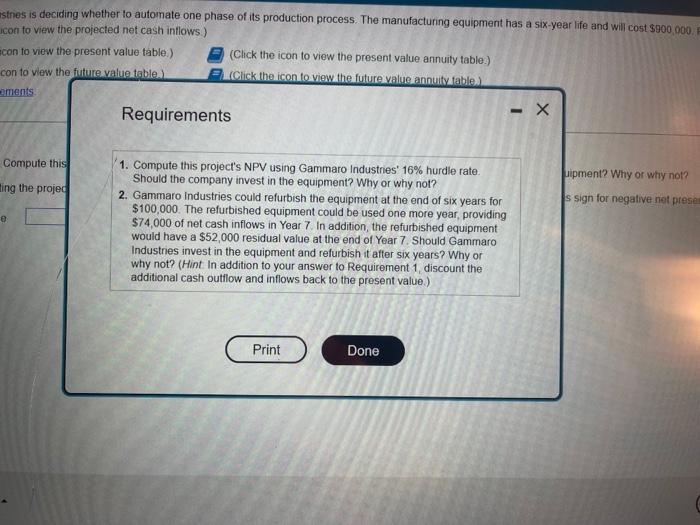

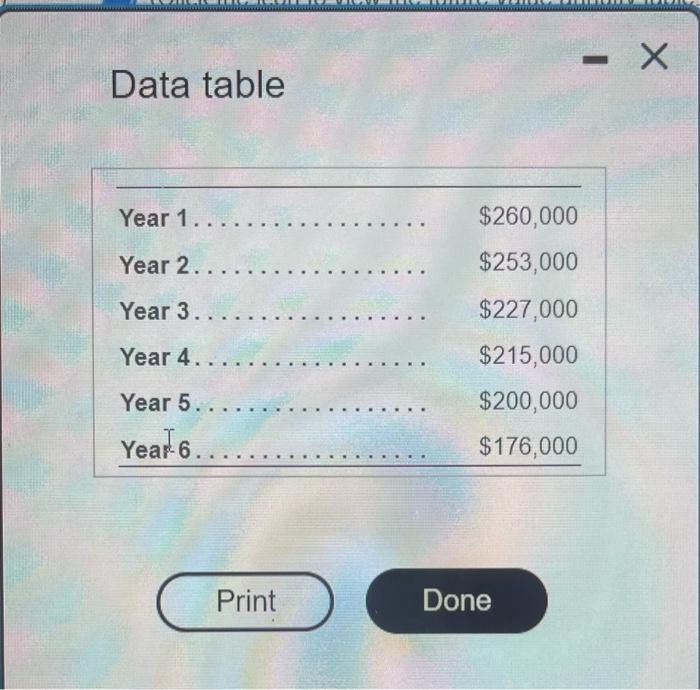

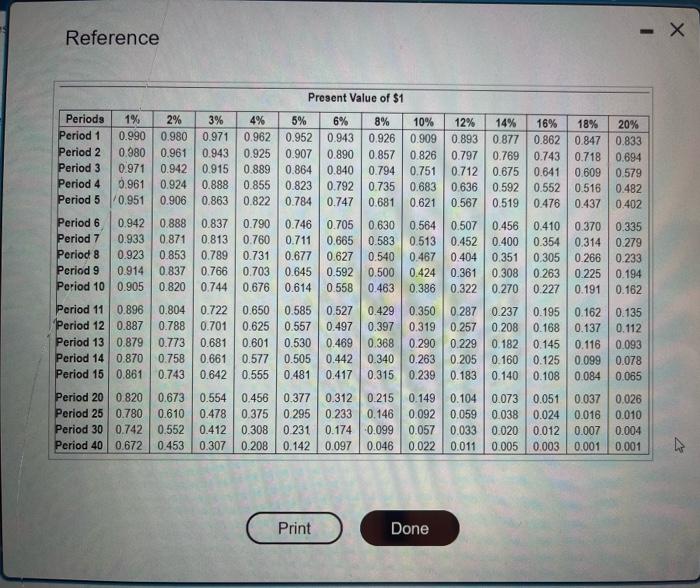

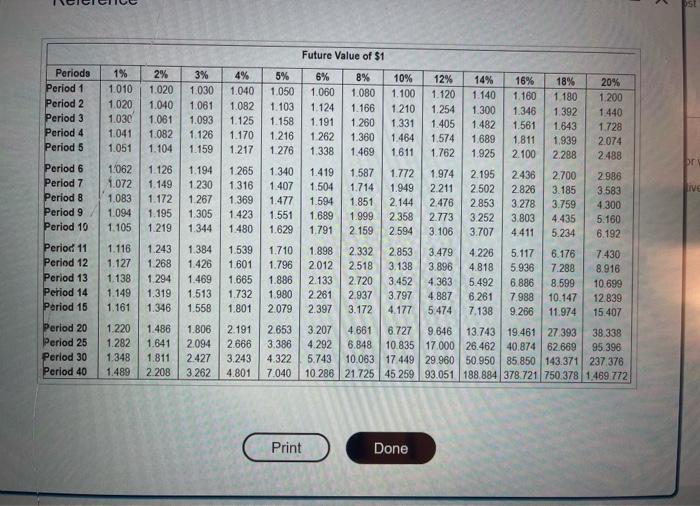

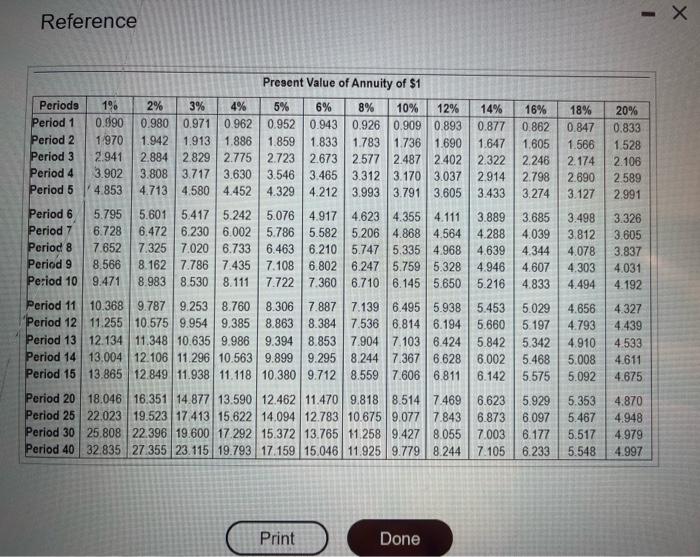

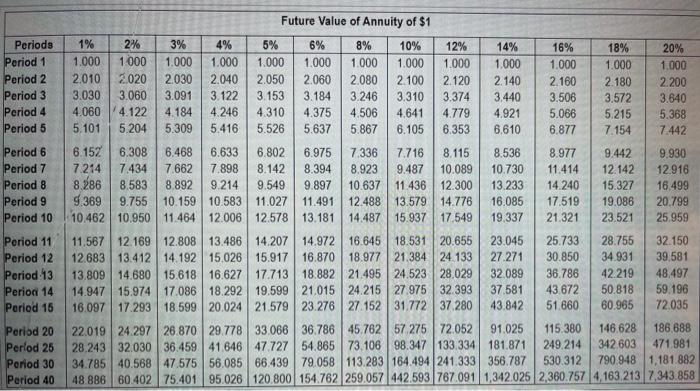

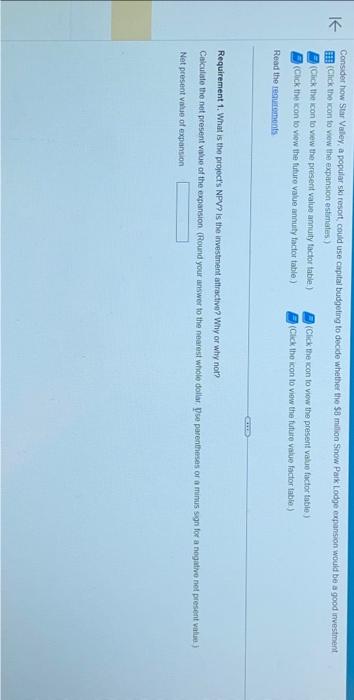

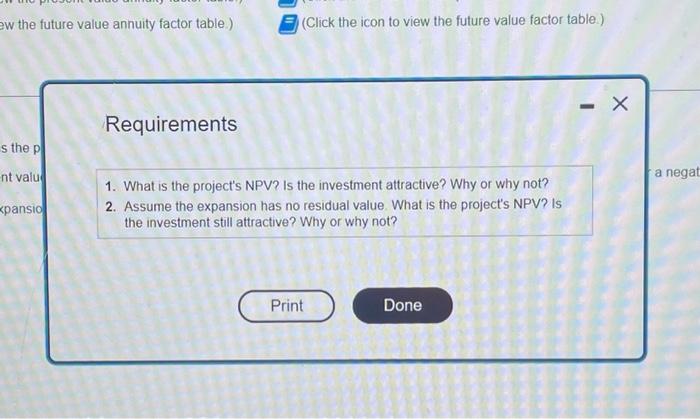

(Cick the kon to vere the projectid net cach infons). (Click the icoe to vioe the peosent value tabie) (Ciok the iron to verw the present value maty table) (cick the icon to vinw the futite vilae areucy table) knad the legurertents Not present yalue Ines is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $900,000. on to view the projected net cash inflows) (Click the icon to view the present value arnuity table.) (Click the icon to view the future value annuity table). Requirements 1. Compute this project's NPV using Gammaro Industries' 16% hurdle rate Should the company invest in the equipment? Why or why not? 2. Gammaro Industries could refurbish the equipment at the end of six years for $100,000. The refurbished equipment could be used one more year, providing $74,000 of net cash inflows in Year 7 . In addition, the refurbished equipment would have a $52,000 residual value at the end of Year 7 . Should Gammaro Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint. In addition to your answer to Requirement 1 , discount the additional cash outflow and inflows back to the present value.) Data table Reference Future Value of $1 Reference Future Value of Annuity of $1 Consider haw Star Valley, a popular ski resort, could use capital budgeting to decide whether the Si millian Snow Paik Lodge expansion woula be a good investment \{Chick tho icon fo verw the expansion estimates:) (Clack the icon fo vew the presert value annuity taclor table.) (Click, the icon fo viow the present value factor table) (Click the icon to view the future value annuty factor table.) (Click, the icon to viow the future value foctor lable.) Read the regiritements Requirement 1. What is the projoct's NPV? Is the imvestment attractre? Why or why not? Cakculate the not present value of the exgansion (Round your unswer to the nearest whole dollar Dse parentheses or a mirtus sign foe a nogatho ned present valiue) Net present value of expansion (Click the icon to view the future value factor table.) Requirements 1. What is the project's NPV? Is the investment attractive? Why or why not? 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts